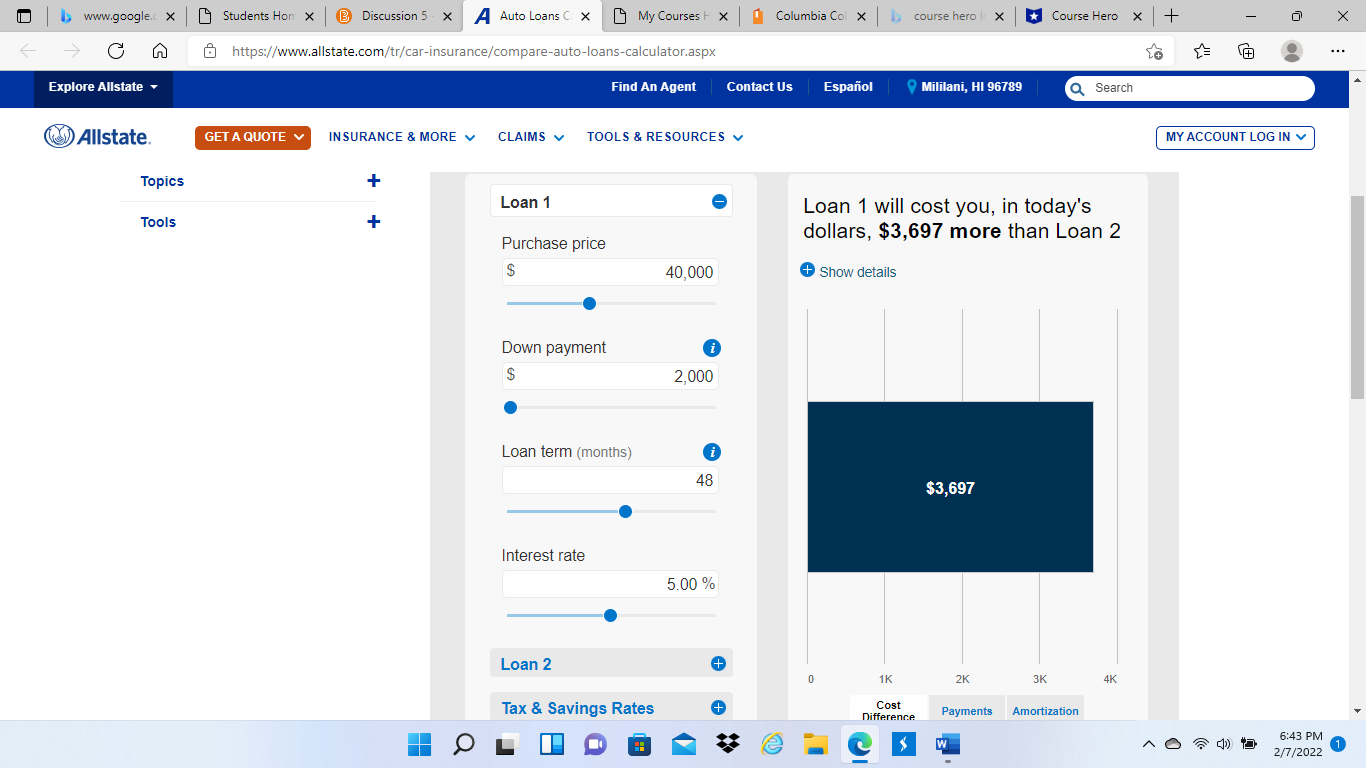

Question: Use the AllState website to compare two different loan offers from a car dealer of your choice. Be sure to use the same car value

Use the AllState website to compare two different loan offers from a car dealer of your choice. Be sure to use the same car value for each loan

Which loan is the better value? Explain your reasoning. Are there other factors to consider before determining which offer to go with?

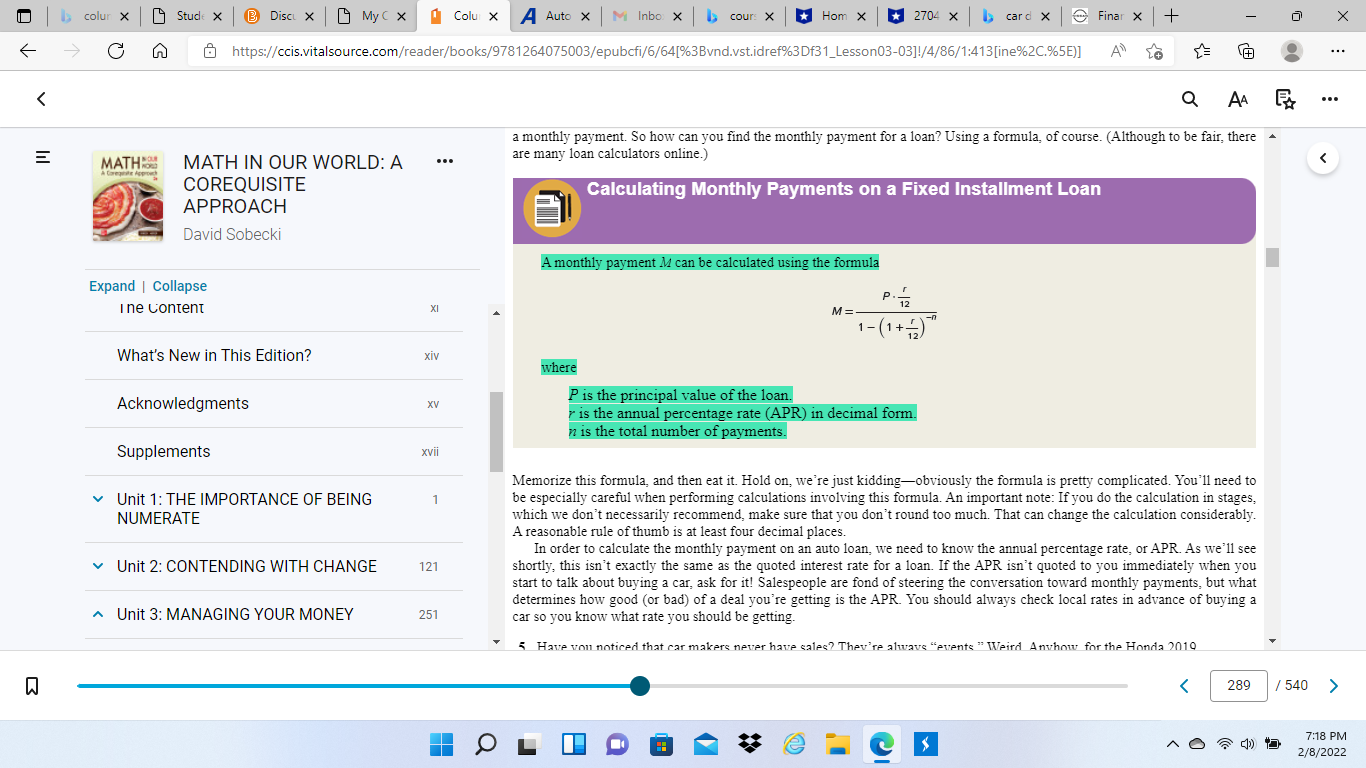

Calculate the payments yourself using the formula we learned in the first half of this unit. Do your values match those of the amortization app found at the site above?

www.google.c x Students Hon X B Discussion 5 - X A Auto Loans C X My Courses . X Columbia Col X | course hero k X * Course Hero X + X CA 8 https://www.allstate.com/tr/car-insurance/compare-auto-loans-calculator.aspx Explore Allstate Find An Agent Contact Us Espanol Mililani, HI 96789 Search Allstate. GET A QUOTE INSURANCE & MORE " CLAIMS ~ TOOLS & RESOURCES v MY ACCOUNT LOG IN v Topics + Loan 1 Loan 1 will cost you, in today's Tools + Purchase price dollars, $3,697 more than Loan 2 S 40,000 + Show details Down payment i 2,000 Loan term (months) i 48 $3,697 Interest rate 5.00 % Loan 2 + 1K 2K 3K 4K Tax & Savings Rates + Cost Difference Payments Amortization 6:43 PM e 2/7/2022 1b colur X Stud x @ Disc x _ MyCX Colu X A Auto X M Inbo X | cour: X Hom x * 2704 x > card x | Finar X + X -> https://ccis.vitalsource.com/reader/books/9781264075003/epubcfi/6/64[%3Bund.vst.idref%3Df31_Lesson03-03]!/4/86/1:413[ine%2C.%5E)] A Q AA ... a monthly payment. So how can you find the monthly payment for a loan? Using a formula, of course. (Although to be fair, there MATH MATH IN OUR WORLD: A ... are many loan calculators online.) COREQUISITE Calculating Monthly Payments on a Fixed Installment Loan APPROACH David Sobecki A monthly payment M can be calculated using the formula Expand | Collapse P .- I ne Content X M = 1 - ( 1 + # ) " What's New in This Edition? xiv where Acknowledgments XV P is the principal value of the loan. is the annual percentage rate (APR) in decimal form. n is the total number of payments Supplements xvii Memorize this formula, and then eat it. Hold on, we're just kidding-obviously the formula is pretty complicated. You'll need to Unit 1: THE IMPORTANCE OF BEING be especially careful when performing calculations involving this formula. An important note: If you do the calculation in stages, NUMERATE which we don't necessarily recommend, make sure that you don't round too much. That can change the calculation considerably. A reasonable rule of thumb is at least four decimal places. In order to calculate the monthly payment on an auto loan, we need to know the annual percentage rate, or APR. As we'll see Unit 2: CONTENDING WITH CHANGE 121 shortly, this isn't exactly the same as the quoted interest rate for a loan. If the APR isn't quoted to you immediately when you start to talk about buying a car, ask for it! Salespeople are fond of steering the conversation toward monthly payments, but what determines how good (or bad) of a deal you're getting is the APR. You should always check local rates in advance of buying a Unit 3: MANAGING YOUR MONEY 251 car so you know what rate you should be getting. 5 Have you noticed that car makers never have sales? They're always "events " Weird Anyhow for the Honda 2010 7:18 PM 2/8/2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts