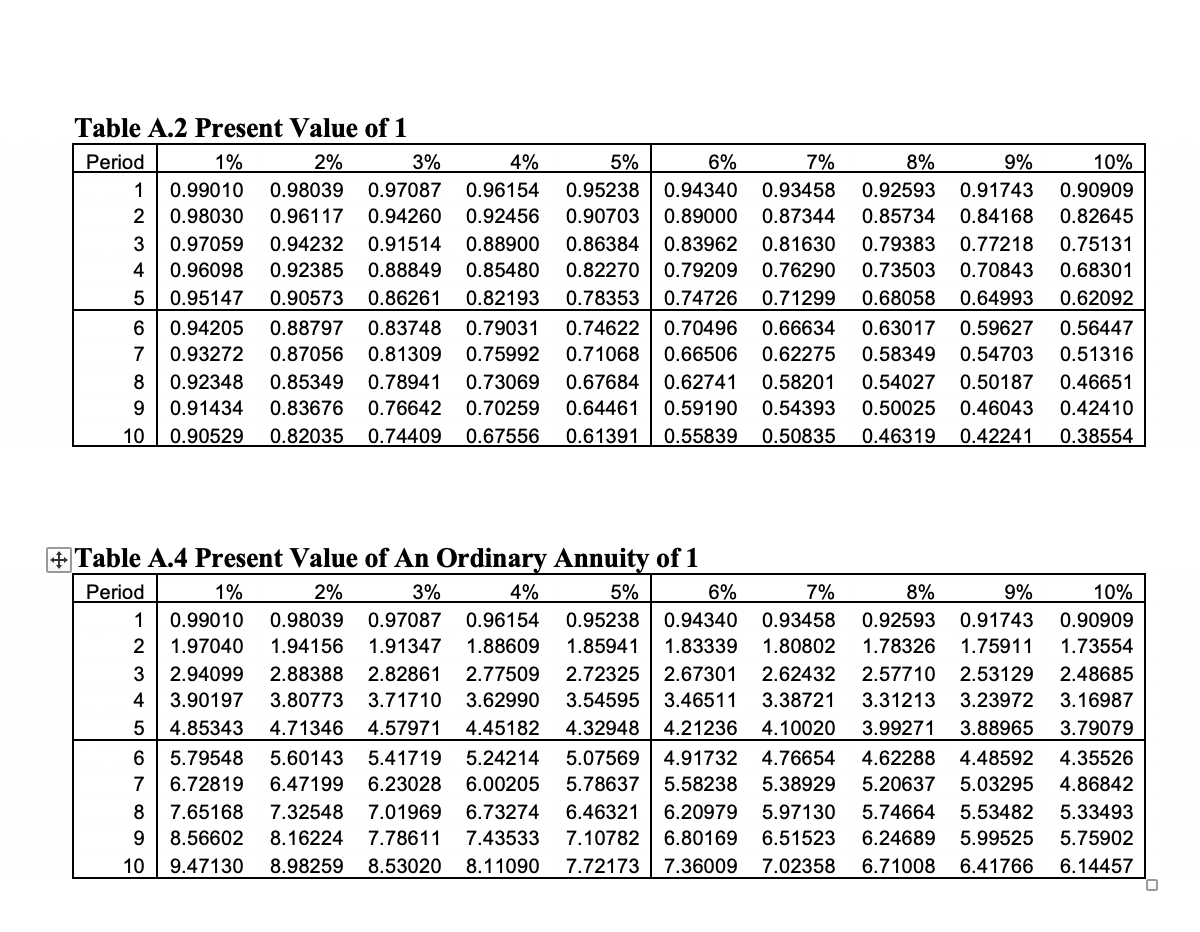

Question: Use PV Factor Tables (a portion is provided on page #12) or financial calculator or Excel. Please show calculation details The company issues a note

Use PV Factor Tables (a portion is provided on page #12) or financial calculator or Excel. Please show calculation details

- The company issues a note to an entity to borrow cash for five years and will pay $500,000 to the entity at the end of the fifth year but not pay any interest. If the annual market interest rate is 4%, please calculate the present value of the note (compounded annually and rounded to the nearest dollar).

- Based on Part 1, if the company will pay $500,000 at the end of the fifth year and interest $25,000 at the end of each of the five years, please calculate the present value of the note (rounded to the nearest dollar).

- Based on Part 1, if the company will pay $500,000 at the end of the fifth year and interest $25,000 at the end of each of the last four years (the second to fifth years), please calculate the present value of the note (rounded to the nearest dollar).

9% AWN Table A.2 Present Value of 1 Period 1% 2% 3% 1 0.99010 0.98039 0.97087 2 0.98030 0.96117 0.94260 3 0.97059 0.94232 0.91514 4 0.96098 0.92385 0.88849 5 0.95147 0.90573 0.86261 6 0.94205 0.88797 0.83748 7 0.93272 0.87056 0.81309 8 0.92348 0.85349 0.78941 9 0.91434 0.83676 0.76642 10 0.90529 0.82035 0.74409 LOOOOOO 4% 0.96154 0.92456 0.88900 0.85480 0.82193 0.79031 0.75992 0.73069 0.70259 0.67556 5% 0.95238 0.90703 0.86384 0.82270 0.78353 0.74622 0.71068 0.67684 0.64461 0.61391 6% 0.94340 0.89000 0.83962 0.79209 0.74726 0.70496 0.66506 0.62741 0.59190 0.55839 7% 0.93458 0.87344 0.81630 0.76290 0.71299 0.66634 0.62275 0.58201 0.54393 0.50835 8% 0.92593 0.85734 0.79383 0.73503 0.68058 0.63017 0.58349 0.54027 0.50025 0.46319 0.91743 0.84168 0.77218 0.70843 0.64993 0.59627 0.54703 0.50187 0.46043 0.42241 10% 0.90909 0.82645 0.75131 0.68301 0.62092 0.56447 0.51316 0.46651 0.42410 0.38554 # Table A.4 Present Value of An Ordinary Annuity of 1 Period 1% 2% 3% 4% 5% 6% 1 0.99010 0.98039 0.97087 0.96154 0.95238 0.94340 2 1.97040 1.94156 1.91347 1.88609 1.85941 1.83339 2.94099 2.88388 2.82861 2.77509 2.72325 2.67301 4 3.90197 3.80773 3.71710 3.62990 3.54595 3.46511 5 4.85343 4.71346 4.57971 4.45182 4.32948 4.21236 6 5.79548 5.60143 5.41719 5.24214 5.07569 4.91732 7 6.72819 6.47199 6.23028 6.00205 5.78637 5.58238 8 7.65168 7.32548 7.01969 6.73274 6.46321 6.20979 9 8.56602 8.16224 7.78611 7.43533 7.10782 6.80169 10 9.47130 8.98259 8.53020 8.11090 7.72173 7.36009 O O OOO OWN 7% 0.93458 1.80802 2.62432 3.38721 4.10020 4.76654 5.38929 5.97130 6.51523 7.02358 8% 9% 0.92593 0.91743 1.78326 1.75911 2.57710 2.53129 3.31213 3.23972 3.99271 3.88965 4.62288 4.48592 5.20637 5.03295 5.74664 5.53482 6.24689 5.99525 6.71008 6.41766 10% 0.90909 1.73554 2.48685 3.16987 3.79079 4.35526 4.86842 5.33493 5.75902 6.14457

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts