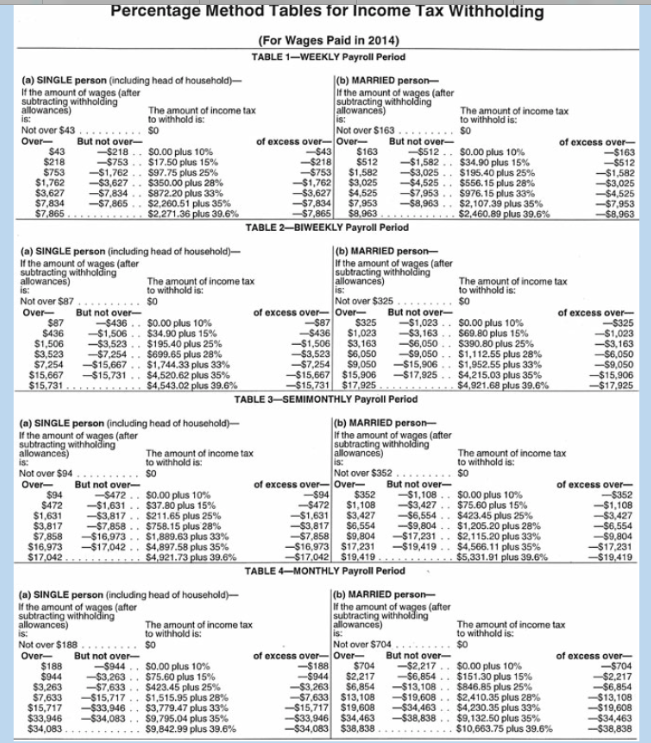

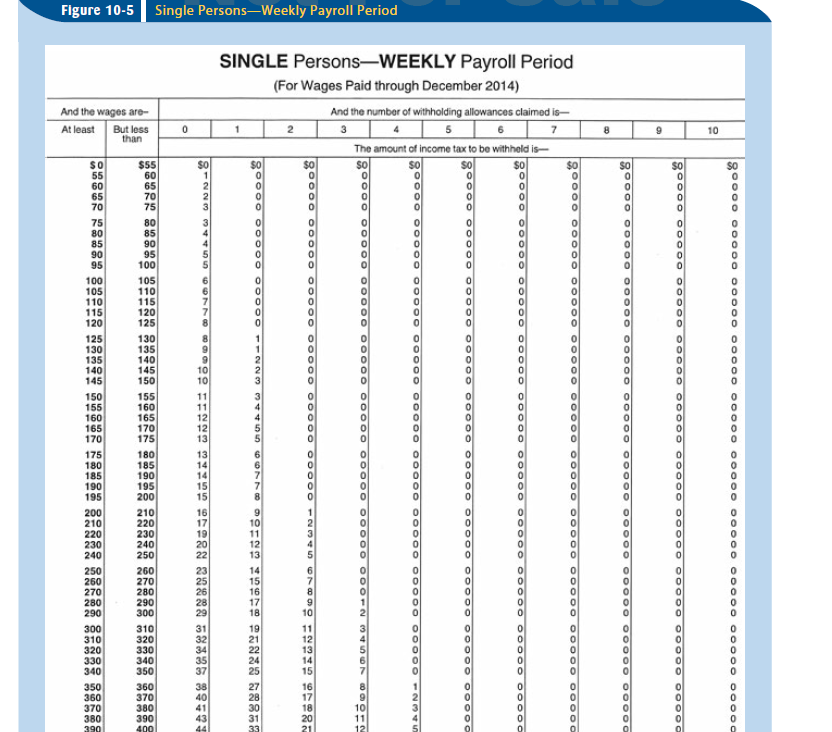

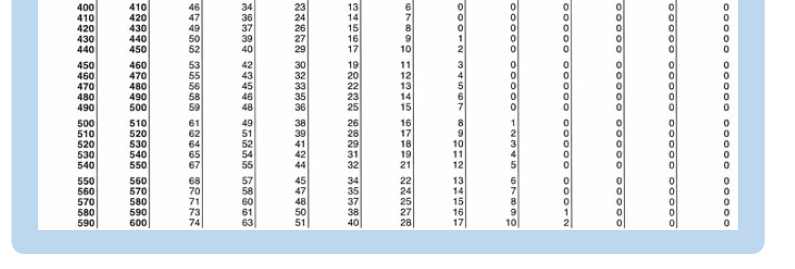

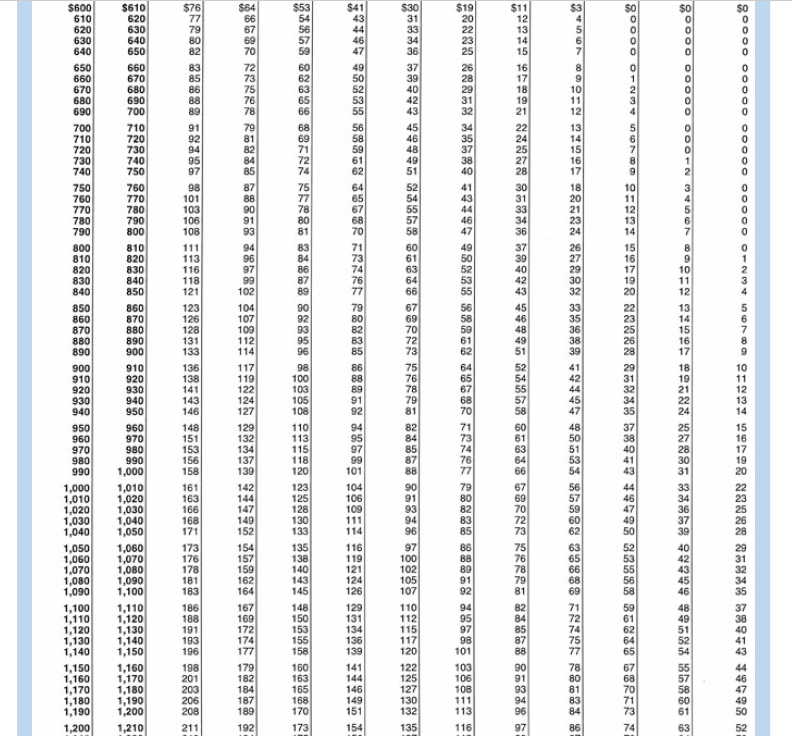

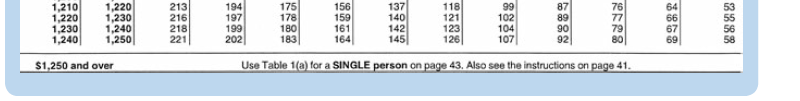

Question: Use Table 10-3, Table 10-4 and Table 10-5 from your textbook to answer the following question. Compute and compare the federal income tax withholding amounts

Use Table 10-3, Table 10-4 and Table 10-5 from your textbook to answer the following question.

Compute and compare the federal income tax withholding amounts using the percentage method and the wage-bracket method. Round all computations to the nearest cent.

Fred Greys: weekly wages, $503; single; 2 withholding allowances

| Percentage method: | $ | |

| Wage-bracket method: | $ | |

| Difference: | $ |

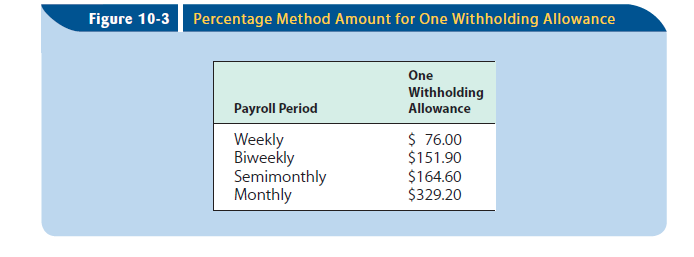

Figure 10-3 Percentage Method Amount for one Withholding Allowance One Withholding Payroll Period Allowance 76.00 Weekly $151.90 Biweekly $164.60 Semimonthly Monthly $329.20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts