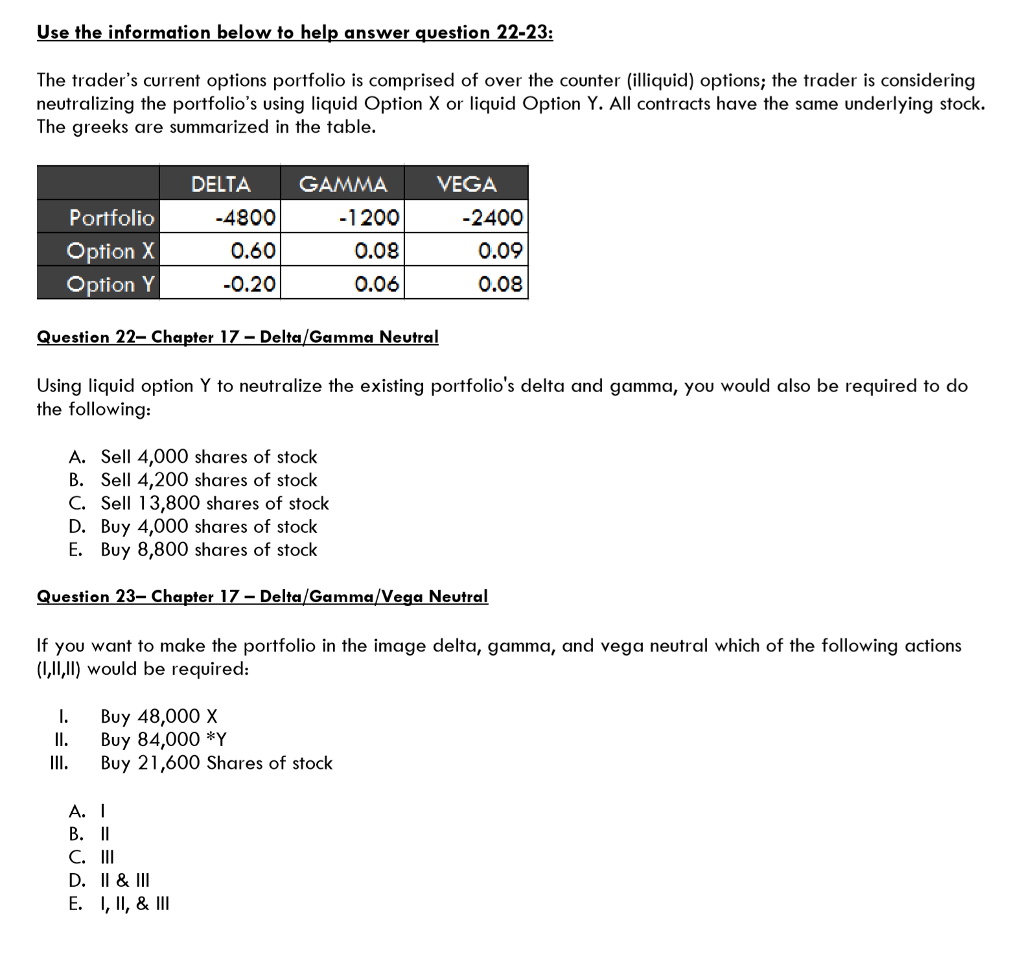

Question: Use the information below to help answer question 22-23: The trader's current options portfolio is comprised of over the counter (illiquid) options; the trader is

Use the information below to help answer question 22-23: The trader's current options portfolio is comprised of over the counter (illiquid) options; the trader is considering neutralizing the portfolio's using liquid Option X or liquid Option Y. All contracts have the same underlying stock. The greeks are summarized in the table. DELTA GAMMA VEGA Portfolio Option X Option Y 4800 0.60 0.20 1200 0.08 0.06 -2400 0.09 0.08 uestion 22- Chapter 17-Delta/Gamma Neutral Using liquid option Y to neutralize the existing portfolio's delta and gamma, you would also be required to do the following: A. Sell 4,000 shares of stock B. Sell 4,200 shares of stock C. Sell 13,800 shares of stock D. Buy 4,000 shares of stock E. Buy 8,800 shares of stock uestion 23- Chapter 17 - Delta/Gamma/Vega Neutral If you want to make the portfolio in the image delta, gamma, and vega neutral which of the following actions (II,l) would be required: WOU I. Buy 48,000 X II. Buy 84,000 *Y II. Buy 21,600 Shares of stock A. I E. I, II, &

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts