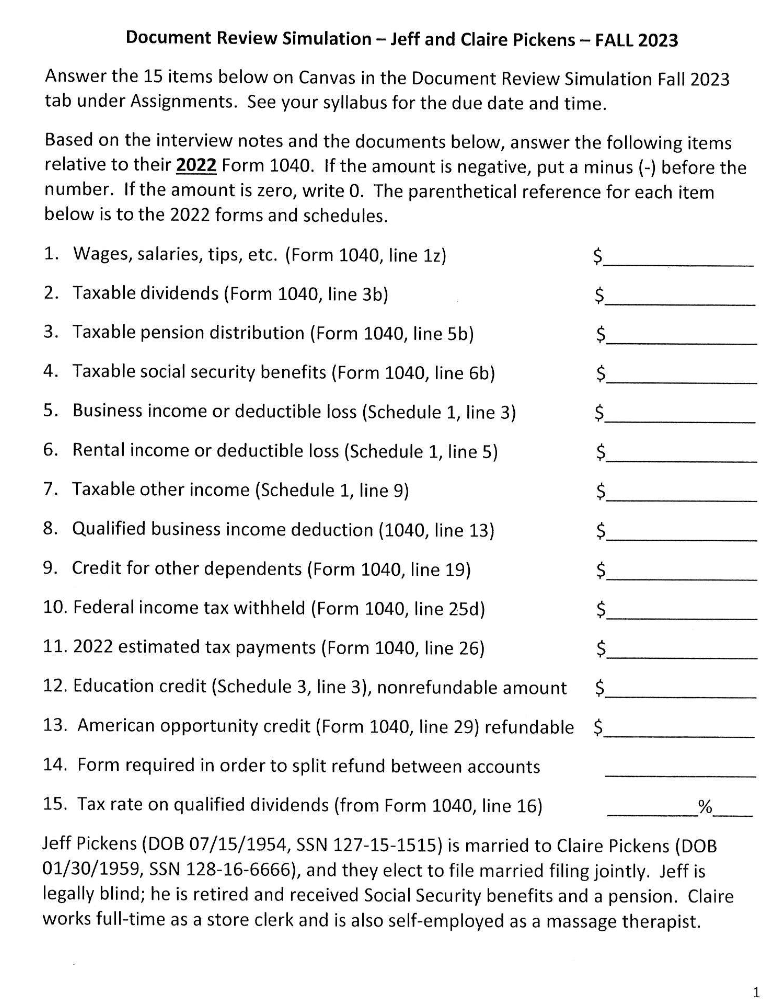

Question: Document Review Simulation - Jeff and Claire Pickens - FALL 2023 Answer the 15 items below on Canvas in the Document Review Simulation Fall 223

![the following items relative to their 2022 Form 104i]. if the amount](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/12/674de83c0054b_971674de83bd5843.jpg)

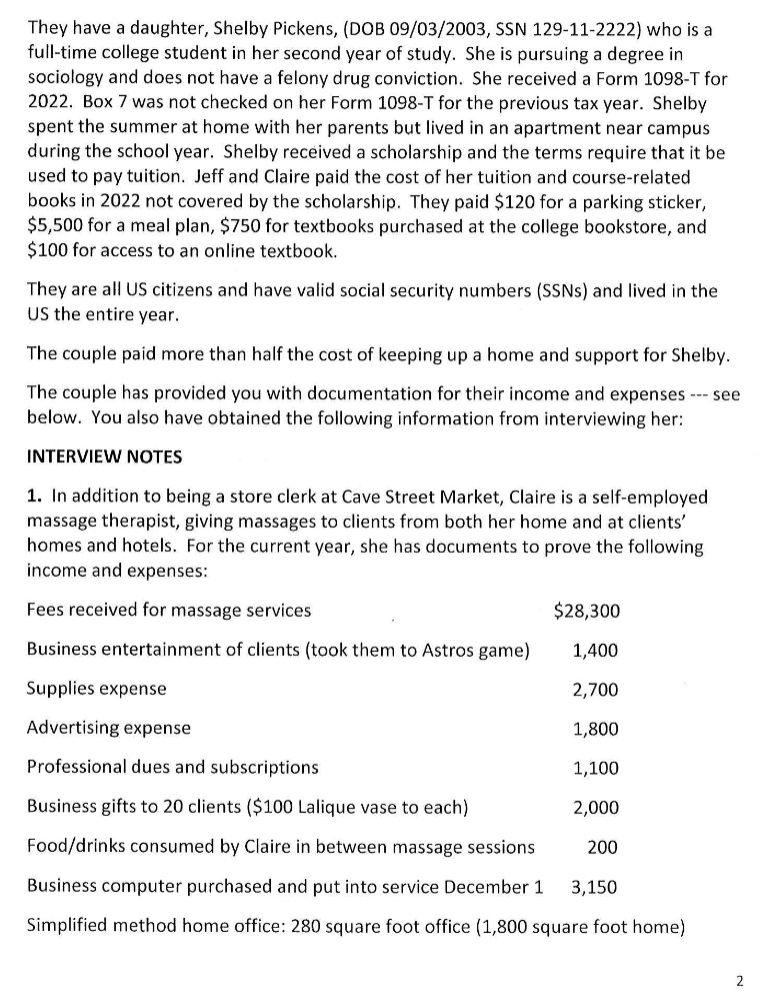

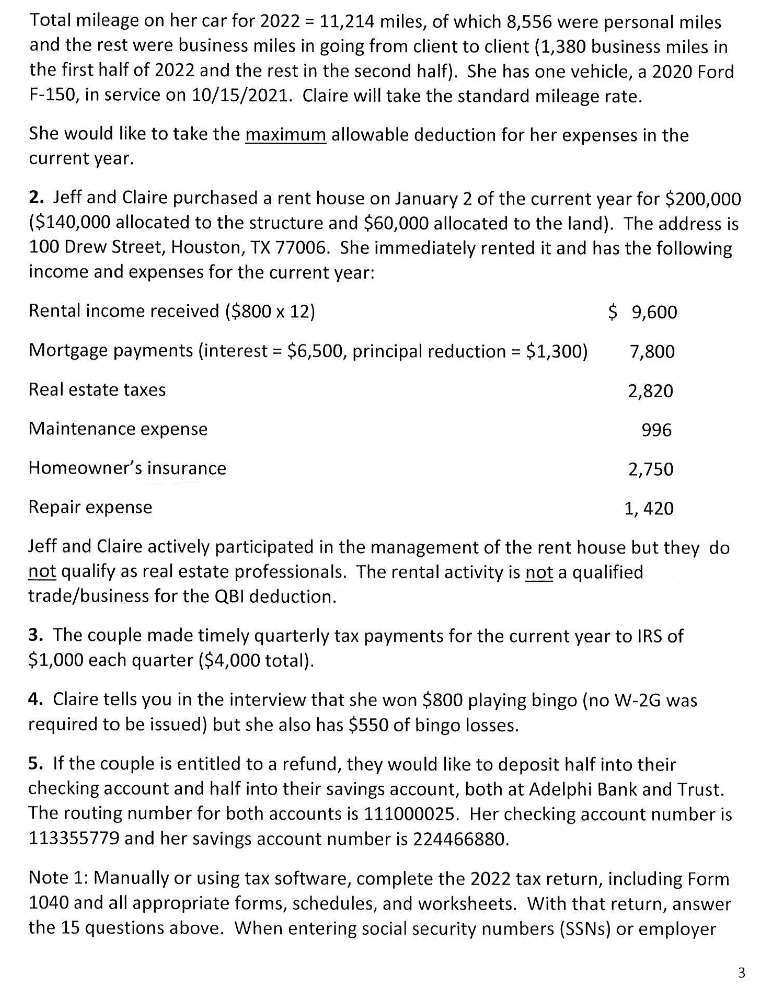

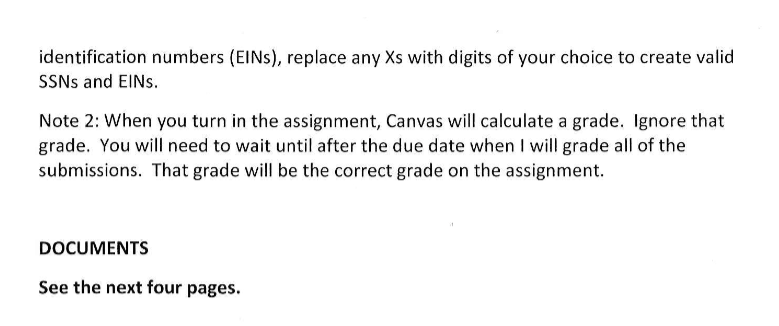

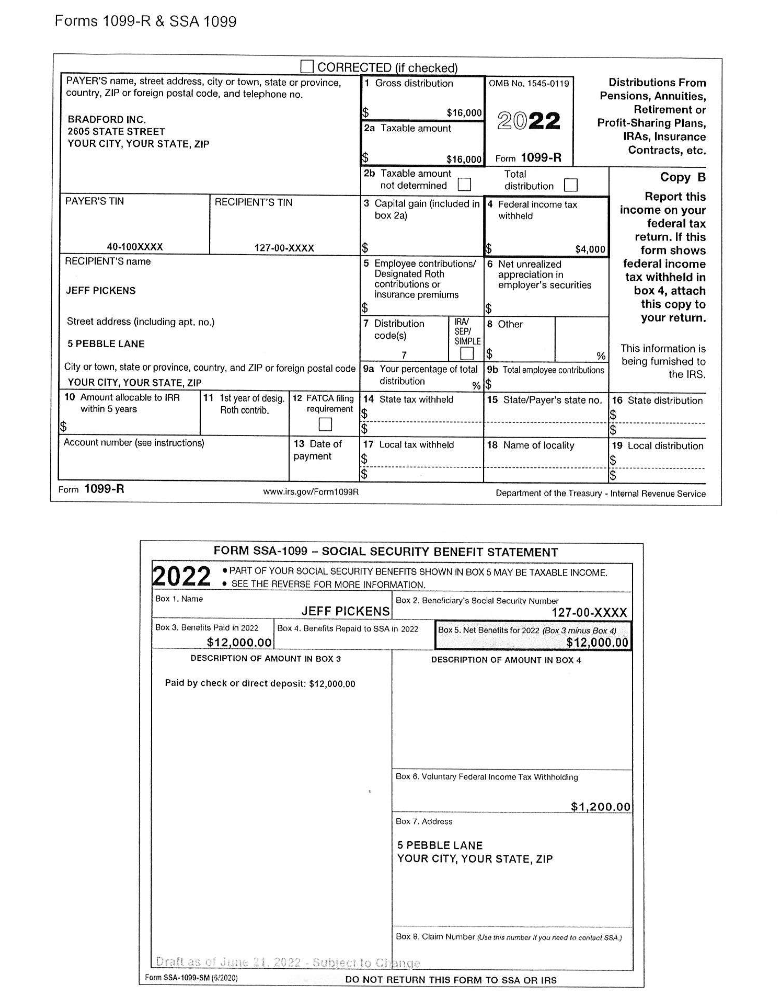

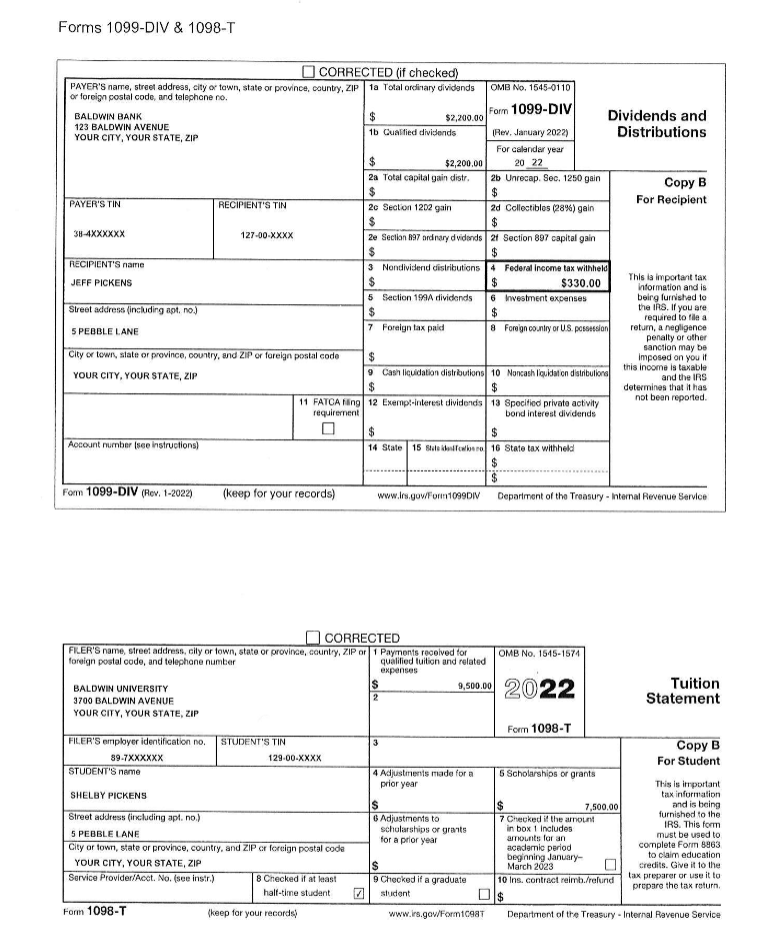

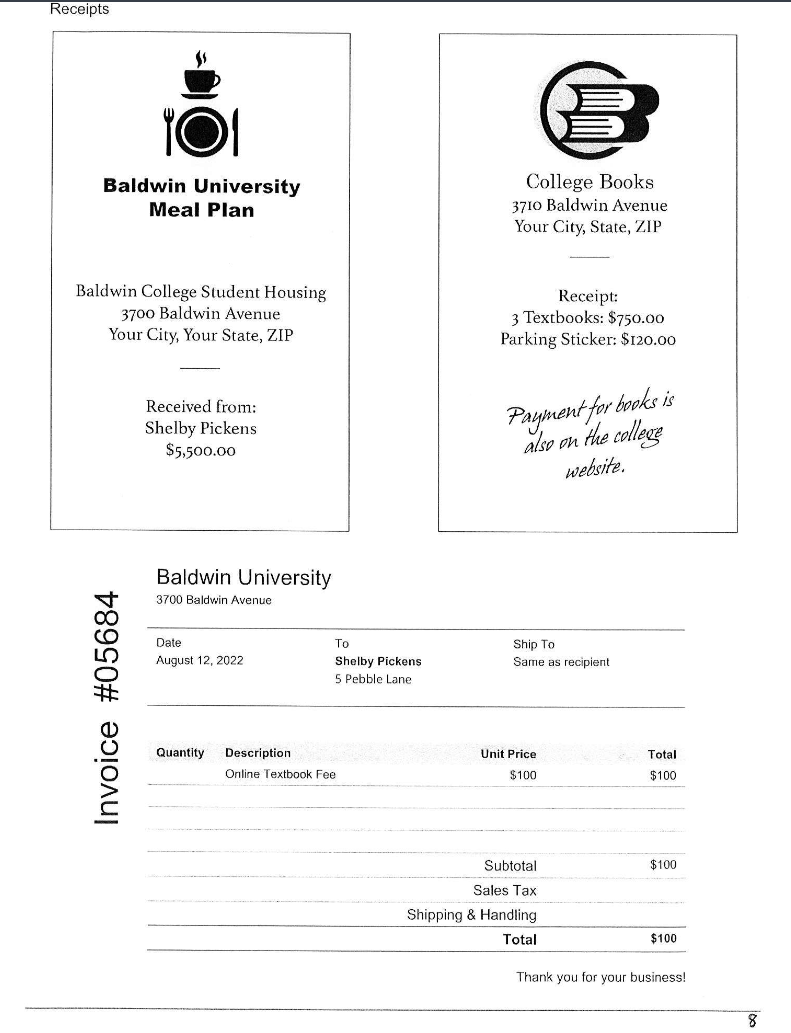

Document Review Simulation - Jeff and Claire Pickens - FALL 2023 Answer the 15 items below on Canvas in the Document Review Simulation Fall 223 tab under Assignments. See 1your svllabus for the due date and time. Based on the interview notes and the documents below, answer the following items relative to their 2022 Form 104i]. if the amount is negative, put a minus {1 before the number. If the amount is zero, write 0. The parenthetical reference for each item below is to the 2322 forms and schedules. 1. Wages, salaries, tips, etc. {Form 1040, line 12] 2. Taxable dividends {Form 1-341], line 3b] 3. Taxable pension distribution {Form 1040, line 5b} 4. Taxable social security benefits {Form 104-3, line Eb} 5. Business income or deductible loss {Schedule 1, line 3] 6. Rental income or deductible loss {Schedule 1, line 5] If. Taxable other income {Schedule 1, line 9} 8. Qualified business income deduction [1040, line 13} 9. Credit for other dependents {Form 1040, line 19} 10. Federal income tax withheld {Form 1D4D, line 2-5d} mmmmmmmmmmm 11. 2022 estimated tax pavments (Form 1D4D, line 2E} 12. Education credit {Schedule 3, line 3}, nonrefundable amount 5 13. American opportunitv credit {Form 1U4D, line 29] refundable S 14. Form required in order to split refund between accounts 15. Tax rate on qualified dividends {from Form 1040, line 16} 943 Jeff Pickens [DOB U?f15f1954, SSN 12115-1515} is married to Claire Pickens (DUB 01f30f1959, SSH 1281636666}, and thev elect to file married filing jointly. Jeff is legailv blind; he is retired and received Social Security benefits and a pension. Claire works fulltime as a store clerk and is also selfemoloved as a massage therapist. They have a daughter, Shelby Pickens, {DUB 09f03f2003, SSN 129112222} who is a full-time college student in her second year of study. She is pursuing a degree in sociology and does not have a felony drug conviction. She received a Form 1098-T for 2022. Box 2 was not checked on her Form 1093-T for the previous tax year. Shelby spent the summer at home with her parents but lived in an apartment near campus during the school year. Shelby received a scholarship and the terms require that it be used to pay tuition. Jeff and Claire paid the cost of her tuition and course-related books in 2022 not covered by the scholarship. The-y paid $120 for a parking sticker, $5,500 for a meal plan, $250 for textbooks purchased at the college bookstore, and $100 for access to an online textbook. They are all US citizens and have valid social security numbers {SSNs} and lived in the US the entire year. The couple paid more than half the cost of keeping up a home and support for Shelby. The couple has provided you with documentation for their income and expenses see below. You also have obtained the following information from interviewing her: lNTERUlEW NOTES 1. In addition to being a store clerk at Cave Street lvlarket, Claire is a self-employed massage therapist, giving massages to clients from both her home and at clients' homes and hotels. For the current year, she has documents to prove the following income and expenses: Fees received for massage services _ $23,300 Business entertainment of clients {took them to Astros game} 1,400 Supplies expense 2,700 Advertising expense 1,800 Professional dues and subscriptions 1,100 Business gifts to 20 clients {5 100 Lalique vase to each} 2,000 Foodfdrinks consumed by Claire in between massage sessions 200 Business computer purchased and put into service December 1 3,150 Simplified method home office: 280 square foot office {1,800 square foot home} Total mileage on her car for 2022 = 11,214 miles, of which 8,556 were personal miles and the rest were business miles in going from client to client {1,380 business miles in the first half of 2022 and the rest in the second half}. She has one vehicle, a 2020 Ford F150, in service on 10f15f2021. Claire will take the standard mileage rate. She would like to take the maximum allowable deduction for her expenses in the current year. 2. Jeff and Claire purchased a rent house on January 2 of the current year for $200,000 {$140,000 allocated to the structure and $60,000 allocated to the land}. The address is 100 Drew Street, Houston, TX 22006. She immediately rented it and has the following income and expenses for the current year: Rental income received {$300 x 12] 5 0,000 Mortgage payments {interest = 56,500, principal reduction = $1,300} 2,300 Real estate taxes 2,320 Maintenance expense 9% Homeowner's insurance 2,250 Repair expense 1, 4-20 Jeff and Claire actively participated in the management of the rent house but they do got qualify as real estate professionals. The rental activity is n_ot a qualified tradefbusiness for the QEI deduction. 3. The couple made timely quarterly tax payments for the current year to ms of $1,000 each quarter [$4,000 total}. 4. Claire tells you in the interview that she won $800 piaying bingo {no WZG was required to be issued} but she also has 5550 of bingo losses. 5. If the couple is entitled to a refund, they would like to deposit half into their checking account and half into their savings account, both at Adelphi Bank and Trust. The routing number for both accounts is 111000025. Her checking account number is 113355229 and her savings account number is 224455830. Note 1: Manually or using tax software, complete the 2022 tax return, including Form 1040 and all appropriate forms, schedules, and worksheets. With that return, answer the 15 questions above. When entering social security numbers [SSNs] or employer identification numbers {EINs}, replace any Xs with digits of your choice to create valid SSNs and Ele. Note 2: When you turn in the assignment, Canvas will calculate a grade. Ignore that grade. You will need to wait until after the due date when I will grade all of the submissions. That grade will be the correct grade on the assignment. DOCUMENTS See the next four pages. Form W2 a Employee's social security number Safe, accurate, 128-00-XXXX OMB No. 1545-0008 FAST! Use IRE file Visit the IRS website at www.irs.gowelle b Employer identification number (EIN) Wages, lips, other compensation 2 Federal income tax withheld 25-7XXXXXX $45,000.00 $3,000.00 c Employer's name, address, and ZIP code Social security wages 4 Social security tax withheld $45,000.00 $2,790.00 CAVE STREET MARKET 5 Medicare wages and tips 6 Medicare tax withheld 200 ROCK ROAD $45,000.00 $652.50 YOUR CITY, YOUR STATE, ZIP Social security tips 8 Allocated tips d Control number 10 Dependent care benefits e Employee's first name and initial Last name Sull. 11 Nonqualified plans 12a See instructions for box 12 $2,300.00 CLAIRE PICKENS 13 Third party employed plan 5 PEBBLE LANE X YOUR CITY, YOUR STATE, ZIP 14 Other 120 120 1 Employee's address and ZIP code 15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name YS 25-7XXXXXX $45 000.0 0 W-2 Wage and Tax Statement Department of the Treasury-Internal Revenue Service Form 2022 Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being furnished to the Internal Revenue Service.Forms 1099-R & SSA 1099 CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, 1 Gross distribution OMB No. 1545-0119 Distributions From country, ZIP or foreign postal code, and telephone no Pensions, Annuities, $16,000 Retirement or BRADFORD INC. 2a 1 Taxable amount 2022 Profit-Sharing Plans 2605 STATE STREET IRAS, Insurance YOUR CITY, YOUR STATE, ZIP Contracts, etc. $16,000 Form 1099-R 2b Taxable amount Total Copy B not determined distribution Report this PAYER'S TIN RECIPIENT'S TIN 3 Capital gain (included in 4 Federal income tax withheld income on your box 2a) federal tax return. If this 40-100XXXX 127-00-XXXX $4,000 form shows RECIPIENT'S name Employee contributions/ 6 Net unrealized federal income Designated Roth appreciation in tax withheld in contributions of employer's securities JEFF PICKENS insurance premiums box 4, attach this copy to Distribution IRA/ 8 Other your return. Street address (including apt. no.) (sjepoo SEP SIMPLE 5 PEBBLE LANE $ This information is 9% being fumished to City or town, state or province, country. and ZIP or foreign postal code | 9a Your percentage of total 9b Total amaloyes contributions the IRS. YOUR CITY, YOUR STATE, ZI distribution 10 Amount allocable to IRA 11 1st year of dosig. 12 FATCA fling 14 State tax withheld 15 State/Payer's state no. 16 State distribution within 5 years Roth contrib requirement S Account number (see instructions) 13 Date of 17 Local tax withheld 18 Name of locality 19 Local distribution payment Form 1099-R www.irs.gow/form10938 Department of the Treasury - Internal Revenue Service FORM SSA-1099 - SOCIAL SECURITY BENEFIT STATEMENT 2022 . PART OF YOUR SOCIAL SECURITY BENEFITS SHOWN IN BOX 6 MAY BE TAXABLE INCOME. . SEE THE REVERSE FOR MORE INFORMATION. Box 1. Name Box 2. Beneficiary's Social Security Number JEFF PICKENS 127-00-XXXX Box 3, Benefits Pad in 2022 Box 4. Benefits Ropaid to SSA in 2022 Box 5. Net Benefits for 2022 (Box 3 minus Box 4) $12,000.00 $12,000.00 DESCRIPTION OF AMOUNT IN BOX 3 DESCRIPTION OF AMOUNT IN DOX 4 Paid by check or direct deposit: $12,000.00 Box 8, Valuntary Federal Income Tax Withholding $1,200.00 Box 7. Address 5 PEBBLE LANE YOUR CITY, YOUR STATE, ZIP Box 9, Chim Number (Use this number if you need to contact 584) Draft as of June 21. 2022 - Subject to Change Form SS4-1090-5M [542020) DO NOT RETURN THIS FORM TO SSA OR IRSForms 1099-DIV & 1098-T O CORRECTED (if checked) PAYER'S name, street address, city of town, state or province, country, ZIP | 1a Total ordinary dividends OMB No, 1545-0110 or foreign postal code, and talephone ro. Form 1099-DIV BALDWIN BANK $2,200.00 Dividends and 123 BALDWIN AVENUE 1b Cualtied dividends [Rev. January 2022) YOUR CITY, YOUR STATE, ZIP Distributions For calendar year $ $2,200.00 20 22 2a Total capital gain distro 26 Unrecap. Soc. 1250 gain Copy B $ $ PAYER'S TIN RECIPIENT'S TIN For Recipient 20 Section 1202 gain 2d Collectibles (28%) gain 38-4XXXXXX 127-00-XXXX 2e Section hay ordinary dividends 21 Section 857 capital gain RECIPIENT'S name Nondividend distributions Federal Income tax withheld JEFF PICKENS $ $330.00 This is important lax Information and is Section 1/7A dividlands Investment expenses being furnished to Street address (including apt. no.) $ the IRS. If you are required to file a 7 5 PEBBLE LANE Foreign lax paid a Foreign country or U.S. possession return, a negligence penalty or other sanction may be City of town, state or province, country, and ZIP or foreign postal code $ Imposed on you if this income is taxable YOUR CITY, YOUR STATE, ZIP Cash liquidation distributions 10 Noncash Iqvidal on distributors and the IRS determines that it hag 11 FATCA fing | 12 Exempt-interest dividends not bean reported. 13 Spocifico private activity requirement bond interest dividends Account number (see Instructions) 14 State 15 Stale Mulfordbaro 16 State tax withheld Form 1099-DIV (Rev. 1-2022) (keep for your records) www.irs.gow/For1099DIV Department of the Treasury - Internal Revenue Service CORRECTED FIER'S name, street address, cily or town, state or province, country, ZIP or | 1 Payments mayonis received for OMB No. 1515-1574 foreign postal code, and telephone number expanses BALDWIN UNIVERSITY S 9,500.00 2022 Tuition 3700 BALDWIN AVENUE Statement YOUR CITY, YOUR STATE, ZIP Form 1098-T FILER'S employer identification no. STUDENT'S TIN Copy B 59 7XXXXXX 129-00.XXXX For Student STUDENT'S name 1 Adjustments made for a 5 Scholarships or grants prior year This is important SHELBY PICKENS tax information 7,500,00 and is being Street address (including apt. no.) 3 Adjustments to Checked if the amount furnished to the in box 1 includes IRS. This form 5 PEBBLE LANE scholarships or grants for a prior year amounts for an must be used to City or town, state or province, country, and ZIP or foreign postal code academic period complete Form 8963 beginning January- to claim education YOUR CITY, YOUR STATE, ZIP March 2023 credits. Give it to the Service Provider/Acct. No. (see insir.) B Checked if at least 9 Checked if a graduate 10 Ins. contract reimbrelund tax preparer or use it to prepare the tax return. half-time student sludan For 1098-T (keep for your records Www.ira.gowForm1098T Department of the Treasury - Internal Revenue ServiceReceipts Baldwin University College Books Meal Plan 3710 Baldwin Avenue Your City, State, ZIP Baldwin College Student Housing Receipt: 3700 Baldwin Avenue 3 Textbooks: $750.00 Your City, Your State, ZIP Parking Sticker: $120.00 Received from: Payment for books is Shelby Pickens also on the college $5,500.00 website . Baldwin University 3700 Baldwin Avenue Date To Ship To August 12, 2022 Shelby Pickens Same as recipient 5 Pebble Lane Invoice #05684 Quantity Description Unit Price Total Online Textbook Fee $100 $100 Subtotal $100 Sales Tax Shipping & Handling Total $100 Thank you for your business! 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts