Question: use finance knowledge and formula Problem #1 (4 marks) The Markham Machine Corporation requires $85 million to finance an expansion. The company will sell new

use finance knowledge and formula

use finance knowledge and formula

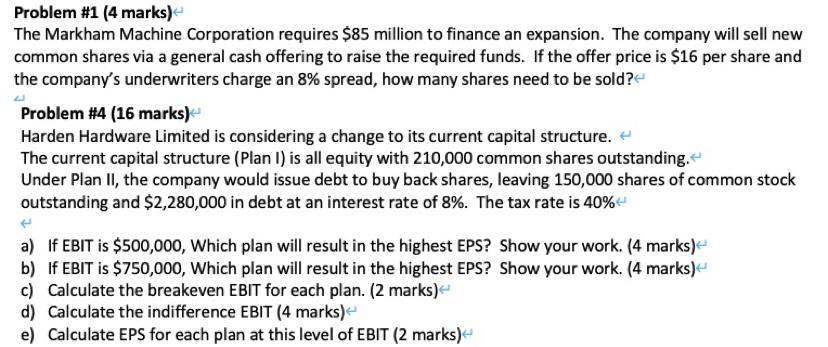

Problem #1 (4 marks) The Markham Machine Corporation requires $85 million to finance an expansion. The company will sell new common shares via a general cash offering to raise the required funds. If the offer price is $16 per share and the company's underwriters charge an 8% spread, how many shares need to be sold? Problem #4 (16 marks) Harden Hardware Limited is considering a change to its current capital structure. The current capital structure (Plan 1) is all equity with 210,000 common shares outstanding. Under Plan II, the company would issue debt to buy back shares, leaving 150,000 shares of common stock outstanding and $2,280,000 in debt at an interest rate of 8%. The tax rate is 40% a) If EBIT is $500,000, Which plan will result in the highest EPS? Show your work. (4 marks) b) If EBIT is $750,000, Which plan will result in the highest EPS? Show your work. (4 marks) c) Calculate the breakeven EBIT for each plan. (2 marks) d) Calculate the indifference EBIT (4 marks) e) Calculate EPS for each plan at this level of EBIT (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts