Question: USE THE CASE STUDY pleasd answer the following question 2. What strategic group dimensions and strategic groups can you identify? What are the differences between

USE THE CASE STUDY

pleasd answer the following question

2. What strategic group dimensions and strategic

groups can you identify? What are the differences

between them?

Case example

Game-changing forces and the global advertising industry

Peter Cardwell

This case is centred on the global advertising industry which

faces significant strategic game-changing forces driven by

technological innovation, the rise of consumer spending

in developing economies, changes in consumer media

consumption and pressures from major advertisers for

results-based compensation.

In the second decade of the new millennium, advertising

agencies faced a number of unanticipated challenges.

Traditional markets and industry operating methods,

developed largely in North America and Western Europe

following the rise of consumer spending power in the

twentieth century, were being radically reappraised.

The industry was subject to game-changing forces

from the so-called 'digital revolution' with the entry of

search companies like Google, Facebook and Amazon as

rivals for advertising budgets on mobile devices. Changing

patterns in global consumer markets impacted on both

industry dynamics and structure. Budgets being spent

through traditional advertising agencies were being

squeezed as industry rivalry intensified with the entry of

specialist consultancies.

Overview

Traditionally, the business objective of advertising agen-

cies is to target a specific audience on behalf of clients

with a message that encourages them to try a product

or service and ultimately purchase it. This is done largely

through the concept of a brand being communicated

via media channels. Brands allow consumers to differen-

tiate between products and services and it is the job of

the advertising agency to position the brand so that it is

associated with functions and attributes which are valued

by target consumers. These brands may be consumer

brands (e.q. Procter & Gamble, Samsung, Nestle) or

business-to-business (B2B) brands (e.g. IBM, Airbus Indus-

trie and UPS). Some brands target both consumers and

businesses (e.g. Microsoft and Apple).

As well as private-sector brand companies, govern-

ments spend heavily to advertise public-sector services

such as healthcare and education or to influence indi-

vidual behaviour (such as 'Don't drink and drive'). For

example, the UK government had an advertising budget

of f300m (335m) in the late-2010s. Charities, political

groups, religious groups and other not-for-profit organ-

isations also use the advertising industry to attract funds

into their organisation or to raise awareness of issues.

Together these account for approximately 3 per cent of

advertising spend.

Advertisements are usually placed in selected media

(TV, press, radio, mobile and desktop internet, etc.) by an

advertising agency acting on behalf of the client brand

company; thus they are acting as 'agents'. The client

company employs the advertising agency to use its know-

ledge, skills, creativity and experience to create advert-

ising and marketing to drive consumption of the client's

brands. Clients traditionally have been charged according

to the time spent on creating the advertisements plus a

commission based on the media and services bought on

behalf of clients. However, in recent years, larger advert-

isers such as Coca-Cola, Procter & Gamble and Unilever

have been moving away from this compensation model

to a 'value' or results-based model based on a number of

metrics, including growth in sales and market share.

Ad industry growth

Money spent on advertising has increased dramatic-

ally over the past two decades and in 2018 was over

$205billion (176bn, 158bn) in the USA and $583 billion

worldwide. While there might be a decline in recessionary

years, it is predicted that spending on advertising will

exceed $787 billion globally by 2022.

The industry is shifting its focus as emerging markets

drive revenues from geographic sectors that would not.

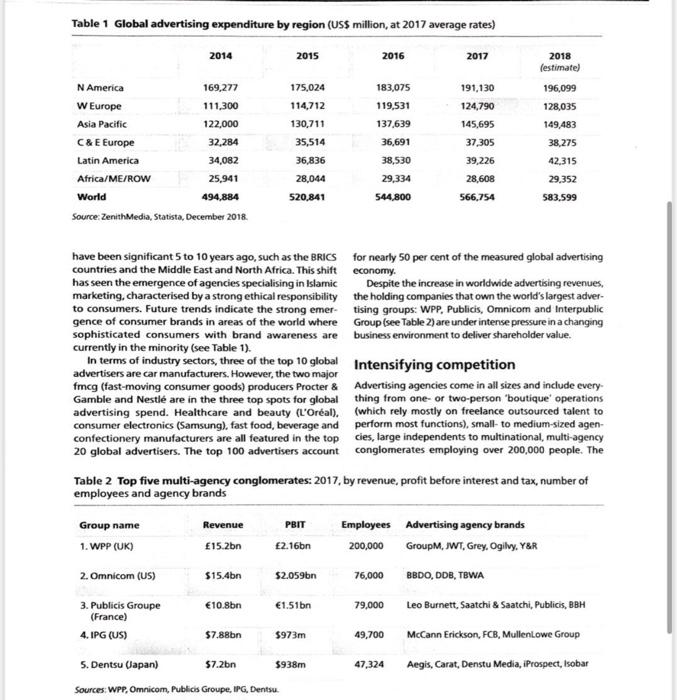

Table 1 Global advertising expenditure by region (US$ million, at 2017 average rates)

2014

2015

2016

2017

N America

169,277

175,024

183.075

191,130

W Europe

111,300

114,712

119,531

124.790

Asia Pacific

122.000

130,711

137.639

145,695

C & E Europe

32,284

35,514

36.691

37,305

Latin America

34,082

36,836

38,530

39,226

Africa/ME/ROW

25,941

28,044

29,334

28,608

World

494,884

520,841

544,800

566,754

Source: ZenithMedia, Statista, December 2018.

2018

(estimate)

196,099

128,035

149,483

38.275

42,315

29,352

583,599

have been significant 5 to 10 years ago, such as the BRICS

countries and the Middle East and North Africa. This shift

has seen the emergence of agencies specialising in Islamic

marketing, characterised by a strong ethical responsibility

to consumers. Future trends indicate the strong emer-

gence of consumer brands in areas of the world where

sophisticated consumers with brand awareness are

currently in the minority (see Table 1).

In terms of industry sectors, three of the top 10 global

advertisers are car manufacturers. However, the two major

fmcg (fast-moving consumer goods) producers Procter &

Gamble and Nestl are in the three top spots for global

advertising spend. Healthcare and beauty (L'Oral),

consumer electronics (Samsung), fast food, beverage and

confectionery manufacturers are all featured in the top

20 global advertisers. The top 100 advertisers account

for nearly 50 per cent of the measured global advertising

economy.

Despite the increase in worldwide advertising revenues,

the holding companies that own the world's largest adver-

tising groups: WPP, Publicis, Omnicom and Interpublic

Group (see Table 2) are under intense pressure in a changing

business environment to deliver shareholder value.

Intensifying competition

Advertising agencies come in all sizes and include every.

thing from one- or two-person 'boutique' operations

(which rely mostly on freelance outsourced talent to

perform most functions), small- to medium-sized agen-

cies, large independents to multinational, multi-agency

conglomerates employing over 200,000 people. The

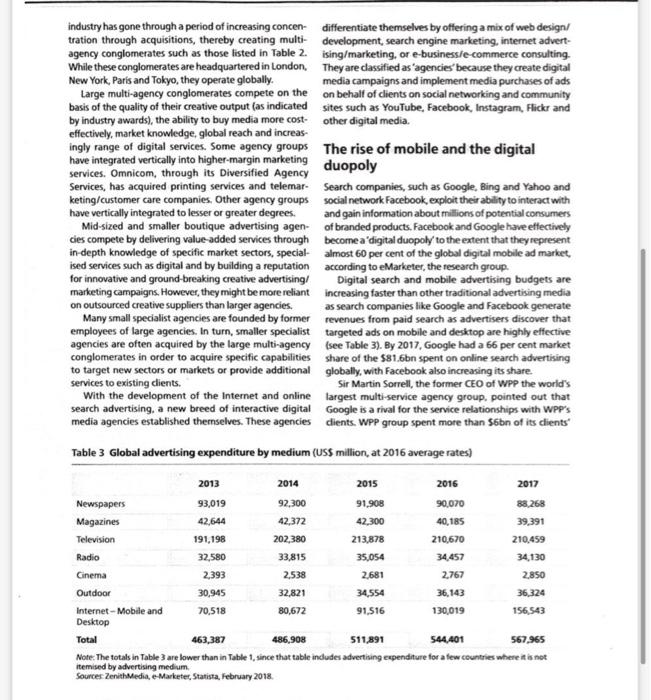

Table 2 Top five multi-agency conglomerates: 2017, by revenue, profit before interest and tax, number of

employees and agency brands

Group name

Revenue

PBIT

Employees

Advertising agency brands

1. WPP (UK)

15.2bn

2.16bn

200,000

GroupM, JWT, Grey, Ogilvy, Y&R

2. Omnicom (US)

$15.4bn

$2.059bn

76,000

BBDO, DDB, TBWA

3. Publicis Groupe

(France)

10.8bn

1.51bn

79,000

Leo Burnett. Saatchi & Saatchi. Publicis. BBH

4. IPG (US)

$7.88bn

973m

49,700

McCann Erickson, CB, MullenLowe Group

5. Dentsu (Japan)

$7.2bn

$938m

47.324

Aegis, Carat, Denstu Media, Prospect, Isobar

industry has gone through a period of increasing concen-

tration through acquisitions, thereby creating multi-

agency conglomerates such as those listed in Table 2.

While these conglomerates are headquartered in London,

New York, Paris and Tokyo, they operate globally.

Large multi-agency conglomerates compete on the

basis of the quality of their creative output (as indicated

by industry awards), the ability to buy media more cost-

effectively, market knowledge, global reach and increas-

ingly range of digital services. Some agency groups

have integrated vertically into higher-margin marketing

services. Omnicom, through its Diversified Agency

Services, has acquired printing services and telemar-

keting/customer care companies. Other agency groups

have vertically integrated to lesser or greater degrees.

Mid-sized and smaller boutique advertising agen-

cies compete by delivering value-added services through

in-depth knowledge of specific market sectors, special-

ised services such as digital and by building a reputation

for innovative and ground-breaking creative advertising/

marketing campaigns. However, they might be more reliant

on outsourced creative suppliers than larger agencies.

Many small specialist agencies are founded by former

employees of large agencies. In turn, smaller specialist

agencies are often acquired by the large multi-agency

conglomerates in order to acquire specific capabilities

to target new sectors or markets or provide additional

services to existing clients.

With the development of the Internet and online

search advertising, a new breed of interactive digital

media agencies established themselves. These agencies

differentiate themselves by offering a mix of web design/

development, search engine marketing, internet advert-

ising/marketing, or e-business/e-commerce consulting.

They are classified as 'agencies' because they create digital

media campaigns and implement media purchases of ads

on behalf of clients on social networking and community

sites such as YouTube, Facebook, Instagram, Flickr and

other digital media.

The rise of mobile and the digital

duopoly

Search companies, such as Google, Bing and Yahoo and

social network Facebook, exploit their ability to interact with

and gain information about millions of potential consumers

of branded products. Facebook and Google have effectively

become a 'digital duopoly' to the extent that they represent

almost 60 per cent of the global digital mobile ad market,

according to Marketer, the research group.

Digital search and mobile advertising budgets are

increasing faster than other traditional advertising media

as search companies like Google and Facebook generate

revenues from paid search as advertisers discover that

targeted ads on mobile and desktop are highly effective

(see Table 3). By 2017, Google had a 66 per cent market

share of the $81.6bn spent on online search advertising

globally, with Facebook also increasing its share.

Sir Martin Sorrell, the former CEO of WPP the world's

largest multi-service agency group, pointed out that

Google is a rival for the service relationships with WPP's

clients. WPP group spent more than $6bn of its clients'

Table 3 Global advertising expenditure by medium (US$ million, at 2016 average rates)

2013

2014

2015

2016

2017

Newspapers

93,019

92,300

91,908

90,070

88.268

Magazines

42.644

42,372

42,300

40,185

39,391

Television

191,198

202,380

213,878

210,670

210,459

Radio

32,580

33,815

35,054

34,457

34,130

Cinema

2,393

2,538

2,681

2,767

2.850

Outdoor

30,945

32,821

34,554

36,143

36,324

Internet - Mobile and

70,518

Desktop

80,672

91,516

130,019

156,543

Total

463,387

486,908

511,891

544,401

567,965

Note: The totals in Table 3 are lower than in Table 1, since that table includes advertising expenditure for a few countries where it is not

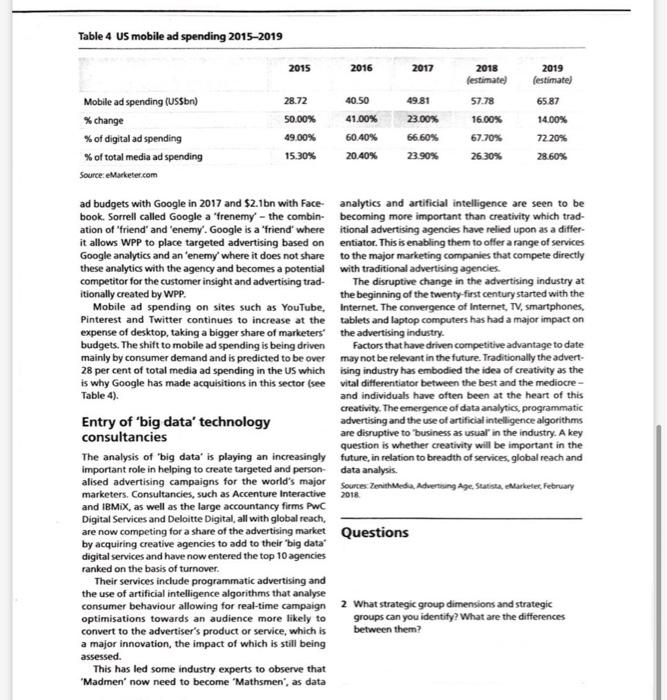

Table 4 US mobile ad spending 2015-2019

7015

Mobile ad spending (USSbn)

28.72

% change

50.00%

% of digital ad spending

49.00%

% of total media ad spending

15.30%

SourceMarete.com

ad budgets with Google in 2017 and $2.1bn with Face-

book.

Sorrel called Google a 'frenemy - the compin-

ation or friend and enemy. Google Is a friend where

it allows WP to place targeted advertisina based on

Gooale analvtics and an enemv where it does not share

these analytics with the agency and becomes a potential

com peutor for the customer insignt and advertising trad

itionallv created bv WPP

Mobile ad spending on sites such as Youlube

Pinterest and witter continues to increase

at the

expense of desktop, taking a bigger share of marketers

budgets. The shift to mobile ad spendina is being driver

mainly by consumer demand and is oredicted to be over

28 per cent of total media ad spendin

g in the US which

is why Google has made acquisitions in this sector (s

Table 4.

Entry of 'big data' technology

consultancies

The analysis of 'big data is playing an inci

important role in helping to create targeted and person

alised advertising campaigns for the world's maior

marketers. Consultancies, such as Accenture Interactive

and IBMiX. as well as the large accountancy firms Pl

Digital Services and Deloitte Digital, all with global reach,

are now competing for a share or the advertising market

by acquirina creative agencies to add to theil

- big data

digital services and nave now entered the top u agencies

ranked on the basis or turnover.

Their services include programmatic advertising and

the use or artificial intelligence

algorithms

consumer behaviour allowing for real-time campaign

optimisations

towaros an auen

convert to the advertisers product or service, which is

a major innovation, the impact or which Is still

being

This has led some industry experts to observe

nat

Madmen now need to become Mathsmen, as data

2016

40.50

41.00%

60.40%

20.40%

49.81

23.00%

66.60%

23.90%

lesumale

57.78

16.00%

67.70%

26.30%

2019

65.87

14.00%

72.20%

28.60%

analvtics and artificial inteligence are seen tr

becoming more Important than creativity which

trad.

itional advertising agencies have relied upon as a differ

entiator. This is enabling them to offer a range or service!

to the maior marketina companies that compete directiv

with traditional advertising agencies.

Ine disruptive change in the advertsing at

the beginning or the twenty-first century started win the

Internet. The convergence or Internet, IV, smartpnones

tablets and laoton computers has had a major impact

the advertising industry.

Factors that have driven competitive advantage to date

not be relevant in the tuture. Iraditionally the advert

ising industry nas embodied the idea of creativitv as the

vital differentiator between the best and the mediocre

and individuals have often been

at the heart or this

creativitv. The emergence of data analvtics, programmatic

advertising and the use of artificial intelligence algorthms

are disruptive to 'business as usual' in the industry. A key

question Is whether creativity will be Important in

future, in relation to breadth or services, global

reac an

Sources: ZenithMedia, Advertising Age. Statista, Marketer, Februan

2018.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock