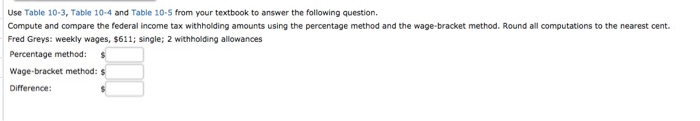

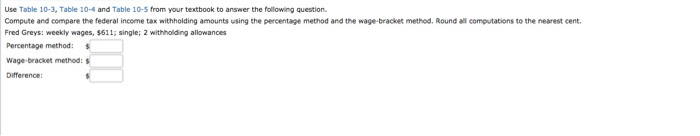

Question: Use Table 10-3, Table 10-4 and Table 10-5 from your textbook to answer the following question. Compute and compare the federal income tax withholding amounts

Use Table 10-3, Table 10-4 and Table 10-5 from your textbook to answer the following question. Compute and compare the federal income tax withholding amounts using the percentage method and the wage-bracket method. Round all computations to the nearest cent. Fred Greys: weekly wages, $611; single; 2 withholding allowances Percentage method: $ Wage-bracket method: $ Difference: Use Table 10-3, Table 10-4 and Table 10-5 from your textbook to answer the following question Compute and compare the federal income tax withholding amounts using the percentage method and the wage bracket method. Round all computations to the nearest cent. Fred Greys: weekly wages, 5611; single; 2 withholding allowances Percentage method: $ Wage-bracket methods Difference

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts