Question: Use the free cash flow framework below for this question in your own words. What does a free cash flow framework in general tell us?

Use the free cash flow framework below for this question in your own words.

What does a free cash flow framework in general tell us? (Please Explain)

What does this specific company free cash flow tell us about the company? (Please Explain)

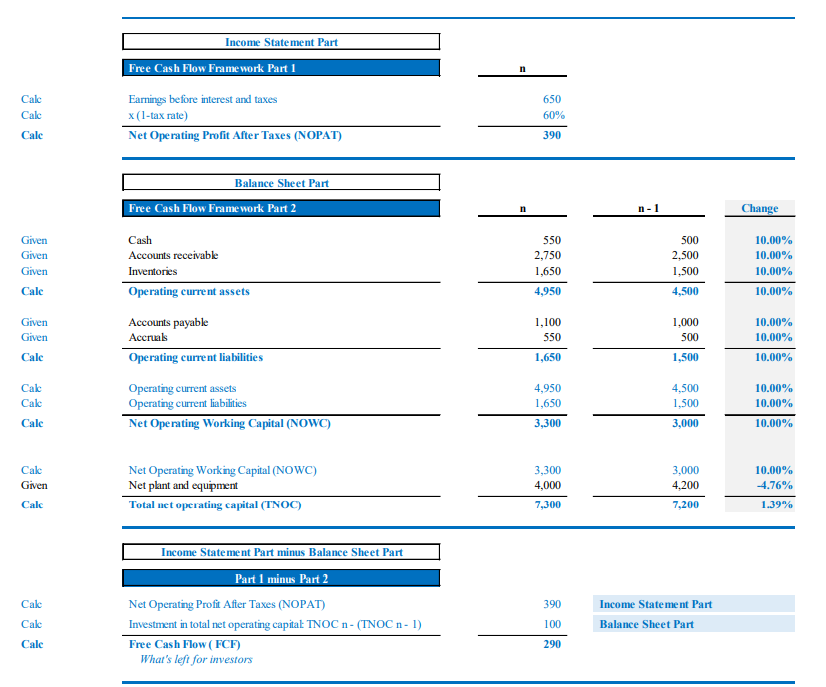

Income Statement Part Free Cash Flow Framework Part 1 Calc \begin{tabular}{l} Earnings before interest and taxes \\ x (1-tax rate) \\ \hline Net Operating Profit After Taxes (NOPAT) \end{tabular} \begin{tabular}{ll} n & \\ \hline & 650 \\ & 60% \\ \hline & 390 \end{tabular} Balance Sheet Part Free Cash Flow Framework Part 2 Given \begin{tabular}{l} Cash \\ Accounts receivable \\ Inventories \\ \hline Operating current assets \end{tabular} n5502,7501,6504,950 Change10.00%10.00%10.00%10.00% Give Give Calc \begin{tabular}{l} Accounts payable \\ Accrual \\ \hline Operating current liabilities \end{tabular} 1,1005501,650 1,0005001,500 \begin{tabular}{l} 10.00% \\ 10.00% \\ \hline 10.00% \end{tabular} Calc \begin{tabular}{l} Operating current assets \\ Operating current liabilities \\ \hline Net Operating Working Capital (NOWC) \end{tabular} 4,9501,6503,300 4,5001,5003,000 10.00%10.00%10.00% \begin{tabular}{ll} Calc & Net Operating Working Capital (NOWC) \\ Given & Net plant and equipment \\ Calc & Total net operating capital (TNOC) \\ & Income Statement Part minus Balance Sheet Part \\ \hline \end{tabular} 3,3004,0007,300 Part 1 minus Part 2 Calc Calc \begin{tabular}{lr} Net Operating Profit After Taxes (NOPAT) & 390 \\ Investment in total net operating capital TNOC n - (TNOC n - 1) & 100 \\ \hline Free Cash Flow ( FCF) & 290 \end{tabular} Income Statement Part Calc What's lefi for investors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts