Question: Use the following information for questions 2 through 4. Two independent companies, Hager Co. and Shaw Co., are in the home building business. Each

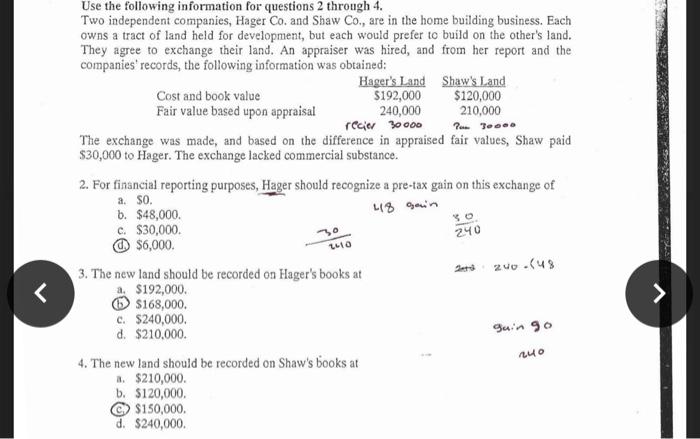

Use the following information for questions 2 through 4. Two independent companies, Hager Co. and Shaw Co., are in the home building business. Each owns a tract of land held for development, but each would prefer to build on the other's land. They agree to exchange their land. An appraiser was hired, and from her report and the companies' records, the following information was obtained: Cost and book value Fair value based upon appraisal Hager's Land $192,000 240,000 recier 30000 Shaw's Land $120,000 210,000 Pam 30000 The exchange was made, and based on the difference in appraised fair values, Shaw paid $30,000 to Hager. The exchange lacked commercial substance. 2. For financial reporting purposes, Hager should recognize a pre-tax gain on this exchange of a. $0. b. $48,000. c. $30,000. $6,000. 48 gain 30 1410 240 < 3. The new land should be recorded on Hager's books at a. $192,000. 23 240-(48 $168,000. c. $240,000. d. $210,000. 4. The new land should be recorded on Shaw's books at a. $210,000. b. $120,000. $150,000. d. $240,000. guin 90 240

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts