Question: Use the data given for solution Sheridan Chiropractic is a company owned by Nancy Sheridan that provides chiropractic services and sells nutritional products. The chart

Use the data given for solution

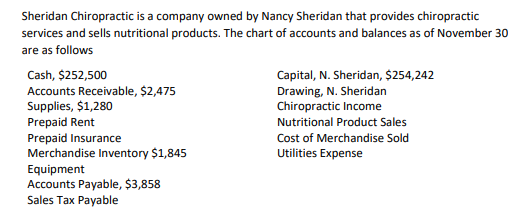

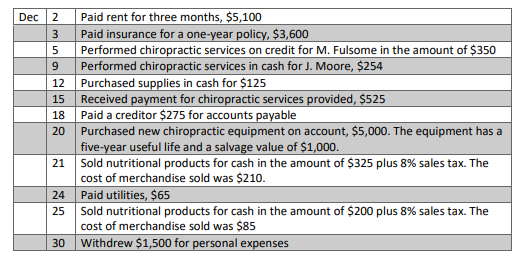

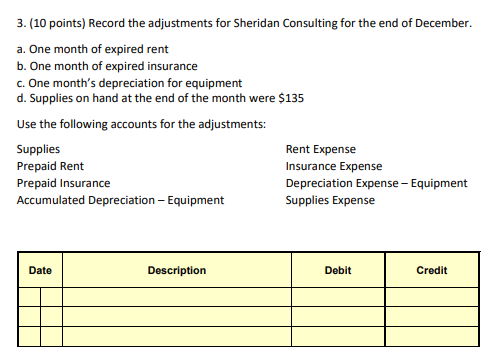

Sheridan Chiropractic is a company owned by Nancy Sheridan that provides chiropractic services and sells nutritional products. The chart of accounts and balances as of November 30 are as follows Cash, $252,500 Accounts Receivable, $2,475 Supplies, $1,280 Prepaid Rent Prepaid Insurance Merchandise Inventory $1,845 Equipment Accounts Payable, $3,858 Sales Tax Payable Capital, N. Sheridan, $254,242 Drawing, N. Sheridan Chiropractic Income Nutritional Product Sales Cost of Merchandise Sold Utilities Expense Dec Paid rent for three months, $5,100 Paid insurance for a one-year policy, $3,600 5 Performed chiropractic services on credit for M. Fulsome in the amount of $350 9 Performed chiropractic services in cash for J. Moore, $254 12 Purchased supplies in cash for $125 15 Received payment for chiropractic services provided, $525 Paid a creditor $275 for accounts payable Purchased new chiropractic equipment on account, $5,000. The equipment has a five-year useful life and a salvage value of $1,000. 2 3 18 20 21 24 25 30 Sold nutritional products for cash in the amount of $325 plus 8% sales tax. The cost of merchandise sold was $210. Paid utilities, $65 Sold nutritional products for cash in the amount of $200 plus 8% sales tax. The cost of merchandise sold was $85 Withdrew $1,500 for personal expenses 3. (10 points) Record the adjustments for Sheridan Consulting for the end of December. a. One month of expired rent b. One month of expired insurance c. One month's depreciation for equipment d. Supplies on hand at the end of the month were $135 Use the following accounts for the adjustments: Supplies Prepaid Rent Prepaid Insurance Accumulated Depreciation - Equipment Date Description Rent Expense Insurance Expense Depreciation Expense - Equipment Supplies Expense Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts