Question: Explain the solution to part a and b Use the general market information below to help answer the questions that follow: - The risk-free rate

Explain the solution to part a and b

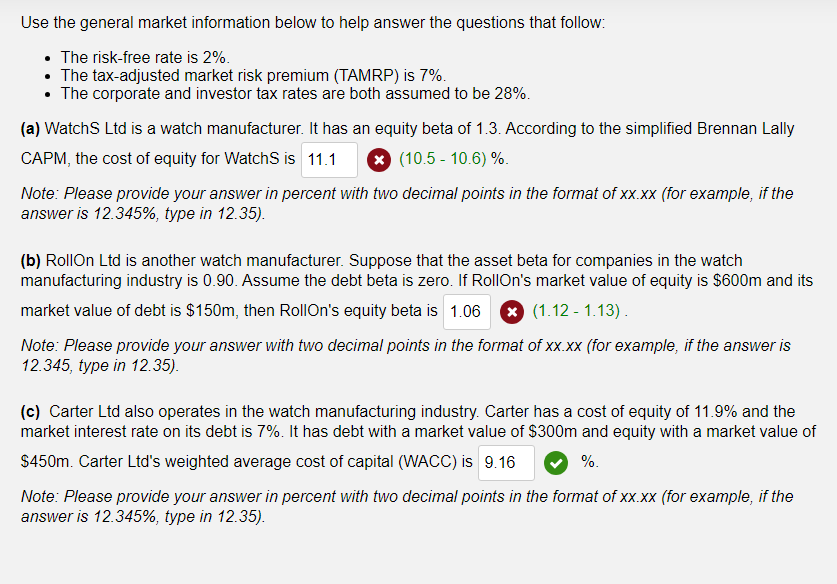

Use the general market information below to help answer the questions that follow: - The risk-free rate is 2%. - The tax-adjusted market risk premium (TAMRP) is 7%. - The corporate and investor tax rates are both assumed to be 28%. (a) WatchS Ltd is a watch manufacturer. It has an equity beta of 1.3. According to the simplified Brennan Lally CAPM, the cost of equity for WatchS is (10.510.6)%. Note: Please provide your answer in percent with two decimal points in the format of xx.xx (for example, if the answer is 12.345%, type in 12.35 ). (b) RollOn Ltd is another watch manufacturer. Suppose that the asset beta for companies in the watch manufacturing industry is 0.90 . Assume the debt beta is zero. If Rollon's market value of equity is $600m and its market value of debt is $150m, then RollOn's equity beta is x (1.121.13). Note: Please provide your answer with two decimal points in the format of xx.xx (for example, if the answer is 12.345 , type in 12.35). (c) Carter Ltd also operates in the watch manufacturing industry. Carter has a cost of equity of 11.9% and the market interest rate on its debt is 7%. It has debt with a market value of $300m and equity with a market value of $450m. Carter Ltd's weighted average cost of capital (WACC) is %. Note: Please provide your answer in percent with two decimal points in the format of xx.xx (for example, if the answer is 12.345%, type in 12.35 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts