Question: Use the graph on the right to answer the following question. Alan earns S225,000 per year and is considering a second job that would

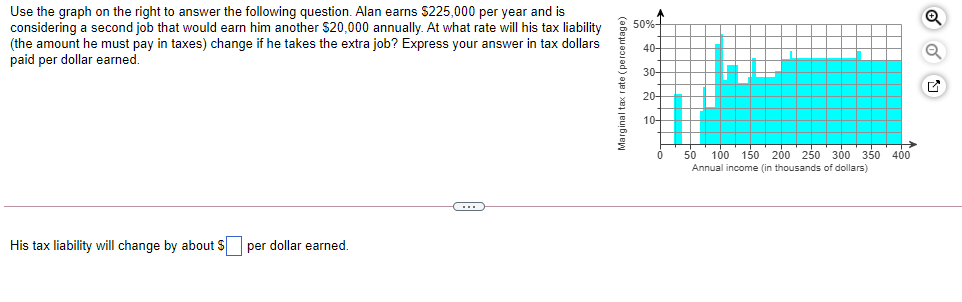

Use the graph on the right to answer the following question. Alan earns S225,000 per year and is considering a second job that would earn him another $20,000 annually. At what rate will his tax liability (the amount he must pay in taxes) change if he takes the extra job? Express your answer in tax dollars paid per dollar earned. 50%- 40- 30- 20- 10- 50 100 150 200 250 300 350 400 Annual income (in thousands of dollars) His tax liability will change by about S per dollar earned. Marginal tax

Step by Step Solution

3.33 Rating (165 Votes )

There are 3 Steps involved in it

Solution Alans current earning per year is 225000 The ... View full answer

Get step-by-step solutions from verified subject matter experts