Question: Use the following information to answer Multiple Choice Problems 19 to 22: JG Corporation, a rm with a 30% corporate tax rate and a cost

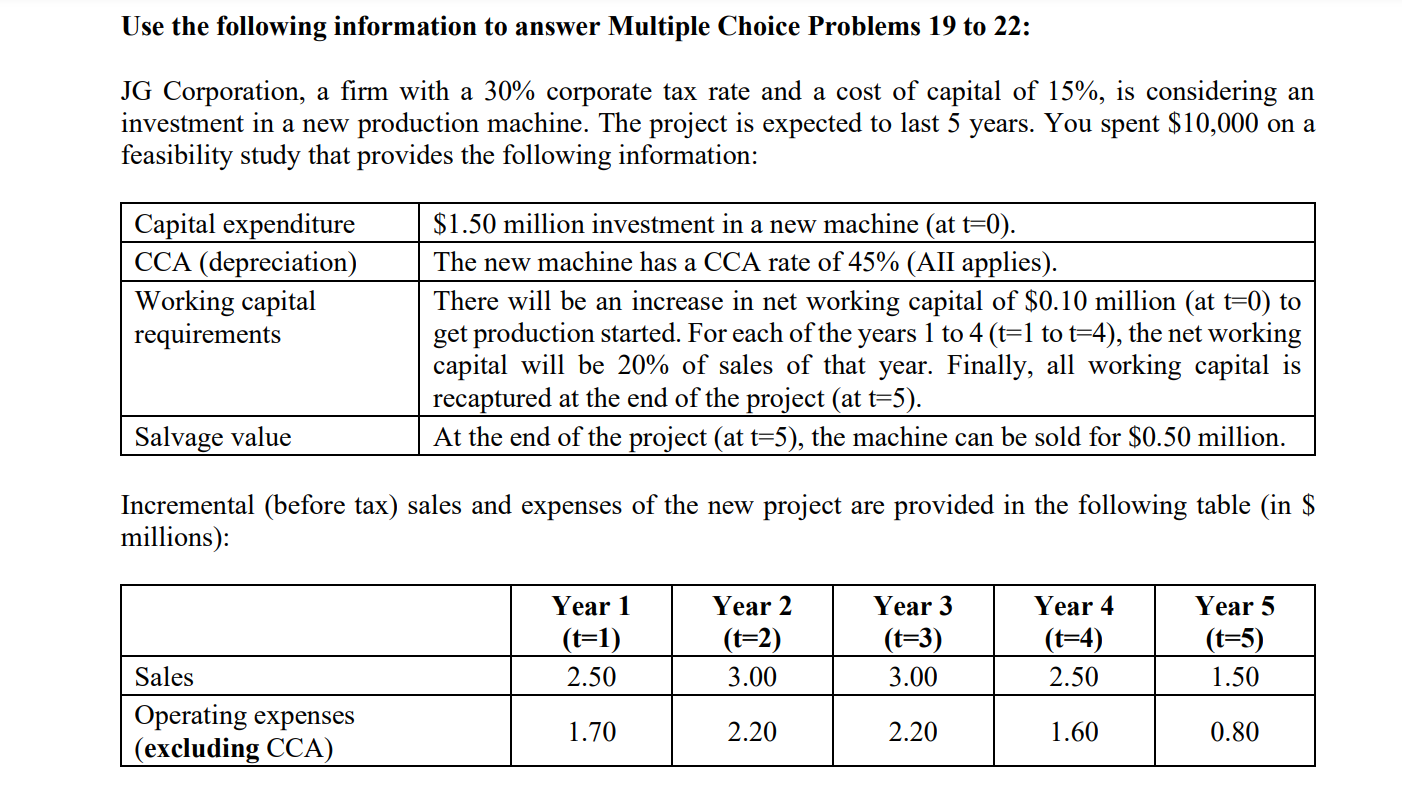

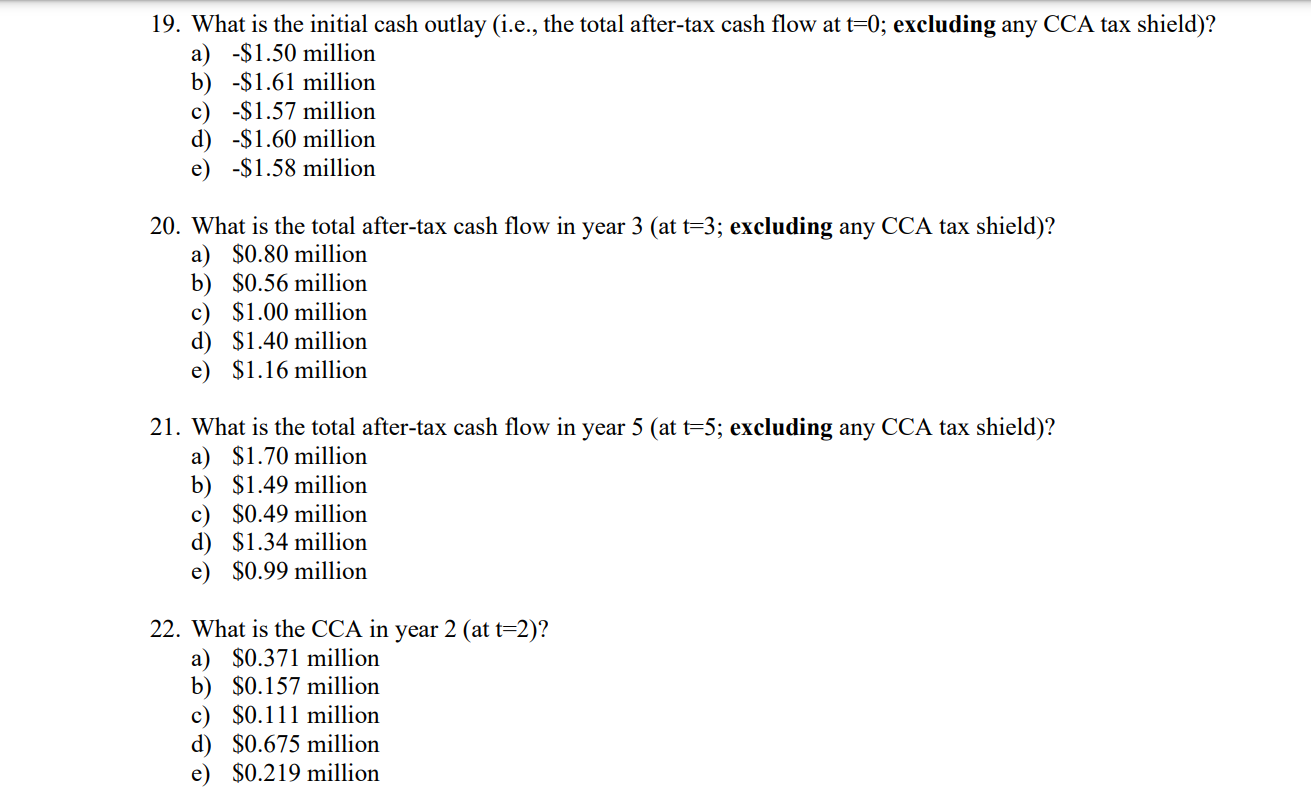

Use the following information to answer Multiple Choice Problems 19 to 22: JG Corporation, a rm with a 30% corporate tax rate and a cost of capital of 15%, is considering an investment in a new production machine. The project is expected to last 5 years. You spent $10,000 on a feasibility study that provides the following information: Capital expenditure $1.50 million investment in a new machine (at t=0). CCA (depreciation) The new machine has a CCA rate of 45% (All applies). Working capital There will be an increase in net working capital of $0.10 million (at 1:0) to requirements get production started. For each of the years 1 to 4 (t=l to t=4), the net working capital will be 20% of sales of that year. Finally, all working capital is recaptured at the end of the project (at t=5). Salvage value At the end of the project (at t=5), the machine can be sold for $0.50 million. Incremental (before tax) sales and expenses of the new project are provided in the following table (in $ millions): Year 1 Year 2 Year 3 Year 4 Year 5 (t=1) (t=2) (t=3) (t=4) (t=5) Operating expenses 19. 20. 21. 22. What is the initial cash outlay (i.e., the total aftertax cash ow at 1:0; excluding any CCA tax shield)? a) $1.50 million b) -$l.61 million c) -$1.57 million 1) -$1.60 million e) $1 .58 million What is the total after-tax cash ow in year 3 (at F3; excluding any CCA tax shield)? a) $0.80 million b) $0.56 million c) $1.00 million d) $1.40 million e) $1.16 million What is the total aertax cash ow in year 5 (at 1:5; excluding any CCA tax shield)? a) $1.70 million b) $1.49 million c) $0.49 million d) $1.34 million e) $0.99 million What is the CCA in year 2 (at t=2)? a) $0.371 million b) $0.157 million c) $0.111 million d) $0.675 million e) $0.219 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts