Question: Use the free cash flow framework below for this question. What does a free cash flow framework in general tell us and what does this

Use the free cash flow framework below for this question.

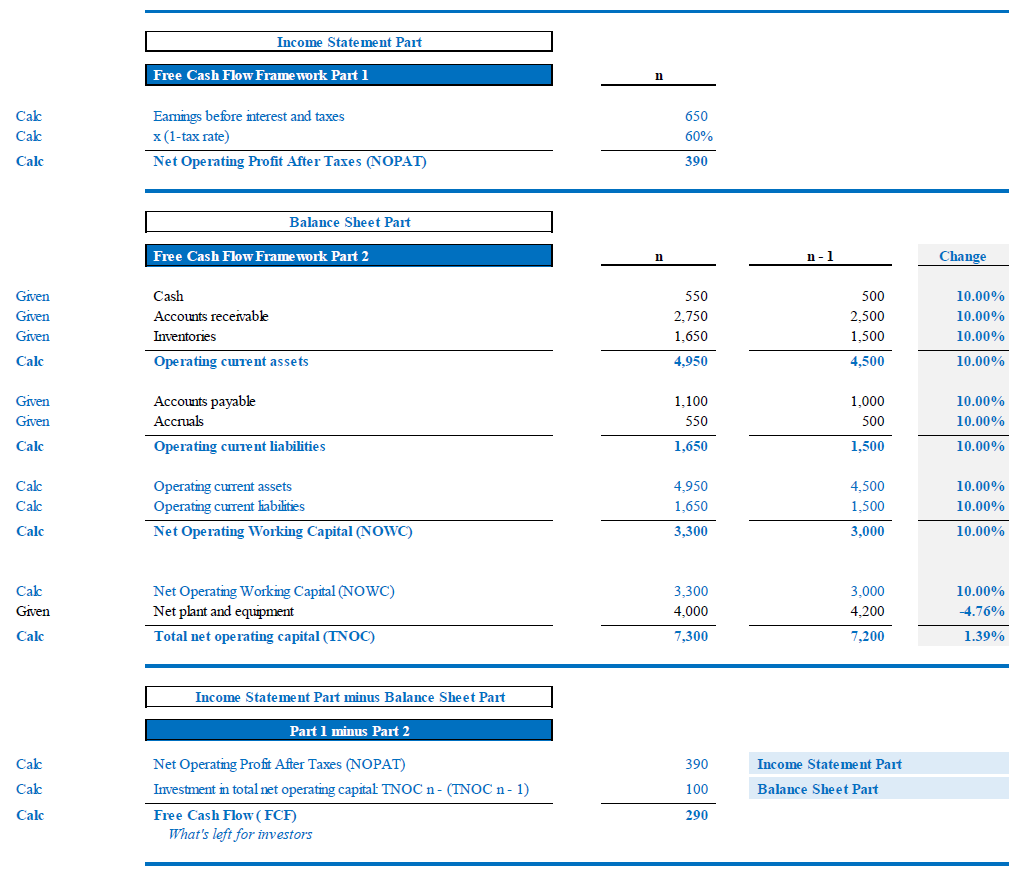

What does a free cash flow framework in general tell us and what does this specific company free cash flow tell us about the company?

Income Statement Part Free Cash Flow Framework Part 1 n Cak Cal Earnings before interest and taxes x(1-tax rate) Net Operating Profit After Taxes (NOPAT) 650 60% 390 Calc Balance Sheet Part Free Cash Flow Framework Part 2 n n-1 Change Given Given Given 550 2.750 Cash Accounts receivable Inventories Operating curent assets 500 2,500 1,500 1.650 10.00% 10.00% 10.00% 10.00% Calc 4,950 4,500 Given 1.100 Accounts payable Accruals 1,000 500 10.00% 10.00% 550 Given Calc Operating current liabilities 1,650 1,500 10.00% Calc Calc Operating current assets Operatmg current liabilities Net Operating Working Capital (NOWC) 4,950 1,650 4,500 1,500 3,000 10.00% 10.00% Calc 3,300 10.00% Cal Given Net Operating Working Capital (NOWC) Net plant and equipment Total net operating capital (TNOC) 3,300 4,000 3,000 4,200 10.00% -4.76% Calc 7,300 7,200 1.39% Income Statement Part minus Balance Sheet Part Part 1 minus Part 2 Calc 390 100 Income Statement Part Balance Sheet Part Calc Net Operating Profit After Taxes (NOPAT) Investment in total net operating capital TNOC n-(INOC n-1) Free Cash Flow (FCF) What's left for investors Calc 290 Income Statement Part Free Cash Flow Framework Part 1 n Cak Cal Earnings before interest and taxes x(1-tax rate) Net Operating Profit After Taxes (NOPAT) 650 60% 390 Calc Balance Sheet Part Free Cash Flow Framework Part 2 n n-1 Change Given Given Given 550 2.750 Cash Accounts receivable Inventories Operating curent assets 500 2,500 1,500 1.650 10.00% 10.00% 10.00% 10.00% Calc 4,950 4,500 Given 1.100 Accounts payable Accruals 1,000 500 10.00% 10.00% 550 Given Calc Operating current liabilities 1,650 1,500 10.00% Calc Calc Operating current assets Operatmg current liabilities Net Operating Working Capital (NOWC) 4,950 1,650 4,500 1,500 3,000 10.00% 10.00% Calc 3,300 10.00% Cal Given Net Operating Working Capital (NOWC) Net plant and equipment Total net operating capital (TNOC) 3,300 4,000 3,000 4,200 10.00% -4.76% Calc 7,300 7,200 1.39% Income Statement Part minus Balance Sheet Part Part 1 minus Part 2 Calc 390 100 Income Statement Part Balance Sheet Part Calc Net Operating Profit After Taxes (NOPAT) Investment in total net operating capital TNOC n-(INOC n-1) Free Cash Flow (FCF) What's left for investors Calc 290

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts