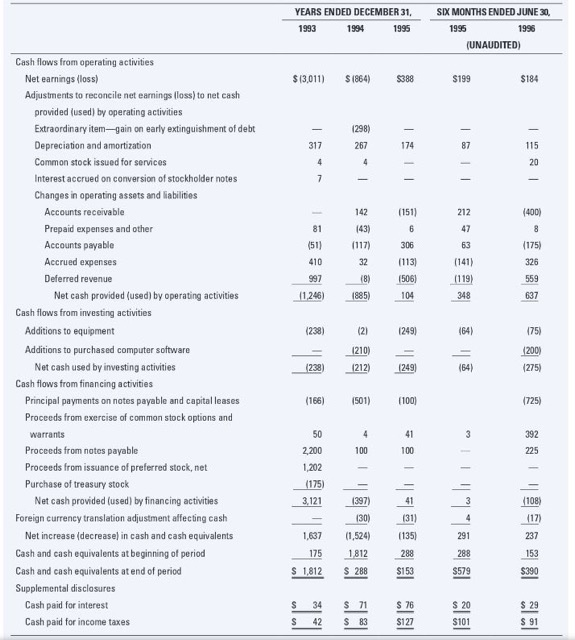

Question: Use the enclosed cash flow statement to answer the question below: Determine weather the venture has been building or burning cash, as well as possible

YEARS ENDED DECEMBER 31, 1993 1994 1995 SIX MONTHS ENDED JUNE 30, 1995 1996 (UNAUDITED) $13,011) $1864) $388 $199 $184 (51) 410 (113) 1506) 104 (141) (119) 997 11246) 1885) 348 (238) (21 Cash flows from operating activities Net earnings (loss) Adjustments to reconcile net earnings floss) to net cash provided (used) by operating activities Extraordinary item-gain on early extinguishment of debt Depreciation and amortization Common stock issued for services Interest accrued on conversion of stockholder notes Changes in operating assets and liabilities Accounts receivable Prepaid expenses and other Accounts payable Accrued expenses Deferred revenue Net cash provided (used) by operating activities Cash flows from investing activities Additions to equipment Additions to purchased computer software Net cash used by investing activities Cash flows from financing activities Principal payments on notes payable and capital leases Proceeds from exercise of common stock options and warrants Proceeds from notes payable Proceeds from issuance of preferred stock, net Purchase of treasury stock Net cash provided (used) by financing activities Foreign currency translation adjustment affecting cash Net increase (decrease in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period Supplemental disclosures Cash paid for interest Cash paid for income taxes 1210 1212) (238) (166) 2.200 1,202 (1751 3.121 1397 1,637 175 0,524) 1812 $ 1812 S 28 YEARS ENDED DECEMBER 31, 1993 1994 1995 SIX MONTHS ENDED JUNE 30, 1995 1996 (UNAUDITED) $13,011) $1864) $388 $199 $184 (51) 410 (113) 1506) 104 (141) (119) 997 11246) 1885) 348 (238) (21 Cash flows from operating activities Net earnings (loss) Adjustments to reconcile net earnings floss) to net cash provided (used) by operating activities Extraordinary item-gain on early extinguishment of debt Depreciation and amortization Common stock issued for services Interest accrued on conversion of stockholder notes Changes in operating assets and liabilities Accounts receivable Prepaid expenses and other Accounts payable Accrued expenses Deferred revenue Net cash provided (used) by operating activities Cash flows from investing activities Additions to equipment Additions to purchased computer software Net cash used by investing activities Cash flows from financing activities Principal payments on notes payable and capital leases Proceeds from exercise of common stock options and warrants Proceeds from notes payable Proceeds from issuance of preferred stock, net Purchase of treasury stock Net cash provided (used) by financing activities Foreign currency translation adjustment affecting cash Net increase (decrease in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period Supplemental disclosures Cash paid for interest Cash paid for income taxes 1210 1212) (238) (166) 2.200 1,202 (1751 3.121 1397 1,637 175 0,524) 1812 $ 1812 S 28

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts