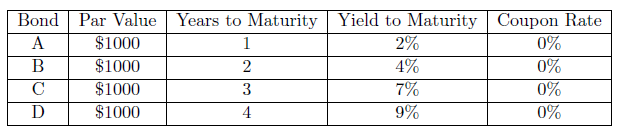

Question: Use the following table to answer the questions below: (a) What is the spot rate for a 3 year bond? (b) Calculate the short rates

Use the following table to answer the questions below:

(a) What is the spot rate for a 3 year bond?

(b) Calculate the short rates r1; r2; r3 and r4.

(c) What price does each of the zero coupon bonds sell for today?

(d) Suppose an agent buys bonds B;C and D, holds them for one year and then sells them all. Find the price the agent will be able to sell each of the three bonds at.

(e) Based on the prices you found in C., write expressions for the Holding Period Returns of bonds B;C and D and observe that the Holding Period Returns are the same.

Bond Par Value Years to Maturity Yield to Maturity Coupon Rate $1000 STDD STDD $1000 2% 4% 1% 9% 0% 0% 0% 0% 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts