Question: *USE ONLY THIS DISCOUNT TABLE Conte plc is a UK Stock Exchange listed business. It already has an overdraft of 60 million which cannot be

*USE ONLY THIS DISCOUNT TABLE

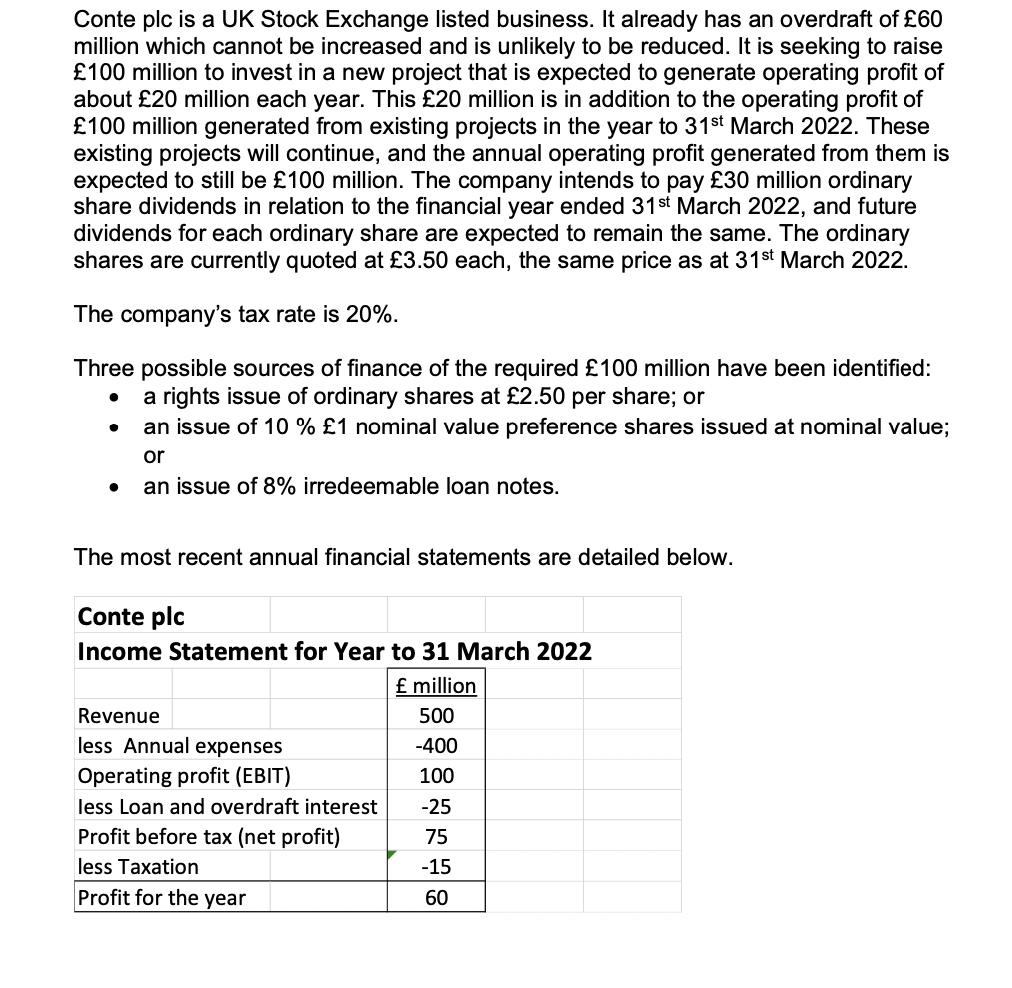

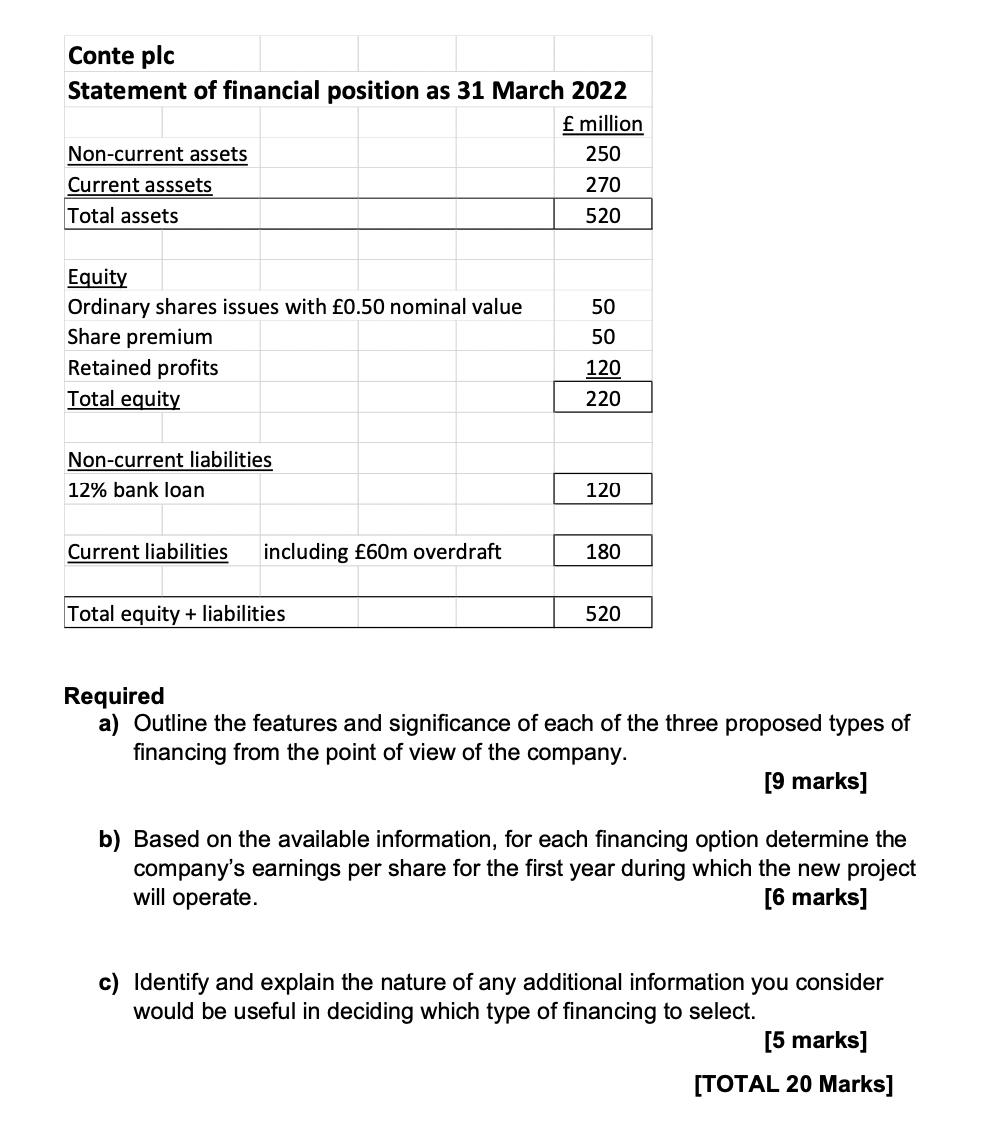

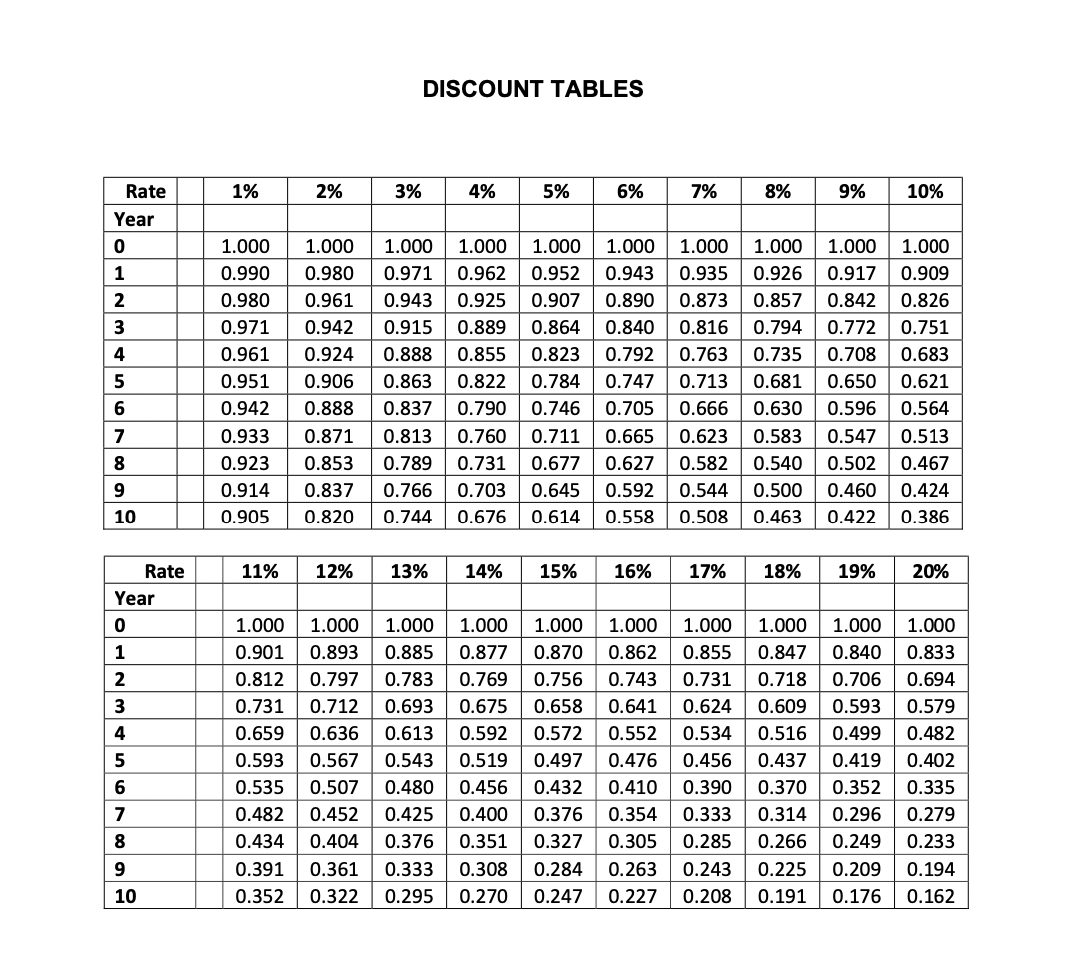

Conte plc is a UK Stock Exchange listed business. It already has an overdraft of 60 million which cannot be increased and is unlikely to be reduced. It is seeking to raise 100 million to invest in a new project that is expected to generate operating profit of about 20 million each year. This 20 million is in addition to the operating profit of 100 million generated from existing projects in the year to 31st March 2022. These existing projects will continue, and the annual operating profit generated from them is expected to still be 100 million. The company intends to pay 30 million ordinary share dividends in relation to the financial year ended 31st March 2022, and future dividends for each ordinary share are expected to remain the same. The ordinary shares are currently quoted at 3.50 each, the same price as at 31st March 2022. The company's tax rate is 20%. 0 Three possible sources of finance of the required 100 million have been identified: a rights issue of ordinary shares at 2.50 per share; or an issue of 10 % 1 nominal value preference shares issued at nominal value; or an issue of 8% irredeemable loan notes. O . The most recent annual financial statements are detailed below. Conte plc Income Statement for Year to 31 March 2022 f million Revenue 500 less Annual expenses -400 Operating profit (EBIT) 100 less Loan and overdraft interest -25 Profit before tax (net profit) 75 less Taxation -15 Profit for the year 60 Conte plc Statement of financial position as 31 March 2022 f million Non-current assets 250 Current asssets 270 Total assets 520 Equity Ordinary shares issues with 0.50 nominal value Share premium Retained profits Total equity 50 50 120 220 Non-current liabilities 12% bank loan 120 Current liabilities including 60m overdraft 180 Total equity + liabilities 520 Required a) Outline the features and significance of each of the three proposed types of financing from the point of view of the company. [9 marks] b) Based on the available information, for each financing option determine the company's earnings per share for the first year during which the new project will operate. [6 marks] c) Identify and explain the nature of any additional information you consider would be useful in deciding which type of financing to select. [5 marks] [TOTAL 20 Marks] DISCOUNT TABLES 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% Rate Year 0 1 2 3 4 5 6 1.000 0.990 0.980 0.971 0.961 0.951 0.942 0.933 0.923 0.914 0.905 1.000 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 1.000 1.000 0.971 0.962 0.943 0.925 0.915 0.889 0.888 0.855 0.863 0.822 0.837 0.790 0.813 0.760 0.789 0.731 0.766 0.703 0.744 0.676 1.000 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.645 0.614 1.000 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 1.000 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 1.000 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 1.000 0.917 0.842 0.772 0.708 0.650 0.596 0.547 0.502 0.460 0.422 1.000 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 7 8 9 10 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% Rate Year 0 1 2 3 4 5 1.000 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 1.000 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 1.000 0.885 0.783 0.693 0.613 0.543 0.480 0.425 0.376 0.333 0.295 1.000 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0.270 1.000 0.870 0.756 0.658 0.572 0.497 0.432 0.376 0.327 0.284 0.247 1.000 0.862 0.743 0.641 0.552 0.476 0.410 0.354 0.305 0.263 0.227 1.000 0.855 0.731 0.624 0.534 0.456 0.390 0.333 0.285 0.243 0.208 1.000 0.847 0.718 0.609 0.516 0.437 0.370 0.314 0.266 0.225 0.191 1.000 0.840 0.706 0.593 0.499 0.419 0.352 0.296 0.249 0.209 0.176 1.000 0.833 0.694 0.579 0.482 0.402 0.335 0.279 0.233 0.194 0.162 6 7 8 9 10 Conte plc is a UK Stock Exchange listed business. It already has an overdraft of 60 million which cannot be increased and is unlikely to be reduced. It is seeking to raise 100 million to invest in a new project that is expected to generate operating profit of about 20 million each year. This 20 million is in addition to the operating profit of 100 million generated from existing projects in the year to 31st March 2022. These existing projects will continue, and the annual operating profit generated from them is expected to still be 100 million. The company intends to pay 30 million ordinary share dividends in relation to the financial year ended 31st March 2022, and future dividends for each ordinary share are expected to remain the same. The ordinary shares are currently quoted at 3.50 each, the same price as at 31st March 2022. The company's tax rate is 20%. 0 Three possible sources of finance of the required 100 million have been identified: a rights issue of ordinary shares at 2.50 per share; or an issue of 10 % 1 nominal value preference shares issued at nominal value; or an issue of 8% irredeemable loan notes. O . The most recent annual financial statements are detailed below. Conte plc Income Statement for Year to 31 March 2022 f million Revenue 500 less Annual expenses -400 Operating profit (EBIT) 100 less Loan and overdraft interest -25 Profit before tax (net profit) 75 less Taxation -15 Profit for the year 60 Conte plc Statement of financial position as 31 March 2022 f million Non-current assets 250 Current asssets 270 Total assets 520 Equity Ordinary shares issues with 0.50 nominal value Share premium Retained profits Total equity 50 50 120 220 Non-current liabilities 12% bank loan 120 Current liabilities including 60m overdraft 180 Total equity + liabilities 520 Required a) Outline the features and significance of each of the three proposed types of financing from the point of view of the company. [9 marks] b) Based on the available information, for each financing option determine the company's earnings per share for the first year during which the new project will operate. [6 marks] c) Identify and explain the nature of any additional information you consider would be useful in deciding which type of financing to select. [5 marks] [TOTAL 20 Marks] DISCOUNT TABLES 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% Rate Year 0 1 2 3 4 5 6 1.000 0.990 0.980 0.971 0.961 0.951 0.942 0.933 0.923 0.914 0.905 1.000 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 1.000 1.000 0.971 0.962 0.943 0.925 0.915 0.889 0.888 0.855 0.863 0.822 0.837 0.790 0.813 0.760 0.789 0.731 0.766 0.703 0.744 0.676 1.000 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.645 0.614 1.000 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 1.000 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 1.000 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 1.000 0.917 0.842 0.772 0.708 0.650 0.596 0.547 0.502 0.460 0.422 1.000 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 7 8 9 10 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% Rate Year 0 1 2 3 4 5 1.000 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 1.000 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 1.000 0.885 0.783 0.693 0.613 0.543 0.480 0.425 0.376 0.333 0.295 1.000 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0.270 1.000 0.870 0.756 0.658 0.572 0.497 0.432 0.376 0.327 0.284 0.247 1.000 0.862 0.743 0.641 0.552 0.476 0.410 0.354 0.305 0.263 0.227 1.000 0.855 0.731 0.624 0.534 0.456 0.390 0.333 0.285 0.243 0.208 1.000 0.847 0.718 0.609 0.516 0.437 0.370 0.314 0.266 0.225 0.191 1.000 0.840 0.706 0.593 0.499 0.419 0.352 0.296 0.249 0.209 0.176 1.000 0.833 0.694 0.579 0.482 0.402 0.335 0.279 0.233 0.194 0.162 6 7 8 9 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts