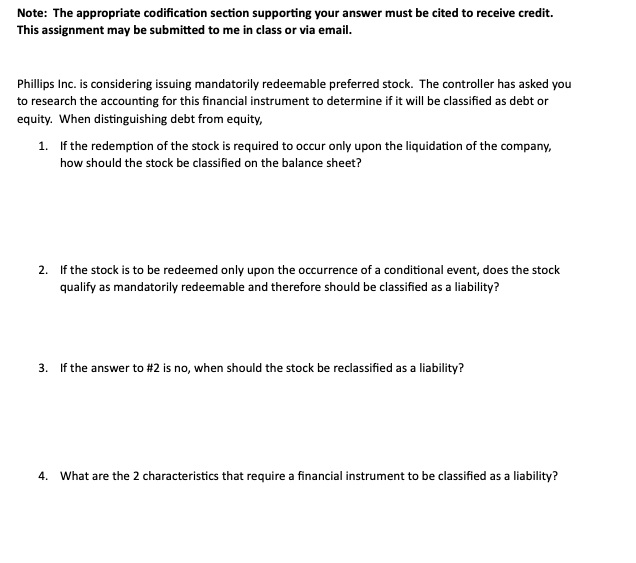

Question: Use FASB Codification Note: The appropriate codification section supporting your answer must be cited to receive credit. This assignment may be submitted to me in

Use FASB Codification Note: The appropriate codification section supporting your answer must be cited to receive credit.

This assignment may be submitted to me in class or via email.

Phillips Inc. is considering issuing mandatorily redeemable preferred stock. The controller has asked you

to research the accounting for this financial instrument to determine if it will be classified as debt or

equity. When distinguishing debt from equity,

If the redemption of the stock is required to occur only upon the liquidation of the company,

how should the stock be classified on the balance sheet?

If the stock is to be redeemed only upon the occurrence of a conditional event, does the stock

qualify as mandatorily redeemable and therefore should be classified as a liability?

If the answer to # is no when should the stock be reclassified as a liability?

What are the characteristics that require a financial instrument to be classified as a liabili

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock