Question: Use the following modified values to work on your Project 1. Price of the house is $160,000. House will be sold in 10 years for

- Use the following modified values to work on your Project 1.

- Price of the house is $160,000.

- House will be sold in 10 years for $185,000.

- The project must be completed in Excel. Answer the questions listed below.

- Evaluate Plan A and Plan C.

- Select the best financing method.

- What is the total amount of interest paid in Plan A and Plan C through the 10-year period, respectively?

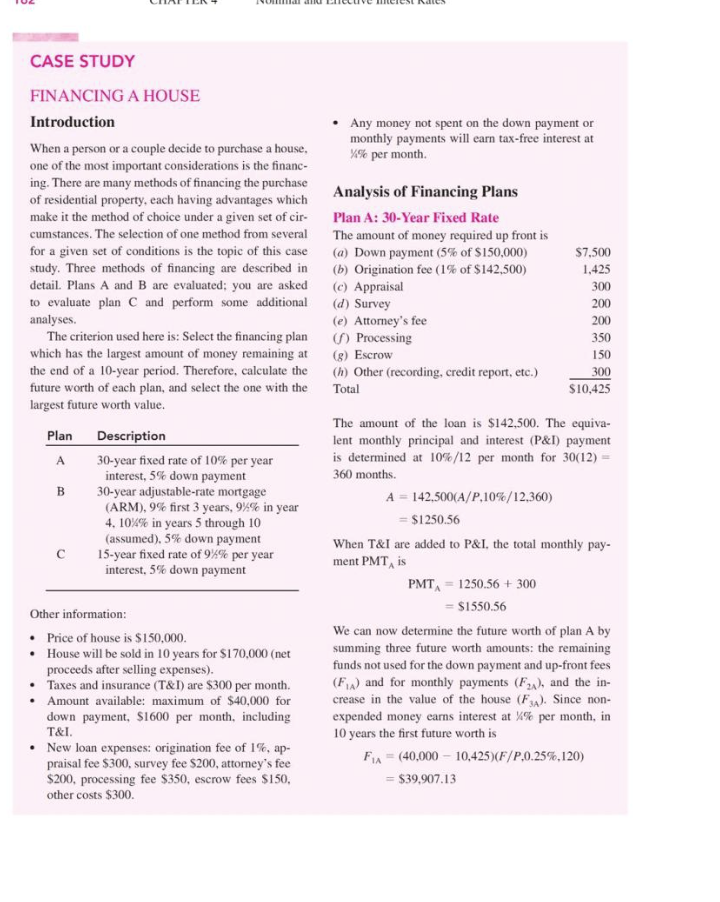

CASE STUDY Any money not spent on the down payment or monthly payments will earn tax-free interest at %% per month Analysis of Financing Plans Plan A: 30-Year Fixed Rate The amount of money required up front is (a) Down payment (5% of $150,000) (b) Origination fee (1% of $142,500) (c) Appraisal (d) Survey (e) Attorney's fee Processing (8) Escrow (h) Other (recording, credit report, etc.) Total $7,500 1,425 300 200 200 FINANCING A HOUSE Introduction When a person or a couple decide to purchase a house. one of the most important considerations is the financ- ing. There are many methods of financing the purchase of residential property, each having advantages which make it the method of choice under a given set of cir- cumstances. The selection of one method from several for a given set of conditions is the topic of this case study. Three methods of financing are described in detail. Plans A and B are evaluated: you are asked to evaluate plan and perform some additional analyses. The criterion used here is: Select the financing plan which has the largest amount of money remaining at the end of a 10-year period. Therefore, calculate the future worth of each plan, and select the one with the largest future worth value. Plan Description 30-year fixed rate of 10% per year interest, 5% down payment 30-year adjustable-rate mortgage (ARM), 9% first 3 years, 94% in year 4. 10%% in years 5 through 10 (assumed), 5% down payment 15-year fixed rate of 98% per year interest, 5% down payment 350 150 300 $10,425 B The amount of the loan is $142,500. The equiva- lent monthly principal and interest (P&I) payment is determined at 10%/12 per month for 30(12) = 360 months. A = 142,500(A/P.10%/12,360) = $1250.56 When T&I are added to P&I, the total monthly pay- ment PMT, is PMT, = 1250.56 + 300 = $1550.56 We can now determine the future worth of plan A by summing three future worth amounts: the remaining funds not used for the down payment and up-front fees (F) and for monthly payments (F2x), and the in- crease in the value of the house (FA). Since non- expended money earns interest at %% per month, in 10 years the first future worth is F = (40,000 - 10,425)(F/P.0.25%,120) = $39,907.13 Other information: Price of house is $150,000. House will be sold in 10 years for $170,000 (net proceeds after selling expenses). Taxes and insurance (T&T) are $300 per month. Amount available: maximum of $40,000 for down payment, $1600 per month, including T&I. New loan expenses: origination fee of 1%, ap- praisal fee $300, survey fee $200, attorney's fee $200, processing fee $350, escrow fees $150, other costs $300. CASE STUDY Any money not spent on the down payment or monthly payments will earn tax-free interest at %% per month Analysis of Financing Plans Plan A: 30-Year Fixed Rate The amount of money required up front is (a) Down payment (5% of $150,000) (b) Origination fee (1% of $142,500) (c) Appraisal (d) Survey (e) Attorney's fee Processing (8) Escrow (h) Other (recording, credit report, etc.) Total $7,500 1,425 300 200 200 FINANCING A HOUSE Introduction When a person or a couple decide to purchase a house. one of the most important considerations is the financ- ing. There are many methods of financing the purchase of residential property, each having advantages which make it the method of choice under a given set of cir- cumstances. The selection of one method from several for a given set of conditions is the topic of this case study. Three methods of financing are described in detail. Plans A and B are evaluated: you are asked to evaluate plan and perform some additional analyses. The criterion used here is: Select the financing plan which has the largest amount of money remaining at the end of a 10-year period. Therefore, calculate the future worth of each plan, and select the one with the largest future worth value. Plan Description 30-year fixed rate of 10% per year interest, 5% down payment 30-year adjustable-rate mortgage (ARM), 9% first 3 years, 94% in year 4. 10%% in years 5 through 10 (assumed), 5% down payment 15-year fixed rate of 98% per year interest, 5% down payment 350 150 300 $10,425 B The amount of the loan is $142,500. The equiva- lent monthly principal and interest (P&I) payment is determined at 10%/12 per month for 30(12) = 360 months. A = 142,500(A/P.10%/12,360) = $1250.56 When T&I are added to P&I, the total monthly pay- ment PMT, is PMT, = 1250.56 + 300 = $1550.56 We can now determine the future worth of plan A by summing three future worth amounts: the remaining funds not used for the down payment and up-front fees (F) and for monthly payments (F2x), and the in- crease in the value of the house (FA). Since non- expended money earns interest at %% per month, in 10 years the first future worth is F = (40,000 - 10,425)(F/P.0.25%,120) = $39,907.13 Other information: Price of house is $150,000. House will be sold in 10 years for $170,000 (net proceeds after selling expenses). Taxes and insurance (T&T) are $300 per month. Amount available: maximum of $40,000 for down payment, $1600 per month, including T&I. New loan expenses: origination fee of 1%, ap- praisal fee $300, survey fee $200, attorney's fee $200, processing fee $350, escrow fees $150, other costs $300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts