Question: Use the following statement to answer question 18 to 24. Invest Up Hardware operates a chain of hardware stores. Recent operations have been stable and

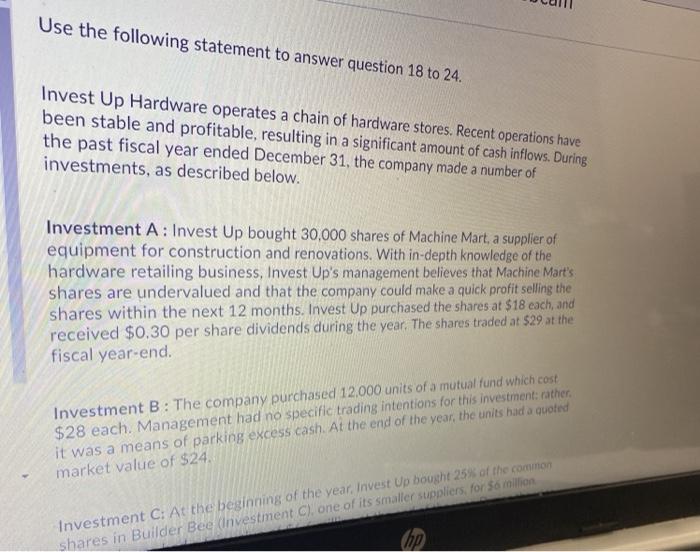

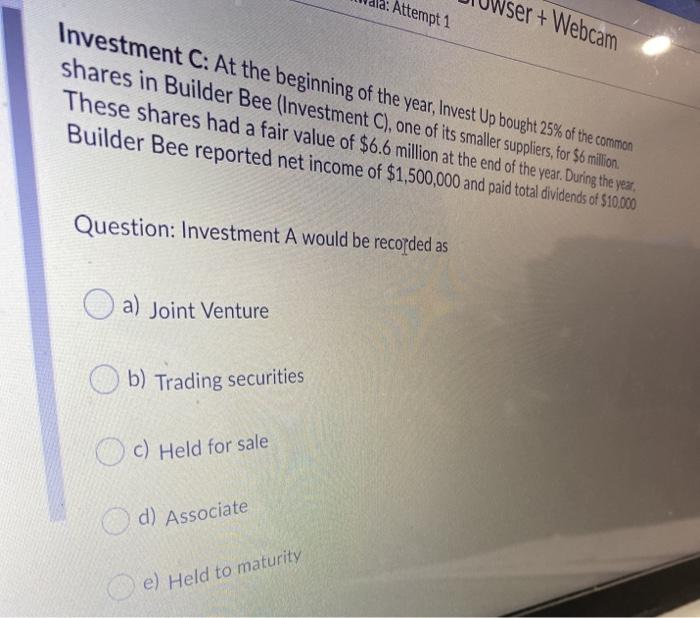

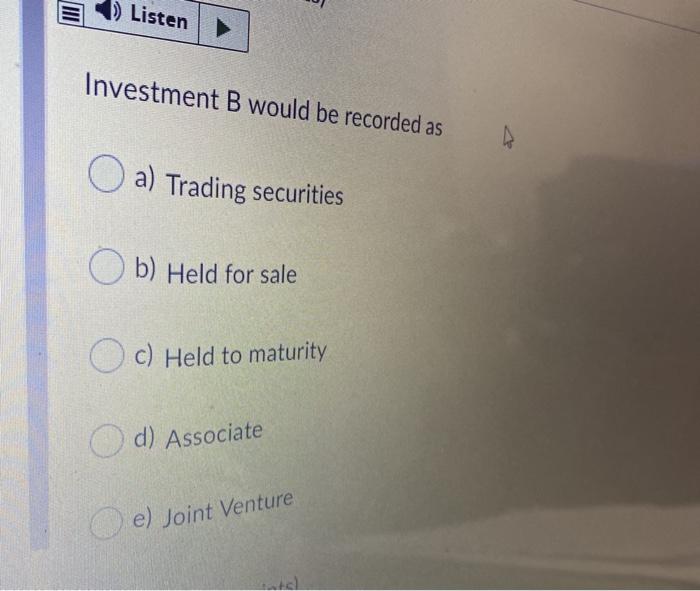

Use the following statement to answer question 18 to 24. Invest Up Hardware operates a chain of hardware stores. Recent operations have been stable and profitable, resulting in a significant amount of cash inflows. During the past fiscal year ended December 31, the company made a number of investments, as described below. Investment A: Invest Up bought 30,000 shares of Machine Mart, a supplier of equipment for construction and renovations. With in-depth knowledge of the hardware retailing business, Invest Up's management believes that Machine Mart's shares are undervalued and that the company could make a quick profit selling the shares within the next 12 months. Invest Up purchased the shares at $18 each, and received $0.30 per share dividends during the year. The shares traded at $29 at the fiscal year-end. Investment B: The company purchased 12.000 units of a mutual fund which cost $28 each. Management had no specific trading intentions for this investment: rather it was a means of parking excess cash. At the end of the year, the units had a quoted market value of $24. Investment C: At the beginning of the year, Invest Up bought 25% of the common shares in Builder Bee (Investment C), one of its smaller suppliers, for so million op Attempt 1 ser + Webcam Investment C: At the beginning of the year, Invest Up bought 25% of the common shares in Builder Bee (Investment C), one of its smaller suppliers, for $6 million. These shares had a fair value of $6.6 million at the end of the year. During the yea. Builder Bee reported net income of $1,500,000 and paid total dividends of $10.000 Question: Investment A would be recorded as a) Joint Venture b) Trading securities c) Held for sale d) Associate e) Held to maturity Listen Investment B would be recorded as O a) Trading securities O b) Held for sale c) Held to maturity d) Associate e) Joint Venture el Investment C would be recorded as a) Trading securities b) Held for sale c) Held to maturity d) Associate e) Joint Venture ent A would be recorded in the balance sheet at the end of the fiscal year for a) 870.000 b) 540.000 c) 879.000 d) 339.000 Listen Investment B would be recorded in the balance sheet at the end of the fiscal year for a) None of the above b) 288.000 c) 48.000 d) 336.000 Investment A would be recorded in the Income statement or Statement of comprehensive income at the end of the fiscal year at a) 540.000 b) 870.000 c) 330.000 d) 339.000 Investment B would be recorded in the Income statement or Statement of comprehensive income at the end of the fiscal year at a) 336.000 b) 288.000 C) -48.000 d) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts