Question: USE THE EXAMPLE TO SUBSTITUTE GIVEN VALUES TO SOLVE FOR THE FOLLOWING: D(1) = D0(1+g) P(o) = D1/(R-g) to calculate price A. Nike Stock ($124.25/Share);

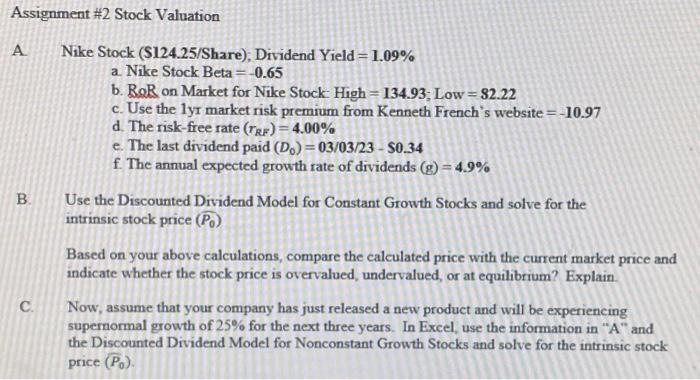

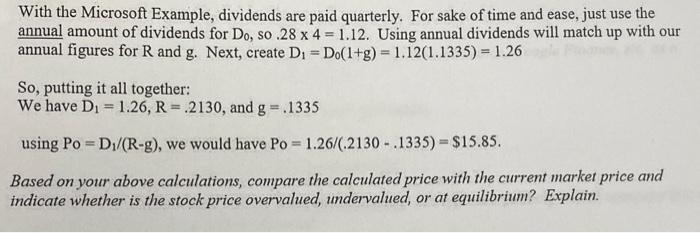

A. Nike Stock (\$124.25/Share); Dividend Yield =1.09% a. Nike Stock Beta =0.65 b. RR on Market for Nike Stock: High =134.93; Low =82.22 c. Use the lyr market risk premium from Kenneth French's website =10.97 d. The risk-free rate (rRF)=4.00% e. The last dividend paid (D0)=03/03/2350.34 f. The annual expected growth rate of dividends (g)=4.9% B. Use the Discounted Dividend Model for Constant Growth Stocks and solve for the intrinsic stock price (P0) Based on your above calculations, compare the calculated price with the current market price and indicate whether the stock price is overvalued, undervalued, or at equilibrium? Explain. C. Now, assume that your company has just released a new product and will be experiencing supernormal growth of 25% for the next three years. In Excel, use the information in "A" and the Discounted Dividend Model for Nonconstant Growth Stocks and solve for the intrinsic stock price (P0). With the Microsoft Example, dividends are paid quarterly. For sake of time and ease, just use the annual amount of dividends for D0, so .284=1.12. Using annual dividends will match up with our annual figures for R and g. Next, create D1=D0(1+g)=1.12(1.1335)=1.26 So, putting it all together: We have D1=1.26,R=.2130, and g=.1335 using P0=D1/(Rg), we would have P0=1.26/(.2130.1335)=$15.85. Based on your above calculations, compare the calculated price with the current market price and indicate whether is the stock price overvalued, undervalued, or at equilibrium? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts