Question: Use the information from Problem 11 - 5 a.Determine the balance of the Deferred Tax Asset or Liability account at the end of each year

Use the information from Problem 11 - 5

a.Determine the balance of the Deferred Tax Asset or Liability account at the end of each year

b.Prepare the journal entry to record the tax provision for year 2 & year 5.

c.If a new income tax rate of 35% is enacted into law at the end of year 4, what would be the revised value of the deferred tax asset or liability?

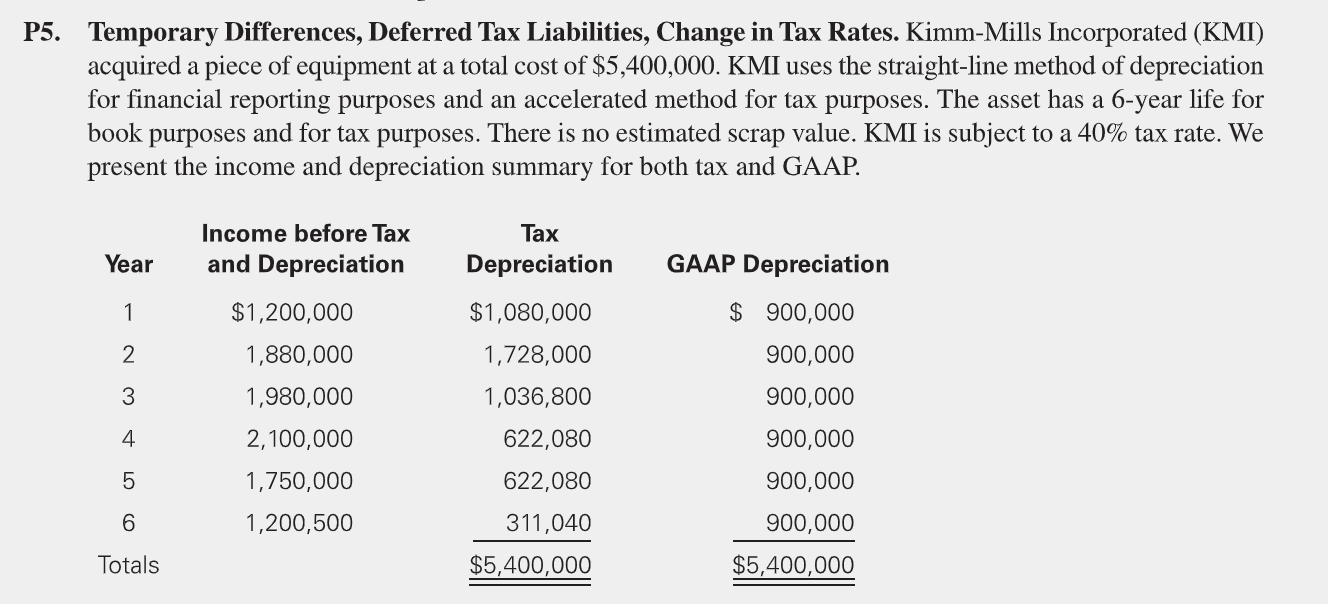

P5. Temporary Differences, Deferred Tax Liabilities, Change in Tax Rates. Kimm-Mills Incorporated (KMI) acquired a piece of equipment at a total cost of $5 ,400,000, KM] uses the straight-line method of depreciation for nancial reporting purposes and an accelerated method for tax purposes. The asset has a 6-year life for book purposes and for tax purposes. There is no estimated scrap value. KMI is subject to a 40% tax rate. We present the income and depreciation summary for both tax and GAAP. Income before Tax Tax Year and Depreciation Depreciation GAAP Depreciation 1 $1,200,000 $1,080,000 3 900,000 2 1,880,000 1,728,000 900,000 3 1 980,000 1,036,800 900,000 4 2,100,000 622,080 900,000 5 1,750,000 522,080 900,000 6 1,200,500 311,040 900,000 Totals $5,400,000 $5,400,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts