Question: Use the 4 Steps for Asset Allocation for an Individual Investor and the information about the individual client below to help answer questions 28-32 Currently

Use the 4 Steps for Asset Allocation for an Individual Investor and the information about the individual client below to help answer questions 28-32

- Currently (T=0), the client has $275K in financial assets, but needs $1,000K to retire in 30 years (T=30)

- No additional contributions to financial assets will be made from now until retirement

- Any capital gains on the financial assets will be taxed at 30.0%

- Inflation is forecasted to be 2.0% per year

- The client will invest their financial assets in either stocks or bonds

- Stocks are expected to return 17.0% with 12.0% of total risk

- Bonds are expected to return 8.0% with 5.0% of total risk

- The correlation of stocks and bonds is assumed to be 0.65

- The risk free rate is 2.5%

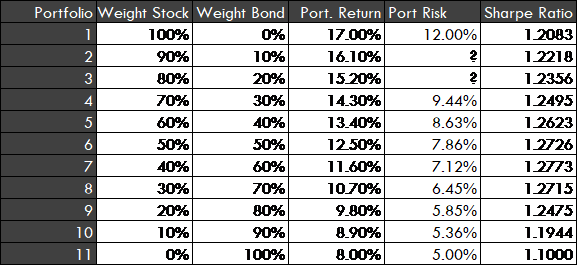

- You are trying to help the client decide between 11 different portfolios with the following weights of stocks and bonds:

- (Asset Allocation) If 85% of the financial assets are invested in stocks and 15% of the financial assets are invested in bonds, the expected total risk of this 85/15 portfolio is closest to:

- 10.68%

- 10.70%

- 10.72%

- 10.74%

- 10.76 %

- (Investment Policy Slides 1 to 45 only) The clients nominal pre-tax return required is closest to:

- 4.4%

- 5.8%

- 6.4%

- 9.1%

- 10.3%

0% 9.44% Portfolio Weight Stock Weight Bond Port. Return Port Risk 100% 17.00% 12.00% 2 90% 10% 16.10% 80% 20% 15 20% 70% 30% 14.30% 5 60% 40% 13.40% 8.63% 50% 50% 12.50% 7.86% 40% 60% 11.60% 7.12% 30% 70% 1070% 6.45% 20% 80% 9.80% 5.85% 10% 90% 8.90% 5.36% 11 0% 100% 8.00% 5.00% Sharpe Ratio 1 2083 12218 12356 12495 1 2623 1 2726 12773 1 2715 1 2475 1.1944 1.1000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts