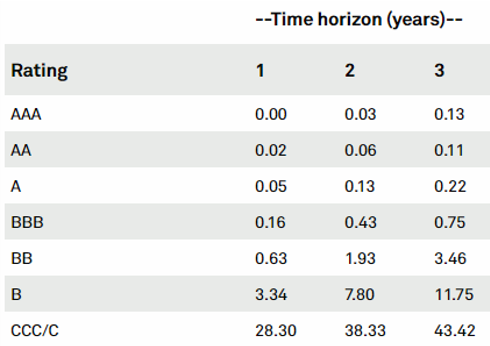

Question: Use the following table of default probability (data from S&P Global Ratings) for this part: In addition, assume that the recovery rate of a defaulted

Use the following table of default probability (data from S&P Global Ratings) for this part:

In addition, assume that the recovery rate of a defaulted bond is 60%.

1. The table shows that 1)........% (two decimal places) of a bond rated AA would default. Based on the recovery rate, the loss rate is 2)......% (round to the nearest unit). Accordingly, on the average, the holder of a A bond maturing in one year will need a credit spread of at least 3)....... basis points (round to the nearest unit) to realize an investment return equivalent to a risk-free asset of the same maturity. In other words, if the one-year risk-free rate is 1.05%, the yield of a A bond should be at least 4)......% (two decimal places).

2. Meanwhile, if the bond was a BB bond maturing in one year, the holder will need a credit spread of at least 5)...... basis points (round to the nearest unit) to realize an investment return equivalent to a risk-free asset of the same maturity, and if the one-year risk-free rate is 1.05%, the yield of a BB bond should be at least 6).....% (two decimal places).

Part II.

1. Prices of stocks move around, and thus the return on investment in stocks are 7) (more/less) volatile than the return on the risk-free asset. Accordingly, investors will demand a 8) (higher/lower) return from stocks, compared with the risk-free asset. The difference between the return of stocks and the risk-free is called the 9)........ .

2. Since the future is uncertain and uncertainty increases as more time elapses, investors should demand 10)(higher/lower) returns for assets with a longer maturity even if other terms are equal. The difference between the return of assets with longer and shorter maturity is called the 11)........

--Time horizon (years)-- Rating 1 2 3 0.00 0.03 0.13 0.02 0.06 0.11 A 0.05 0.13 0.22 0.16 0.43 0.75 0.63 1.93 3.46 B 3.34 7.80 11.75 CCC/C 28.30 38.33 43.42

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts