Question: use excel please 3. Project Cash Flows: You have been operating a microbrewery and beer bar for a few years, then COVID-19 hit. You quickly

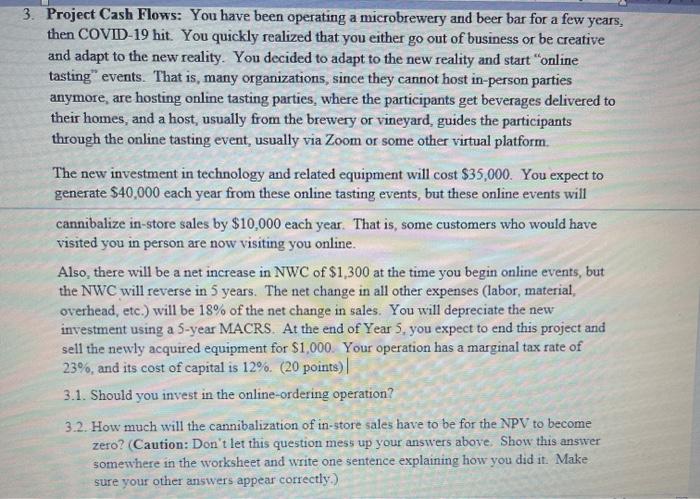

3. Project Cash Flows: You have been operating a microbrewery and beer bar for a few years, then COVID-19 hit. You quickly realized that you either go out of business or be creative and adapt to the new reality. You decided to adapt to the new reality and start "online tasting events. That is, many organizations, since they cannot host in-person parties anymore, are hosting online tasting parties, where the participants get beverages delivered to their homes, and a host, usually from the brewery or vineyard, guides the participants through the online tasting event, usually via Zoom or some other virtual platform. The new investment in technology and related equipment will cost $35,000. You expect to generate $40,000 each year from these online tasting events, but these online events will cannibalize in-store sales by $10,000 each year. That is, some customers who would have visited you in person are now visiting you online. Also, there will be a net increase in NWC of $1,300 at the time you begin online events, but the NWC will reverse in 5 years. The net change in all other expenses (labor, material, overhead, etc.) will be 18% of the net change in sales. You will depreciate the new investment using a 5-year MACRS. At the end of Year 5. you expect to end this project and sell the newly acquired equipment for $1,000. Your operation has a marginal tax rate of 23%, and its cost of capital is 12%. (20 points) 3.1. Should you invest in the online-ordering operation? 3.2. How much will the cannibalization of in-store sales have to be for the NPV to become zero? (Caution: Don't let this question mess up your answers above. Show this answer somewhere in the worksheet and write one sentence explaining how you did it. Make sure your other answers appear correctly)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts