Question: use Excel formula please and explain the steps 1) ABC Yarn Company is evaluating buying a piece of equipment. The cost of the equipment is

use Excel formula please and explain the steps

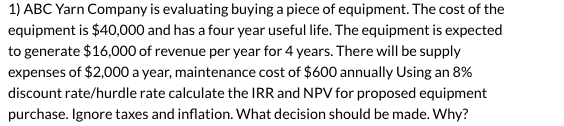

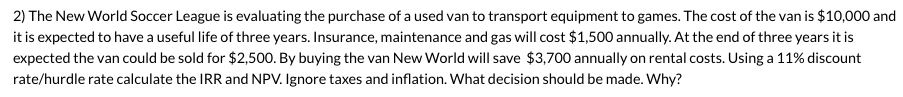

1) ABC Yarn Company is evaluating buying a piece of equipment. The cost of the equipment is $40,000 and has a four year useful life. The equipment is expected to generate $16,000 of revenue per year for 4 years. There will be supply expenses of $2,000 a year, maintenance cost of $600 annually Using an 8% discount rate/hurdle rate calculate the IRR and NPV for proposed equipment purchase. Ignore taxes and inflation. What decision should be made. Why? 2) The New World Soccer League is evaluating the purchase of a used van to transport equipment to games. The cost of the van is $10,000 and it is expected to have a useful life of three years. Insurance, maintenance and gas will cost $1,500 annually. At the end of three years it is expected the van could be sold for $2,500. By buying the van New World will save $3,700 annually on rental costs. Using a 11% discount rate/hurdle rate calculate the IRR and NPV. Ignore taxes and inflation. What decision should be made. Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts