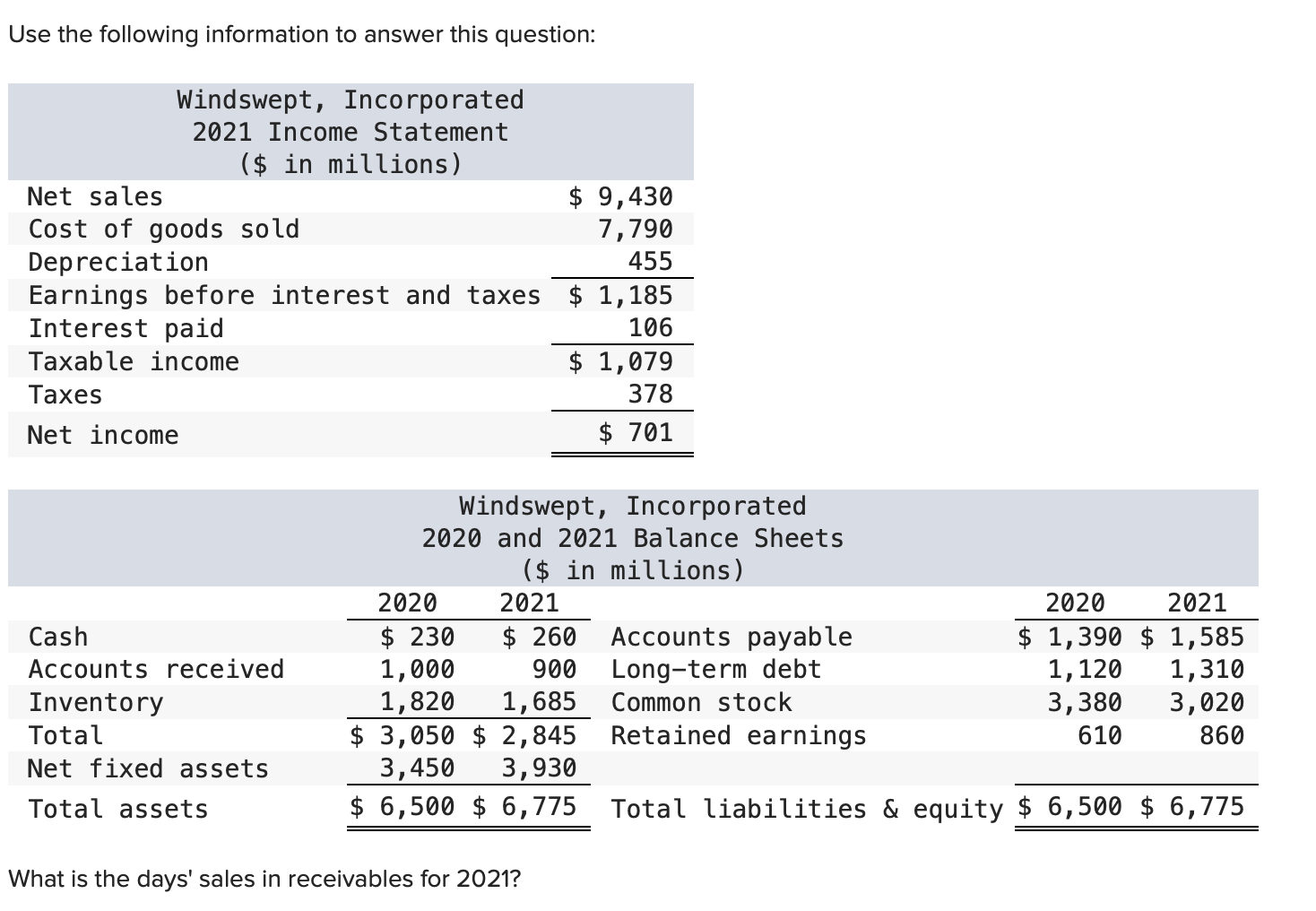

Question: Use the following information to answer this question: Windswept, Incorporated 2021 Income Statement ($ in millions) Net sales $ 9,430 Cost of goods sold 7,790

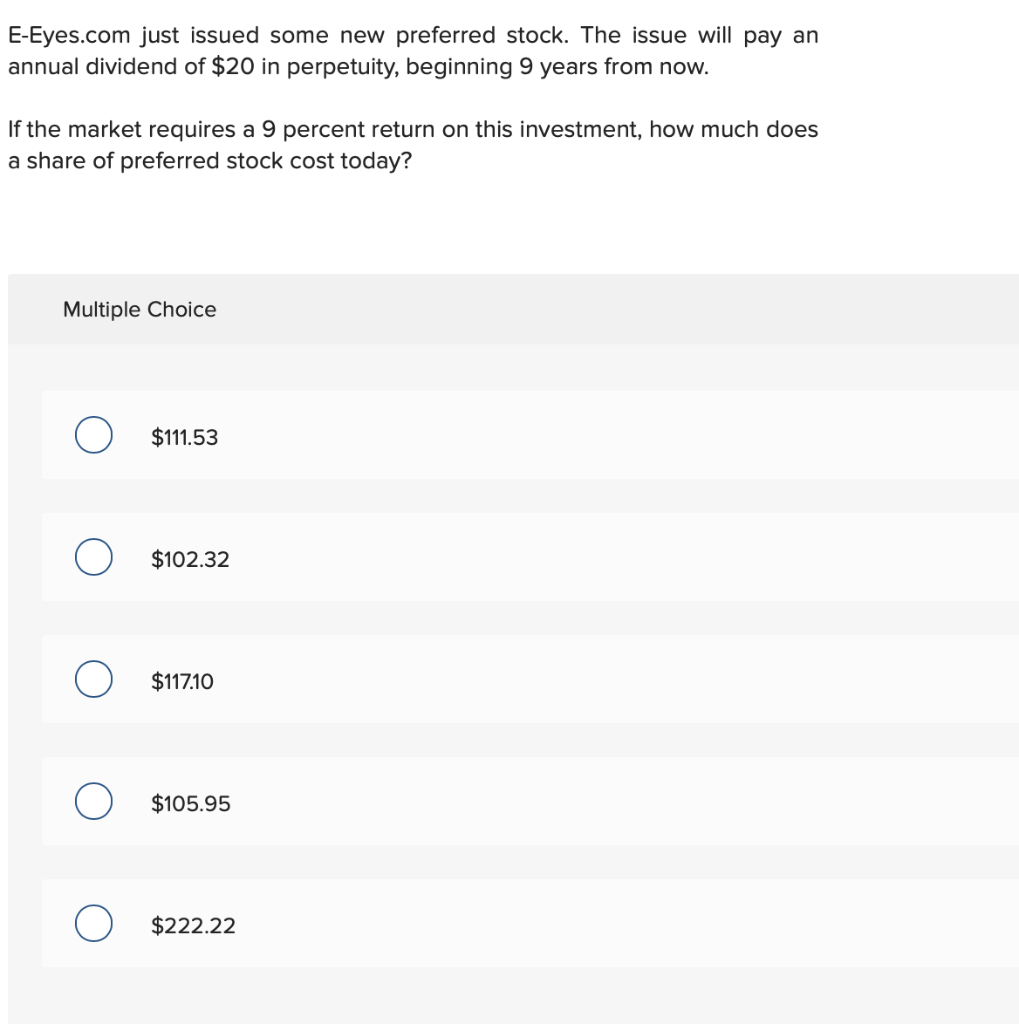

Use the following information to answer this question: Windswept, Incorporated 2021 Income Statement ($ in millions) Net sales $ 9,430 Cost of goods sold 7,790 Depreciation 455 Earnings before interest and taxes $ 1,185 Interest paid 106 Taxable income $ 1,079 Taxes 378 Net income $ 701 Cash Accounts received Inventory Total Net fixed assets Total assets Windswept, Incorporated 2020 and 2021 Balance Sheets ($ in millions) 2020 2021 2020 2021 $ 230 $ 260 Accounts payable $ 1,390 $ 1,585 1,000 900 Long-term debt 1,120 1,310 1,820 1,685 Common stock 3,380 3,020 $ 3,050 $ 2,845 Retained earnings 610 860 3,450 3,930 $ 6,500 $ 6,775 Total liabilities & equity $ 6,500 $ 6,775 What is the days' sales in receivables for 2021? E-Eyes.com just issued some new preferred stock. The issue will pay an annual dividend of $20 in perpetuity, beginning 9 years from now. If the market requires a 9 percent return on this investment, how much does a share of preferred stock cost today? Multiple Choice $111.53 $102.32 $117.10 0 $105.95 $222.22

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts