Question: Use the discounted cash flow (DCF) method to answer the following questions. Do not round intermediate calculations. All values other than per-share amounts are shown

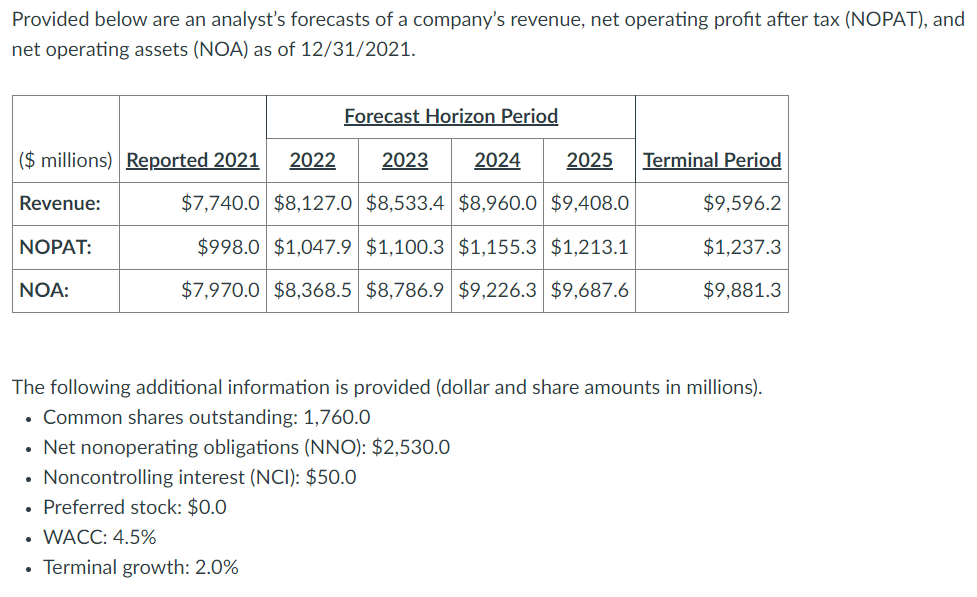

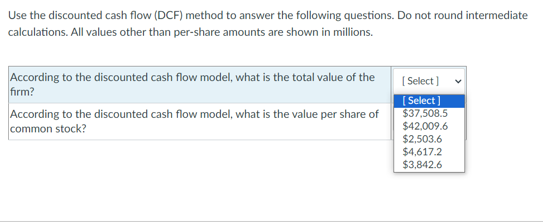

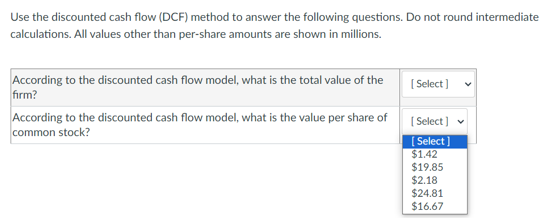

Use the discounted cash flow (DCF) method to answer the following questions. Do not round intermediate calculations. All values other than per-share amounts are shown in millions. Provided below are an analyst's forecasts of a company's revenue, net operating profit after tax (NOPAT), and net operating assets (NOA) as of 12/31/2021. The following additional information is provided (dollar and share amounts in millions). - Common shares outstanding: 1,760.0 - Net nonoperating obligations (NNO): \\$2,530.0 - Noncontrolling interest ( \\( \\mathrm{NCl}) \\) : \\$50.0 - Preferred stock: \\( \\$ 0.0 \\) - WACC: \4.5 - Terminal growth: \2.0 Use the discounted cash flow (DCF) method to answer the following questions. Do not round intermediate calculations. All values other than per-share amounts are shown in millions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts