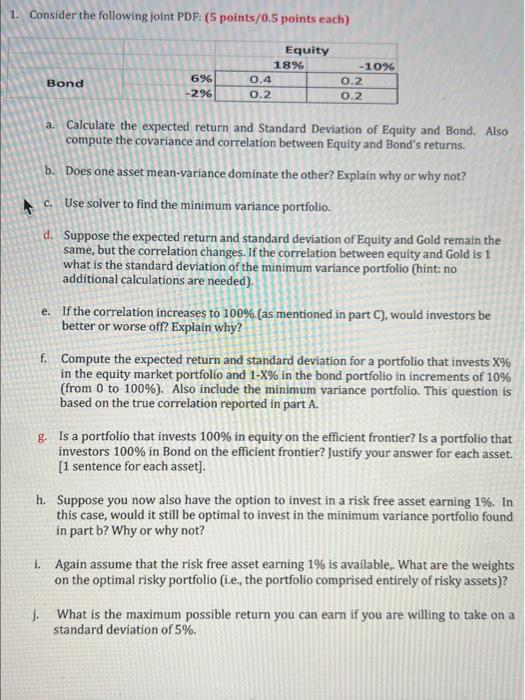

Question: use excel only 1. Consider the following joint PDF: (5 points/0.5 points each) Equity 18% 0.4 0.2 Bond 6% -296 -10% 0.2 0.2 C. a.

1. Consider the following joint PDF: (5 points/0.5 points each) Equity 18% 0.4 0.2 Bond 6% -296 -10% 0.2 0.2 C. a. Calculate the expected return and Standard Deviation of Equity and Bond. Also compute the covariance and correlation between Equity and Bond's returns. b. Does one asset mean-variance dominate the other? Explain why or why not? Use solver to find the minimum variance portfolio d. Suppose the expected return and standard deviation of Equity and Gold remain the same, but the correlation changes. If the correlation between equity and Gold is 1 what is the standard deviation of the minimum variance portfolio (hint: no additional calculations are needed). e. If the correlation increases to 100% as mentioned in part). would investors be better or worse off? Explain why? f. Compute the expected return and standard deviation for a portfolio that invests X% in the equity market portfolio and 1-X% in the bond portfolio in increments of 10% (from 0 to 100%). Also include the minimum variance portfolio. This question is based on the true correlation reported in part A. g. Is a portfolio that invests 100% in equity on the efficient frontier? Is a portfolio that investors 100% in Bond on the efficient frontier2 Justify your answer for each asset. [1 sentence for each asset). h. Suppose you now also have the option to invest in a risk free asset earning 1%. In this case, would it still be optimal to invest in the minimum variance portfolio found in part b? Why or why not? i. Again assume that the risk free asset earning 1% is available. What are the weights on the optimal risky portfolio (i.e, the portfolio comprised entirely of risky assets)? What is the maximum possible return you can earn if you are willing to take on a standard deviation of 5%. J. 1. Consider the following joint PDF: (5 points/0.5 points each) Equity 18% 0.4 0.2 Bond 6% -296 -10% 0.2 0.2 C. a. Calculate the expected return and Standard Deviation of Equity and Bond. Also compute the covariance and correlation between Equity and Bond's returns. b. Does one asset mean-variance dominate the other? Explain why or why not? Use solver to find the minimum variance portfolio d. Suppose the expected return and standard deviation of Equity and Gold remain the same, but the correlation changes. If the correlation between equity and Gold is 1 what is the standard deviation of the minimum variance portfolio (hint: no additional calculations are needed). e. If the correlation increases to 100% as mentioned in part). would investors be better or worse off? Explain why? f. Compute the expected return and standard deviation for a portfolio that invests X% in the equity market portfolio and 1-X% in the bond portfolio in increments of 10% (from 0 to 100%). Also include the minimum variance portfolio. This question is based on the true correlation reported in part A. g. Is a portfolio that invests 100% in equity on the efficient frontier? Is a portfolio that investors 100% in Bond on the efficient frontier2 Justify your answer for each asset. [1 sentence for each asset). h. Suppose you now also have the option to invest in a risk free asset earning 1%. In this case, would it still be optimal to invest in the minimum variance portfolio found in part b? Why or why not? i. Again assume that the risk free asset earning 1% is available. What are the weights on the optimal risky portfolio (i.e, the portfolio comprised entirely of risky assets)? What is the maximum possible return you can earn if you are willing to take on a standard deviation of 5%. J

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts