Question: Use excel where required and please type responses. Disclosure: This is NOT homework that I intend to submit. 13) a) Explain, in general terms, what

Use excel where required and please type responses. Disclosure: This is NOT homework that I intend to submit.

13) a) Explain, in general terms, what is derivative security. Briefly describe why market participants may be interested in using derivatives. (6 marks)

b) Consider the following contract definition: "You have the right, but not the obligation to sell the stock, S, at price X at a time one month from now'. Explain how the definition leads to the payoff of this option contract: what is the payoff at maturity?

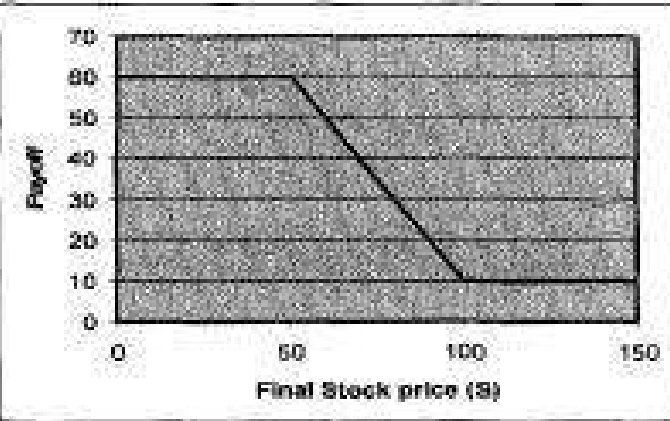

c) Explain how you could generate the following payoff function at time T.

where call and put options are available at all strikes and the risk-free rate is 5 percent per annum.

d) The current (t=0) market value of Withers Ic. stock is 100 million, in one years time (t=1) the market value of Withers Inc stock will either be 150 million or 60 million. If the market value rises to 150 million then Withers Inc plans to expand operations by opening a new plant which will have a present value of 20 million at t=1. If the market value falls to 60 million, then Withers will choose not to expand. Explain how this can be interpreted as a growth option and value the growth option using no arbitrage binomial techniques. The risk-free rate is 5 percent per annum. Explain your working clearly.

TO 90 40 Puyor 20 150 GO Final Stock price (8)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts