Question: use information to answer *question 16* QUESTION 16 Q3: What is the US 10-year treasury note price right before the first coupon payment (hint: if

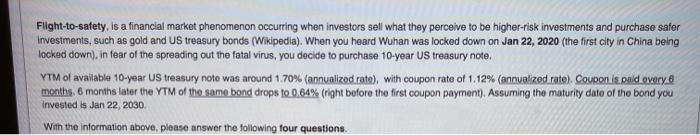

QUESTION 16 Q3: What is the US 10-year treasury note price right before the first coupon payment (hint: if using calculator, set calculator to "annuity due" mode and compute the bond price. Alternatively, using "annuity due" formula with adjustment for future value)? 5 points Save Answer Flight-to-safety, is a financial market phenomenon occurring when investors sell what they perceive to be higher-risk investments and purchase safer Investments, such as gold and US treasury bonds (Wikipedia). When you heard Wuhan was locked down on Jan 22, 2020 (the first city in China being locked down), in fear of the spreading out the fatal virus, you decide to purchase 10-year US treasury note. YTM of available 10-year US treasury note was around 1.70% (annualized rate), with coupon rate of 1.12% (annualized rate Coupon is paid overy 6 months 6 months later the YTM of the same bond drops to 0.64% (right before the first coupon payment). Assuming the maturity date of the bond you invested is Jan 22, 2030 With the information above, please answer the following four questions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts