Question: Use the 2020 tax information below to answer this question. Jos is a 26-year-old, full-time college student sharing rent with a roommate who is filing

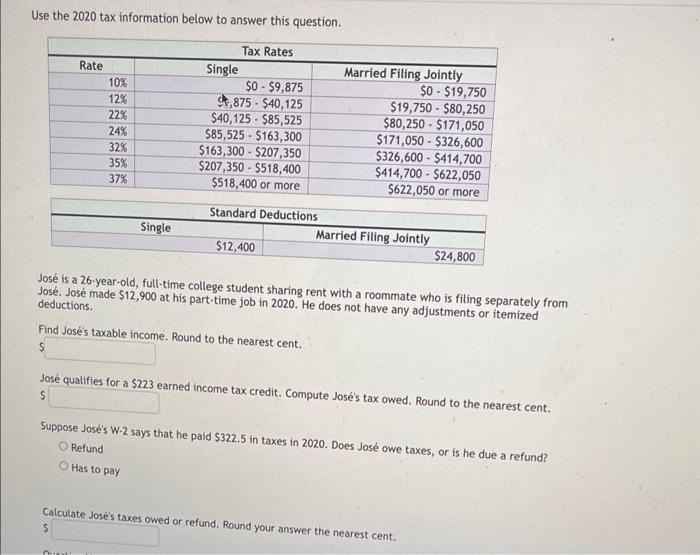

Use the 2020 tax information below to answer this question. Jos is a 26-year-old, full-time college student sharing rent with a roommate who is filing separately from Jos. Jos made $12,900 at his part-time job in 2020 . He does not have any adjustments or itemized deductions. Find Jos's taxable inrnme. Round to the nearest cent. Jos qualifies forr a cons larned income tax credit. Compute Jos's tax owed. Round to the nearest cent. Suppose Jos's W. 2 says that he paid $322.5 in taxes in 2020. Does Jose owe taxes, or is he due a refund? Refund Has to pay Calculate Joci't tava. . ? or refund. Round your answer the nearest cent

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock