Question: use the binomial option pricing model to determine the terminal value of an EURoption with the following variables: Remaining Time: 1 hour, 36 minutes, 04

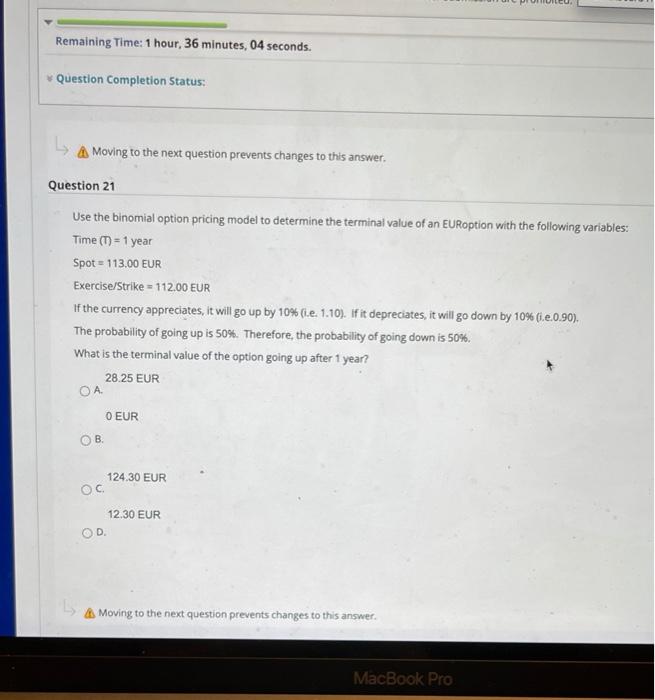

Remaining Time: 1 hour, 36 minutes, 04 seconds. Question Completion Status: Moving to the next question prevents changes to this answer. Question 21 Use the binomial option pricing model to determine the terminal value of an EURoption with the following variables: Time (T) = 1 year Spot = 113.00 EUR Exercise/Strike = 112.00 EUR If the currency appreciates, it will go up by 10% (.e. 1.10). If it depreciates, it will go down by 10% (.e.0.90). The probability of going up is 50%. Therefore, the probability of going down is 50%. What is the terminal value of the option going up after 1 year? 28.25 EUR OA O EUR . 124,30 EUR . 12.30 EUR OD. Moving to the next question prevents changes to this answer MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts