Question: Use Tables for 2018 I solved the problem, but unsure if I did it correctly. Plese check Note: Use the Tax Tables to calculate the

Use Tables for 2018

I solved the problem, but unsure if I did it correctly.

Plese check

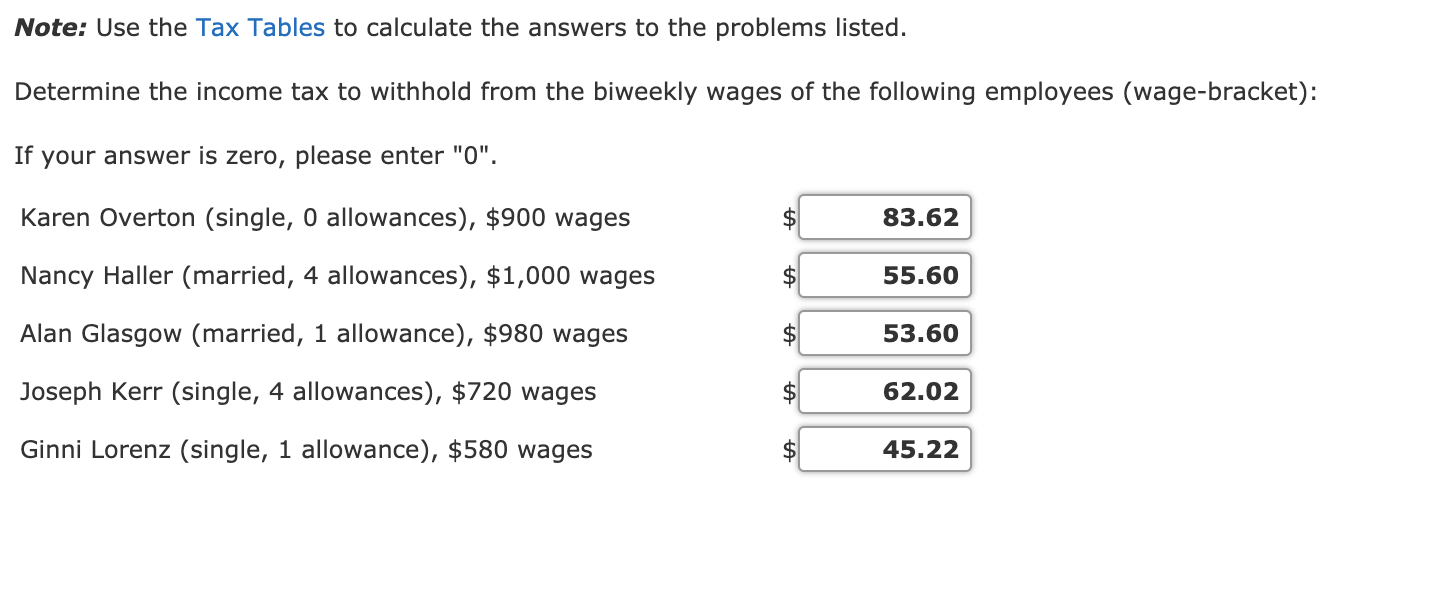

Note: Use the Tax Tables to calculate the answers to the problems listed. Determine the income tax to withhold from the biweekly wages of the following employees (wage-bracket): If your answer is zero, please enter "O". 83.62 Karen Overton (single, O allowances), $900 wages Nancy Haller (married, 4 allowances), $1,000 wages $ 55.60 Alan Glasgow (married, 1 allowance), $980 wages 53.60 Joseph Kerr (single, 4 allowances), $720 wages 62.02 Ginni Lorenz (single, 1 allowance), $580 wages 45.22 Note: Use the Tax Tables to calculate the answers to the problems listed. Determine the income tax to withhold from the biweekly wages of the following employees (wage-bracket): If your answer is zero, please enter "O". 83.62 Karen Overton (single, O allowances), $900 wages Nancy Haller (married, 4 allowances), $1,000 wages $ 55.60 Alan Glasgow (married, 1 allowance), $980 wages 53.60 Joseph Kerr (single, 4 allowances), $720 wages 62.02 Ginni Lorenz (single, 1 allowance), $580 wages 45.22

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts