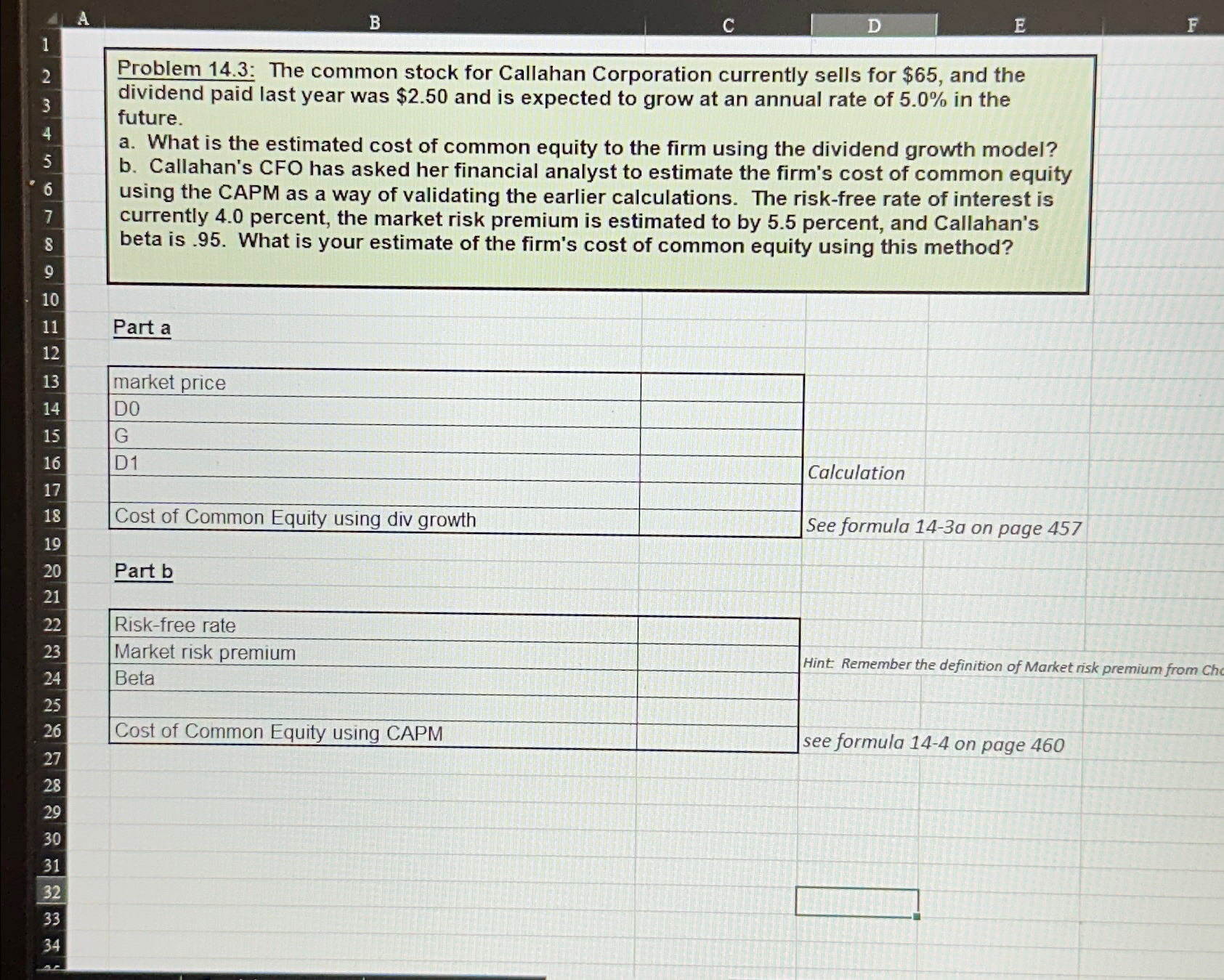

Question: Use excel and please show step by step formulas used to solve in excel for Problem 1 4 . 3 : The common stock for

Use excel and please show step by step formulas used to solve in excel for Problem : The common stock for Callahan Corporation currently sells for $ and the dividend paid last year was $ and is expected to grow at an annual rate of in the future.

a What is the estimated cost of common equity to the firm using the dividend growth model?

b Callahan's CFO has asked her financial analyst to estimate the firm's cost of common equity using the CAPM as a way of validating the earlier calculations. The riskfree rate of interest is currently percent, the market risk premium is estimated to by percent, and Callahan's beta is What is your estimate of the firm's cost of common equity using this method?

Part a

tablemarket price,DGDCost of Common Equity using div growth,

Calculation

See formula a on page

Part b

tableRiskfree rate,Market risk premium,BetaCost of Common Equity using CAPM,

see formula on page

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock