Question: (Use the excel sheet attached to solve this problem) Sweton, Inc. is considering a new project. The project will require $500,000 for new fixed assets.

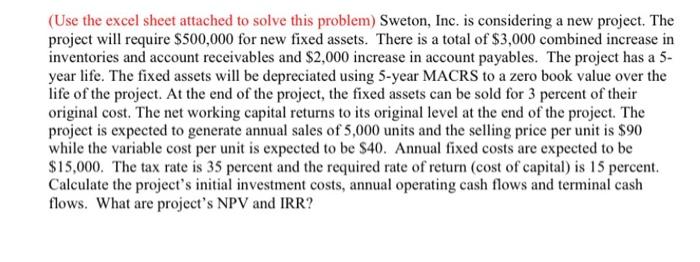

(Use the excel sheet attached to solve this problem) Sweton, Inc. is considering a new project. The project will require $500,000 for new fixed assets. There is a total of $3,000 combined increase in inventories and account receivables and $2,000 increase in account payables. The project has a 5- year life. The fixed assets will be depreciated using 5-year MACRS to a zero book value over the life of the project. At the end of the project, the fixed assets can be sold for 3 percent of their original cost. The net working capital returns to its original level at the end of the project. The project is expected to generate annual sales of 5,000 units and the selling price per unit is $90 while the variable cost per unit is expected to be $40. Annual fixed costs are expected to be $15,000. The tax rate is 35 percent and the required rate of return (cost of capital) is 15 percent. Calculate the project's initial investment costs, annual operating cash flows and terminal cash flows. What are project's NPV and IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts