Question: (Use the excel sheet attached to solve this problem) Sweton, Inc. is considering a new project. The project will require $500,000 for new fixed assets.

(Use the excel sheet attached to solve this problem) Sweton, Inc. is considering a new project. The project will require $500,000 for new fixed assets. There is a total of $3,000 combined increase in inventories and account receivables and $2,000 increase in account payables. The project has a 5- year life. The fixed assets will be depreciated using 5-year MACRS to a zero book value over the life of the project. At the end of the project, the fixed assets can be sold for 3 percent of their original cost. The net working capital returns to its original level at the end of the project. The project is expected to generate annual sales of 5,000 units and the selling price per unit is $90 while the variable cost per unit is expected to be $40. Annual fixed costs are expected to be $15,000. The tax rate is 35 percent and the required rate of return (cost of capital) is 15 percent. Calculate the projects initial investment costs, annual operating cash flows and terminal cash flows. What are projects NPV and IRR?

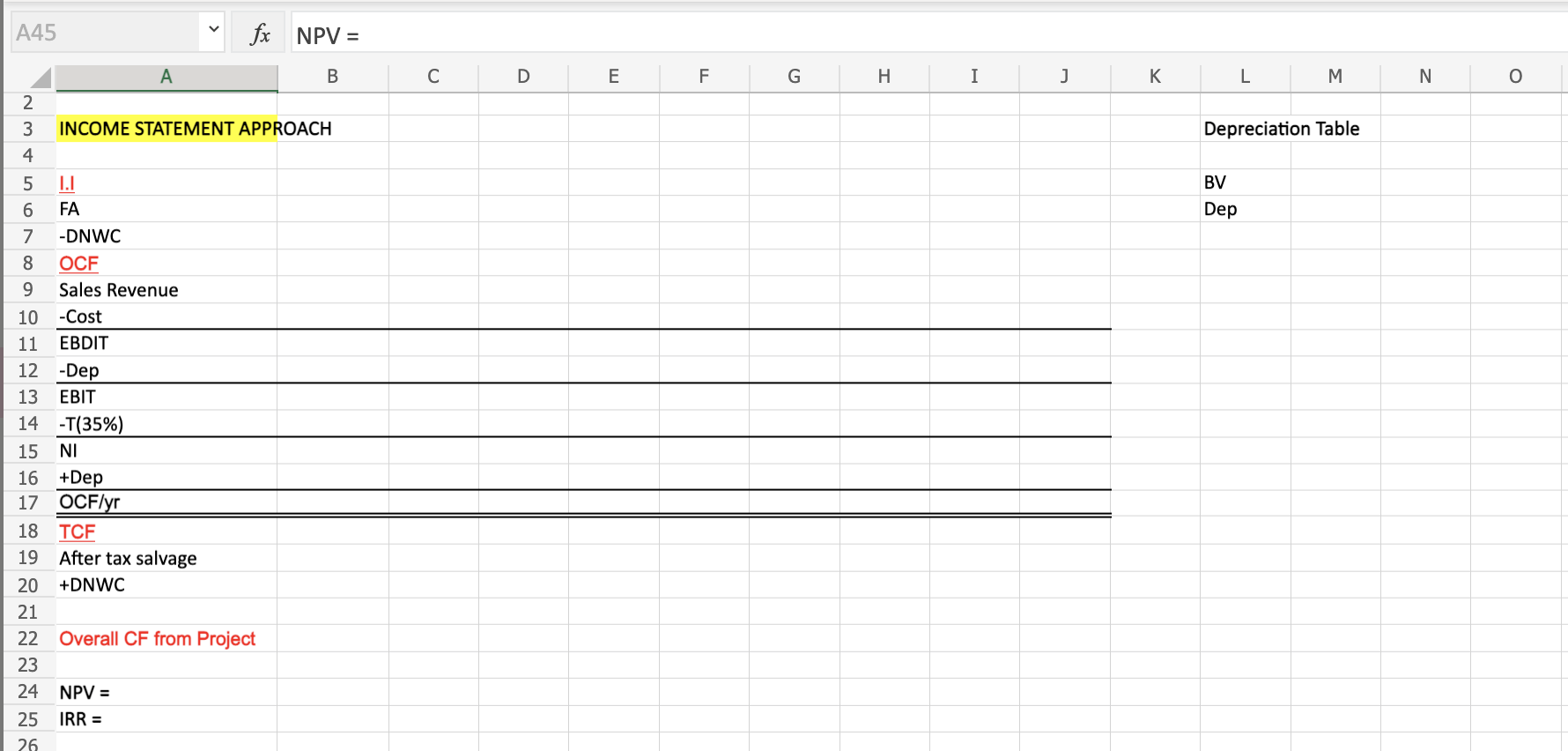

Using the excel sheet setup and income statement approach please solve the question above and show work!

Using the excel sheet setup and income statement approach please solve the question above and show work!

A45 fx NPV = D E F G H I J K L M N o Depreciation Table BV Dep A B 2 3 INCOME STATEMENT APPROACH 4 5 1.1 6 FA 7 -DNWC 8 OCF 9 Sales Revenue 10 -Cost 11 EBDIT 12 -Dep 13 EBIT 14 -T(35%) 15 NI 16 +Dep 17 OCF/yr 18 TCF 19 After tax salvage 20 +DNWC 21 22 Overall CF from Project 23 24 NPV = 25 IRR = 26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts