Question: Use the following statement to answer question 18 to 24. Invest Up Hardware operates a chain of hardware stores. Recent operations have been stable and

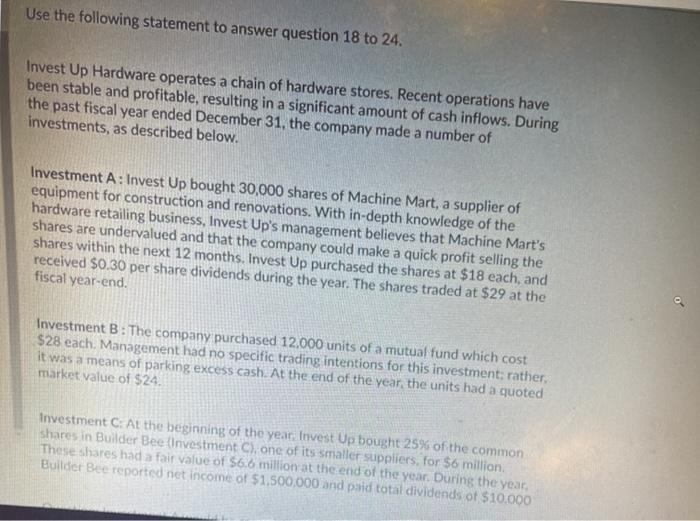

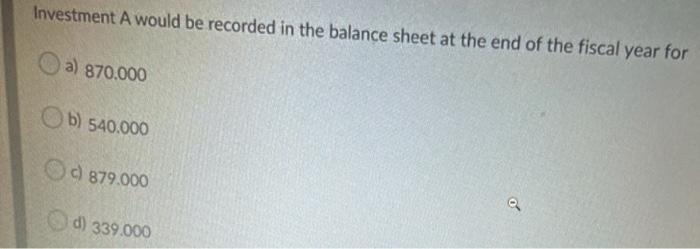

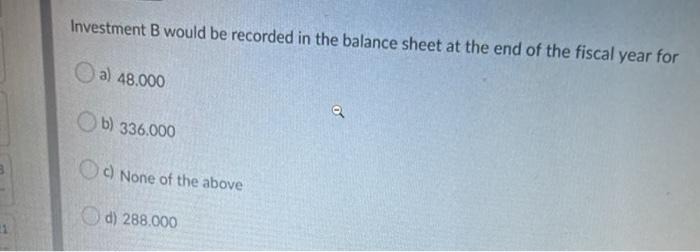

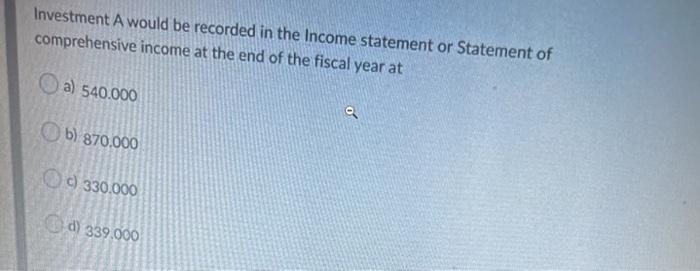

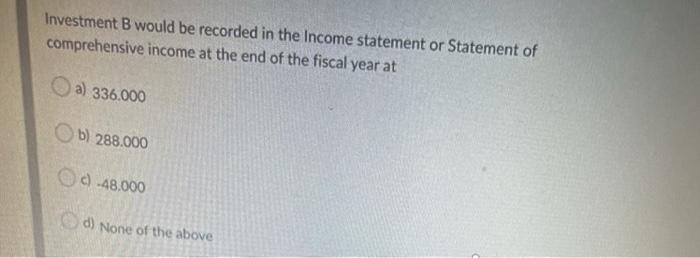

Use the following statement to answer question 18 to 24. Invest Up Hardware operates a chain of hardware stores. Recent operations have been stable and profitable, resulting in a significant amount of cash inflows. During the past fiscal year ended December 31, the company made a number of investments, as described below. Investment A: Invest Up bought 30,000 shares of Machine Mart, a supplier of equipment for construction and renovations. With in-depth knowledge of the hardware retailing business, Invest Up's management believes that Machine Mart's shares are undervalued and that the company could make a quick profit selling the shares within the next 12 months. Invest Up purchased the shares at $18 each, and received $0.30 per share dividends during the year. The shares traded at $29 at the fiscal year-end. Investment B: The company purchased 12,000 units of a mutual fund which cost $28 each. Management had no specific trading intentions for this investment: rather. it was a means of parking excess cash. At the end of the year, the units had a quoted market value of $24. Investment C. At the beginning of the year Invest Up bought 25% of the common shares in Builder Bee Investment C), one of its smaller suppliers, for $6 million, These shares had a fair value of $6.6 million at the end of the year. During the year Builder Bee reported net income of $1.500.000 and paid total dividends of $10,000 Question: Investment A would be recorded as a) Trading securities b) Held for sale 2 c) Joint Venture d) Associate e) Held to maturity Question 19 (2 points) Listen Investment B would be recorded as a) Trading securities b) Held for sale c) Held to maturity a d) Associate e) Joint Venture Investment C would be recorded as a) Trading securities b) Held for sale Held to maturity a a) Associate e) Joint Venture Investment A would be recorded in the balance sheet at the end of the fiscal year for a) 870.000 b) 540.000 Od 879.000 d) 339.000 Investment B would be recorded in the balance sheet at the end of the fiscal year for a) 48.000 b) 336.000 c) None of the above d) 288.000 Investment A would be recorded in the Income statement or Statement of comprehensive income at the end of the fiscal year at a) 540.000 b) 870.000 0 330.000 d) 339.000 Investment B would be recorded in the Income statement or Statement of comprehensive income at the end of the fiscal year at a) 336.000 b) 288.000 0.48.000 d) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts