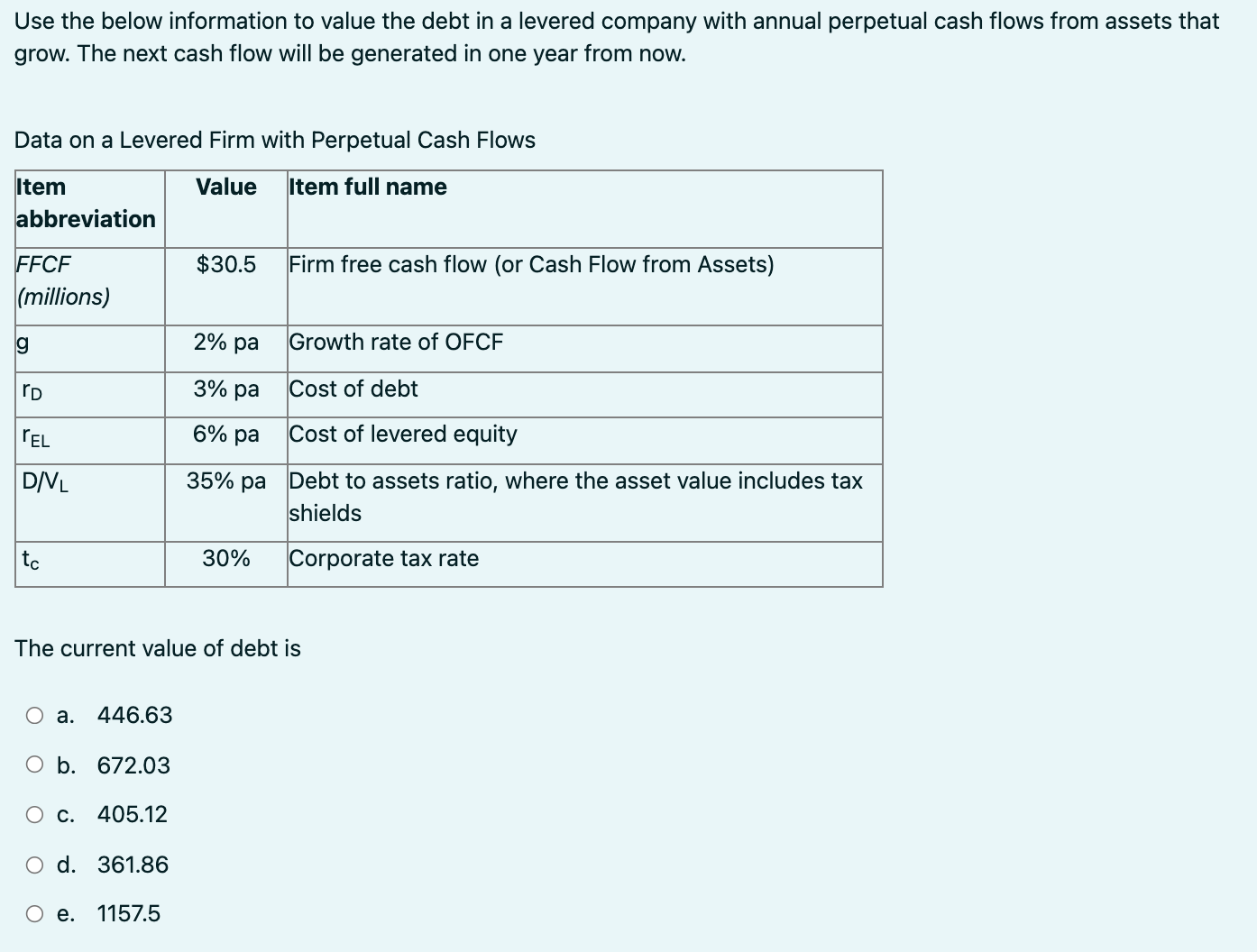

Question: Use the below information to value the debt in a levered company with annual perpetual cash flows from assets that grow. The next cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts