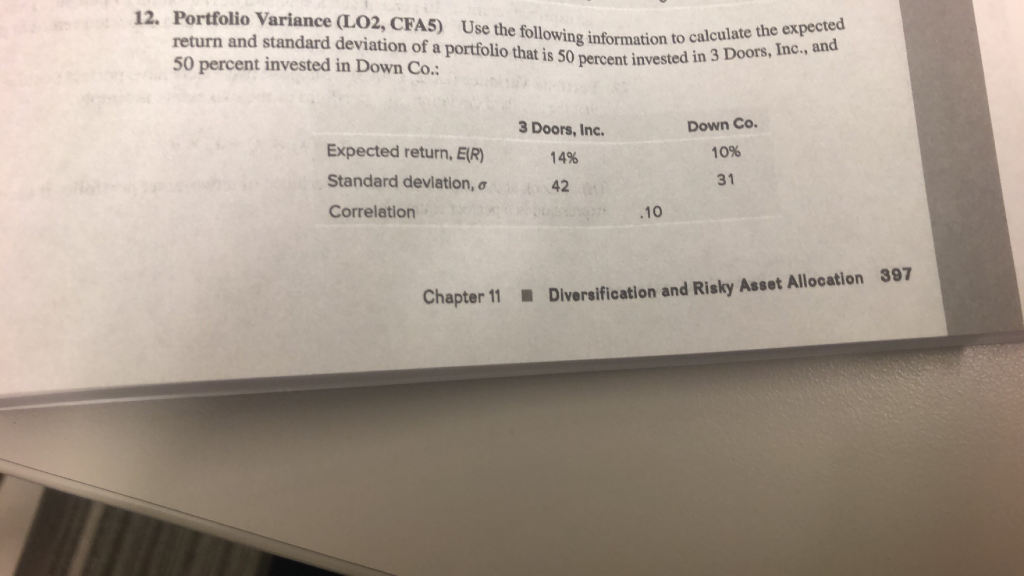

Question: Use information from problem 12 to answer number 14 12. Portfolio Variance (.O2, CFAS) Use the following information to calculat., and the expected return and

Use information from problem 12 to answer number 14

Use information from problem 12 to answer number 14

12. Portfolio Variance (.O2, CFAS) Use the following information to calculat., and the expected return and standard deviation of a portfolio that is 50 percent investedn3 50 percent invested in Down Co.: culate Expected return, E(R) Standard deviation, Correlation 3 Doors, Inc. 14% 42 Down Co 10% 31 .10 Chapter 11Diversification and Risky Asset Allocation 397 FIN 3510 Jordan 8th ed 14. Minimum Varlance Portfolio (L04, CFA4) In Problem 12, what are the expected retun ai standard deviation on the minimum variance portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts