Question: Use the general market information below to help answer the questions that follow: - The risk-free rate is 2%. - The tax-adjusted market risk premium

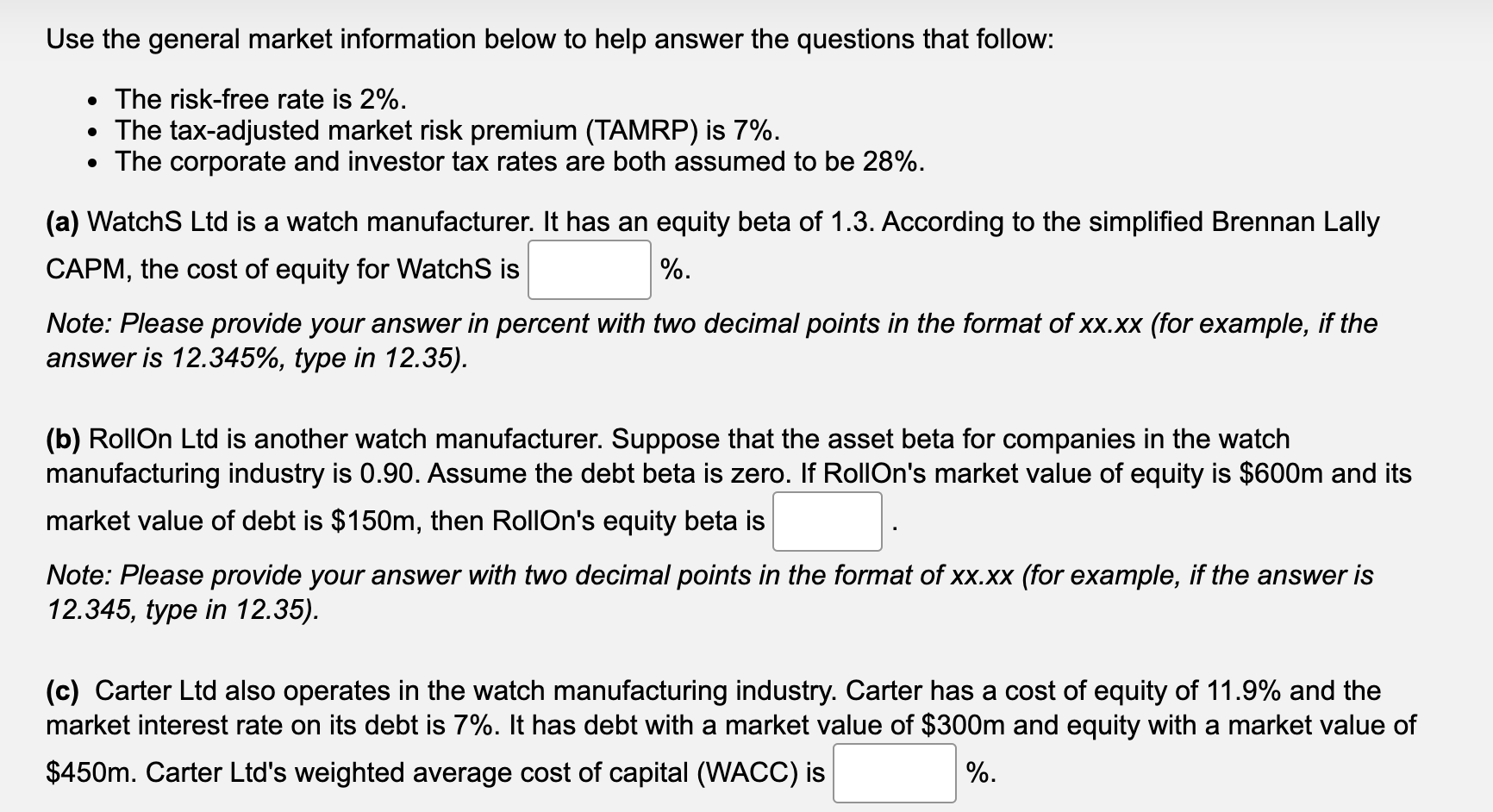

Use the general market information below to help answer the questions that follow: - The risk-free rate is 2%. - The tax-adjusted market risk premium (TAMRP) is 7%. - The corporate and investor tax rates are both assumed to be 28%. (a) WatchS Ltd is a watch manufacturer. It has an equity beta of 1.3. According to the simplified Brennan Lally CAPM, the cost of equity for WatchS is %. Note: Please provide your answer in percent with two decimal points in the format of xx.xx (for example, if the answer is 12.345%, type in 12.35). (b) RollOn Ltd is another watch manufacturer. Suppose that the asset beta for companies in the watch manufacturing industry is 0.90 . Assume the debt beta is zero. If RollOn's market value of equity is $600m and its market value of debt is $150m, then RollOn's equity beta is Note: Please provide your answer with two decimal points in the format of xx.xx (for example, if the answer is 12.345, type in 12.35). (c) Carter Ltd also operates in the watch manufacturing industry. Carter has a cost of equity of 11.9% and the market interest rate on its debt is 7%. It has debt with a market value of $300m and equity with a market value of $450m. Carter Ltd's weighted average cost of capital (WACC) is %. Use the general market information below to help answer the questions that follow: - The risk-free rate is 2%. - The tax-adjusted market risk premium (TAMRP) is 7%. - The corporate and investor tax rates are both assumed to be 28%. (a) WatchS Ltd is a watch manufacturer. It has an equity beta of 1.3. According to the simplified Brennan Lally CAPM, the cost of equity for WatchS is %. Note: Please provide your answer in percent with two decimal points in the format of xx.xx (for example, if the answer is 12.345%, type in 12.35). (b) RollOn Ltd is another watch manufacturer. Suppose that the asset beta for companies in the watch manufacturing industry is 0.90 . Assume the debt beta is zero. If RollOn's market value of equity is $600m and its market value of debt is $150m, then RollOn's equity beta is Note: Please provide your answer with two decimal points in the format of xx.xx (for example, if the answer is 12.345, type in 12.35). (c) Carter Ltd also operates in the watch manufacturing industry. Carter has a cost of equity of 11.9% and the market interest rate on its debt is 7%. It has debt with a market value of $300m and equity with a market value of $450m. Carter Ltd's weighted average cost of capital (WACC) is %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts