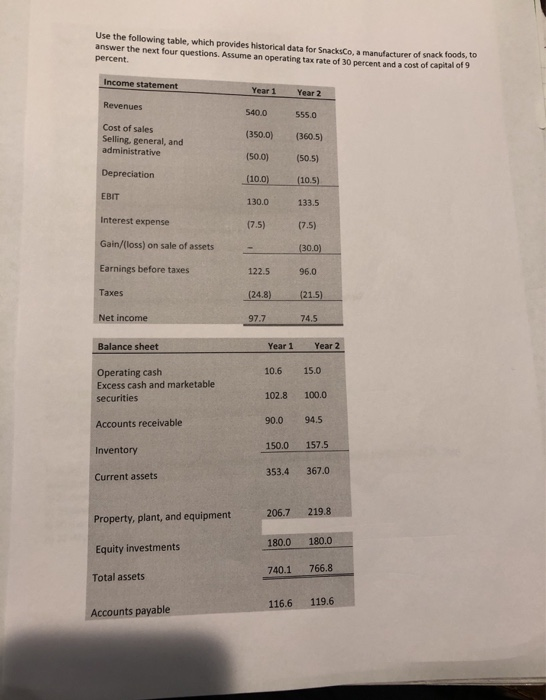

Question: Use the following table, which provides historical data for Snacksco, a manufacturer of snack foods, to answer the next four questions. Assume an operating tax

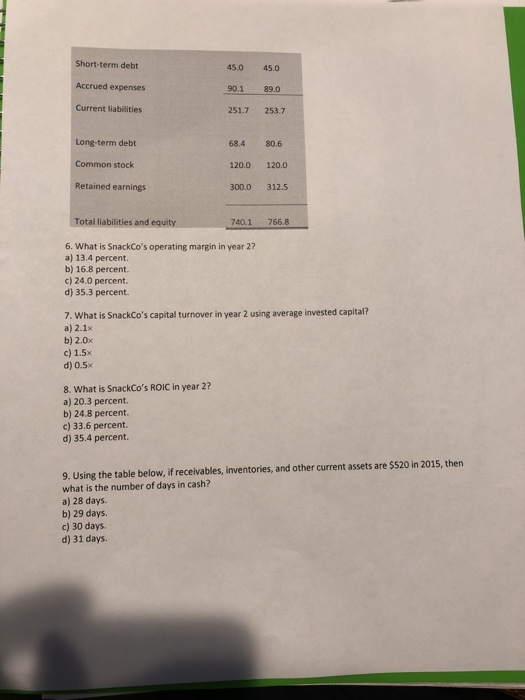

Use the following table, which provides historical data for Snacksco, a manufacturer of snack foods, to answer the next four questions. Assume an operating tax rate of 30 percent and a cost of capital of 9 percent. Income statement Year 1 Year 2 Revenues 540.0 555.0 Cost of sales Selling general, and administrative (350.0) (360.5) (50.5) (50.0) Depreciation (10,0) (10.5) EBIT 130.0 133.5 Interest expense (7.5) (7.5) Gain/(loss) on sale of assets (30.0) Earnings before taxes 96.0 - 122.5 (24.8) 97.7 Taxes (215) 74.5 Net income Balance sheet Year 1 Year 2 10.6 15.0 Operating cash Excess cash and marketable securities 102.8 100.0 Accounts receivable 90.0 94.5 150.0 157.5 Inventory Current assets 353.4 367.0 206.7 219.8 Property, plant, and equipment 180.0 180.0 Equity investments 740.1 766.8 Total assets 116.6 119.6 Accounts payable Short-term debt 45.0 45.0 Accrued expenses 90. 1 251.7 89.0 253.7 Current liabilities Long-term debt Common stock 684 120.0 300.0 30.5 120.0 312.5 Retained earnings Total liabilities and equity 740.1 7668 6. What is SnackCo's operating margin in year 2? a) 13.4 percent. b) 16.8 percent. c) 24.0 percent. d) 35.3 percent. 7. What is SnackCo's capital turnover in year 2 using average invested capital? a) 2.1% b) 2.0x c) 1.5x d) 0.5% 8. What is SnackCo's ROIC in year 2? a) 20.3 percent. b) 24.8 percent. c) 33.6 percent. d) 35.4 percent. 9. Using the table below, if receivables, inventories, and other current assets are $520 in 2015, then what is the number of days in cash? a) 28 days. b) 29 days. c) 30 days. d) 31 days

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts