Question: Use the data file NYSE in R-Studio to answer the following questions: a) Estimate the model returnt = Bo + Bireturnt-1 + Ut , and

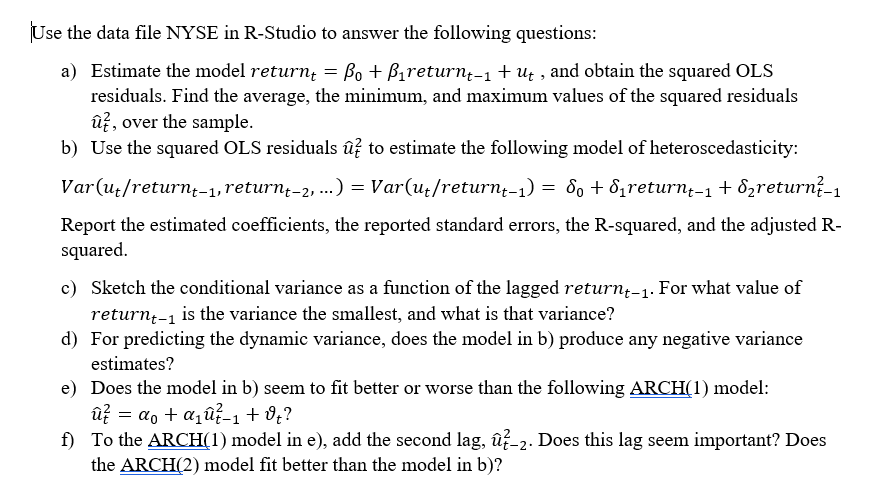

Use the data file NYSE in R-Studio to answer the following questions: a) Estimate the model returnt = Bo + Bireturnt-1 + Ut , and obtain the squared OLS residuals. Find the average, the minimum, and maximum values of the squared residuals , over the sample. b) Use the squared OLS residuals to estimate the following model of heteroscedasticity: Var(uz/returnt-1, returnt-2, ...) = Var(ut/return+-1) = 80 + direturn-1 + 82return{-1 Report the estimated coefficients, the reported standard errors, the R-squared, and the adjusted R- squared c) Sketch the conditional variance as a function of the lagged returnt-1. For what value of returnt-1 is the variance the smallest, and what is that variance? d) For predicting the dynamic variance, does the model in b) produce any negative variance estimates? e) Does the model in b) seem to fit better or worse than the following ARCH(1) model: = do + a -1 +0+? f) To the ARCH(1) model in e), add the second lag, z-2. Does this lag seem important? Does the ARCH(2) model fit better than the model in b)? Use the data file NYSE in R-Studio to answer the following questions: a) Estimate the model returnt = Bo + Bireturnt-1 + Ut , and obtain the squared OLS residuals. Find the average, the minimum, and maximum values of the squared residuals , over the sample. b) Use the squared OLS residuals to estimate the following model of heteroscedasticity: Var(uz/returnt-1, returnt-2, ...) = Var(ut/return+-1) = 80 + direturn-1 + 82return{-1 Report the estimated coefficients, the reported standard errors, the R-squared, and the adjusted R- squared c) Sketch the conditional variance as a function of the lagged returnt-1. For what value of returnt-1 is the variance the smallest, and what is that variance? d) For predicting the dynamic variance, does the model in b) produce any negative variance estimates? e) Does the model in b) seem to fit better or worse than the following ARCH(1) model: = do + a -1 +0+? f) To the ARCH(1) model in e), add the second lag, z-2. Does this lag seem important? Does the ARCH(2) model fit better than the model in b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts