Question: use equations please, not excel 19. A 3% coupon bond with annual coupon payments and 10 years to maturity has a par value of $1,000

use equations please, not excel

use equations please, not excel

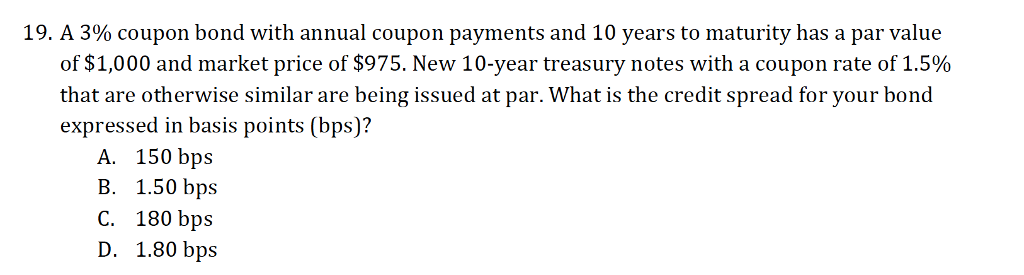

19. A 3% coupon bond with annual coupon payments and 10 years to maturity has a par value of $1,000 and market price of $975. New 10-year treasury notes with a coupon rate of 1.5% that are otherwise similar are being issued at par. What is the credit spread for your bond expressed in basis points (bps)? A. 150 bps B. 1.50 bps C. 180 bps D. 1.80 bps

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts