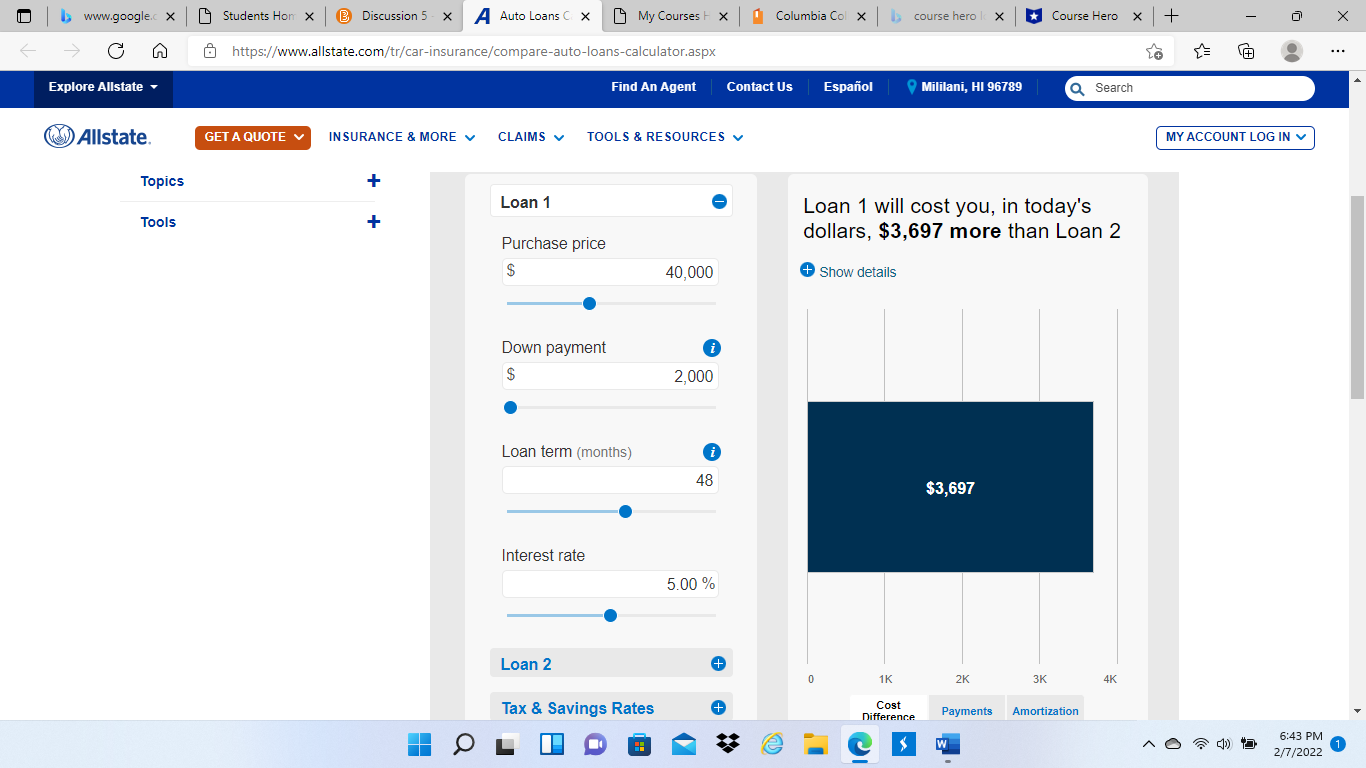

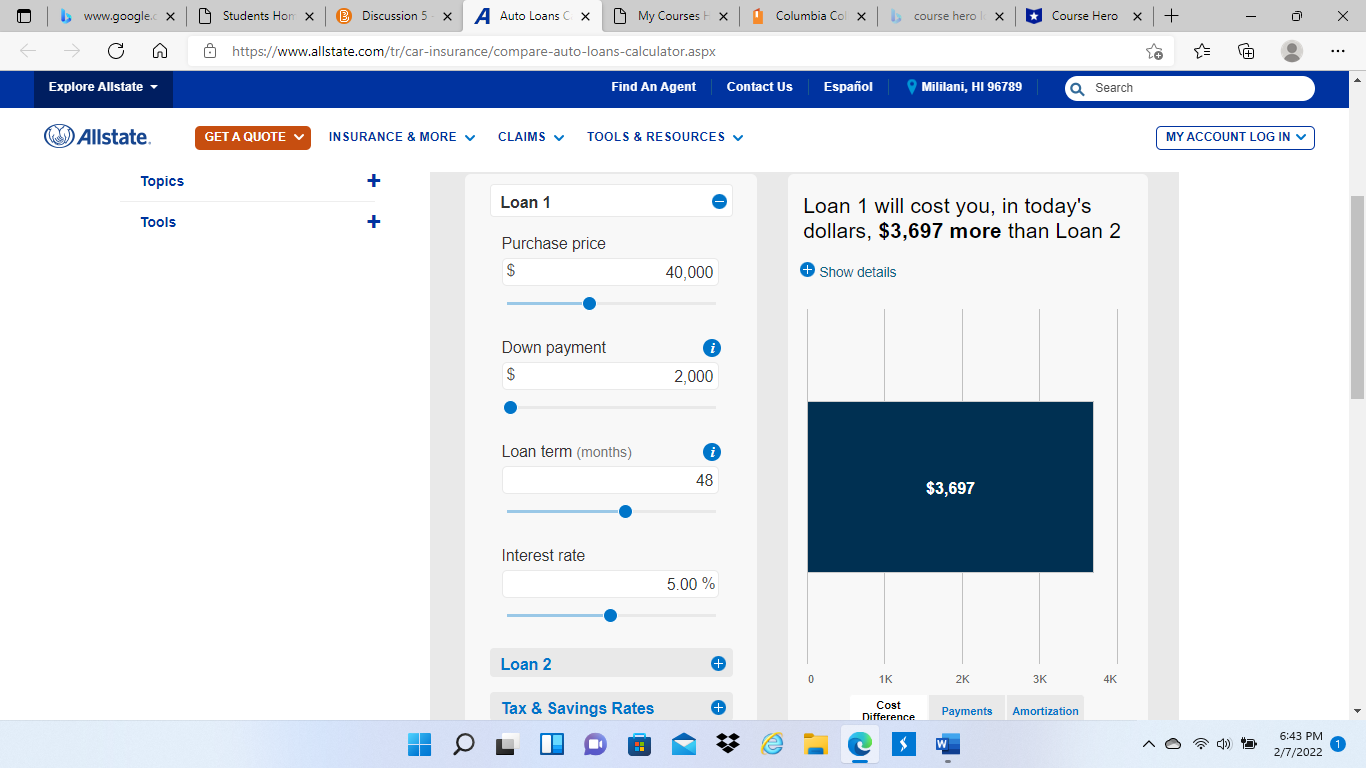

Question: Use the AllState website to compare two different loan offers from a car dealer of your choice. Be sure to use the same car value

Use the AllState website to compare two different loan offers from a car dealer of your choice. Be sure to use the same car value for each loan

Which loan is the better value? Explain your reasoning. Are there other factors to consider before determining which offer to go with?

Calculate the payments yourself using the formula we learned in the first half of this unit. Do your values match those of the amortization app found at the site above?

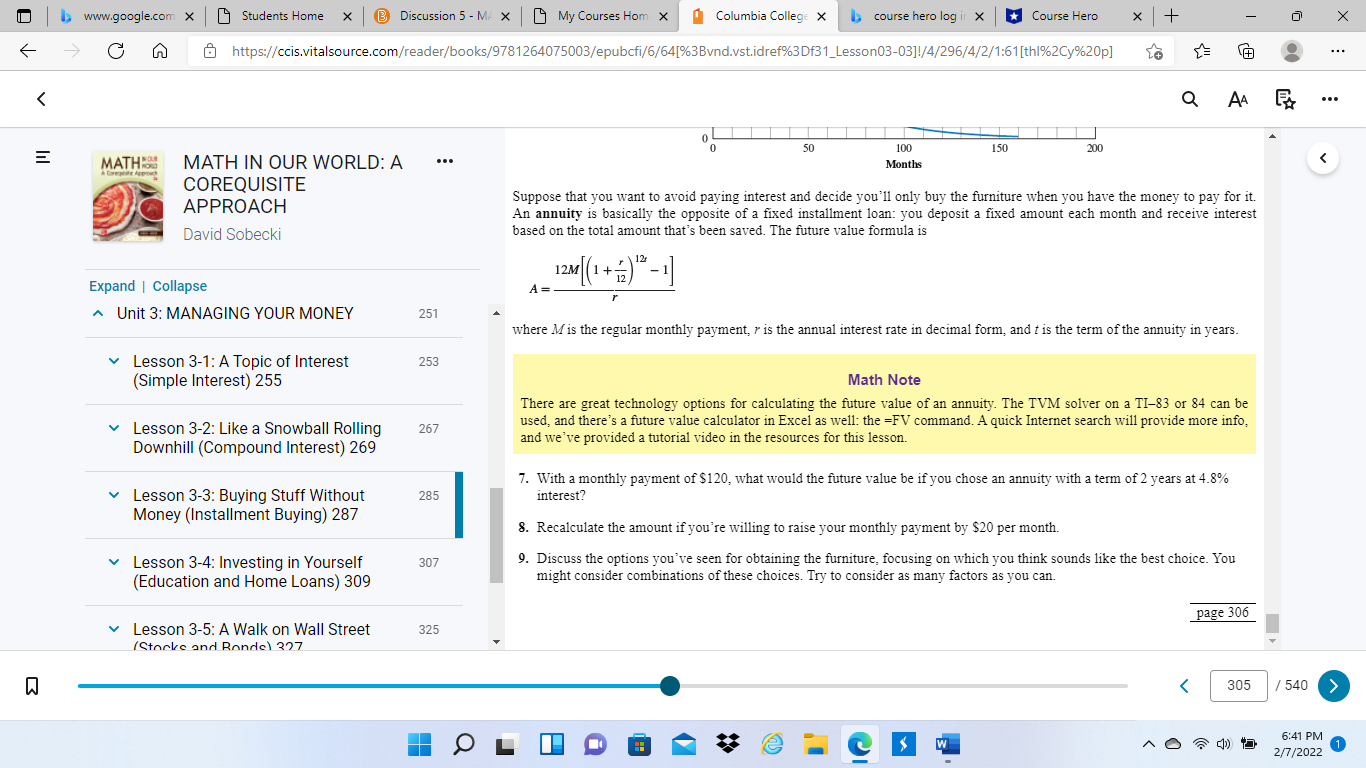

(Hint: You should use the formula for monthly payment from 3-3 in your text.)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock