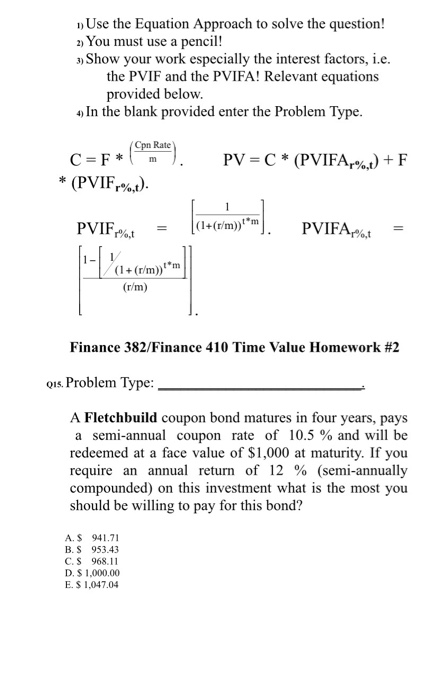

Question: Use the Equation Approach to solve the question! 2) You must use a pencil! 3) Show your work especially the interest factors, i.e. the PVIF

Use the Equation Approach to solve the question! 2) You must use a pencil! 3) Show your work especially the interest factors, i.e. the PVIF and the PVIFA! Relevant equations provided below. 4) In the blank provided enter the Problem Type. Cpn Rate C=F* * (PVIF%,t). PV = C * (PVIFAr%,) + F PVIF%. (1+(r/m)) *** PVIFA, +(r/m) (r/m) Finance 382/Finance 410 Time Value Homework #2 Qis. Problem Type: A Fletchbuild coupon bond matures in four years, pays a semi-annual coupon rate of 10.5 % and will be redeemed at a face value of $1,000 at maturity. If you require an annual return of 12 % (semi-annually compounded) on this investment what is the most you should be willing to pay for this bond? AS 941.71 B.S 953.43 CS 968.11 D. $ 1.000.00 E. $ 1,047.04

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts