Question: Use the following information as your reference. There are five notes and one bond. Theoretical on - the - run Treasury yields for the settlement

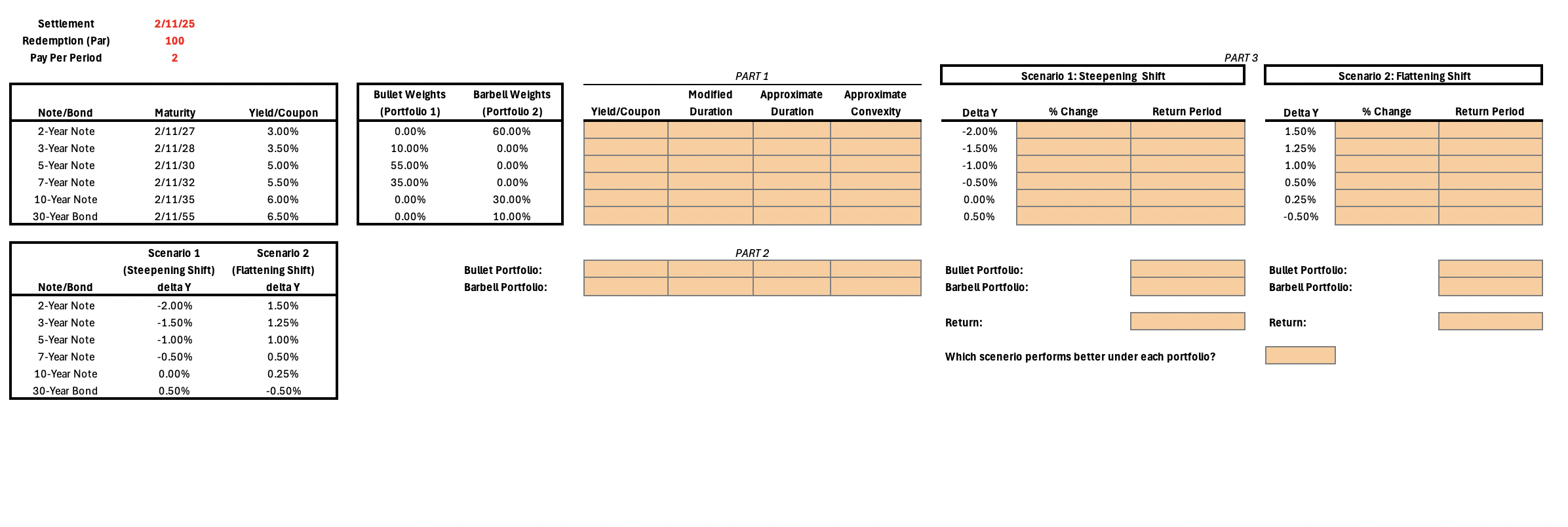

Use the following information as your reference. There are five notes and one bond. Theoretical ontherun Treasury yields for the settlement date of are provided based on maturity. Assume all securities are priced at par.

Portfolio Weights: Instructions:

Calculate the modified duration, approximate duration, and approximate convexity in years using the approximation methods from the notes and textbook. Apply a basispoint increase and decrease in yield for the calculations. Verify your duration result using the MDURATION function in Excel.

Calculate the weighted average yield, approximate and modified duration, and approximate convexity for both the Bullet and Barbell portfolios using the duration and convexity measures from Step

Compute the returns for the Bullet and Barbell portfolios over a month holding period, including one coupon payment in the return calculation, for the two nonparallel shift scenarios below.

a Identify which scenario performs better under each portfolio with comparison to their returns just state "Scenario or "Scenario

begintabularccc

hline & begintabularc

Scenario :

Steepening Shift

endtabular & begintabularc

Scenario :

Flattening Shift

endtabular

hline NoteBond & Delta Y & Delta Y

hline Year Note & &

hline Year Note & &

hline Year Note & &

hline Year Note & &

hline Year Note & &

hline Year Note & &

hline

endtabular Explain the differences in portfolio returns across the various parallel shift scenarios. Your response should discuss the impact of portfolio duration, convexity, and average coupon, referencing the calculations from the previous steps for support refer to the textbook for additional guidance

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock