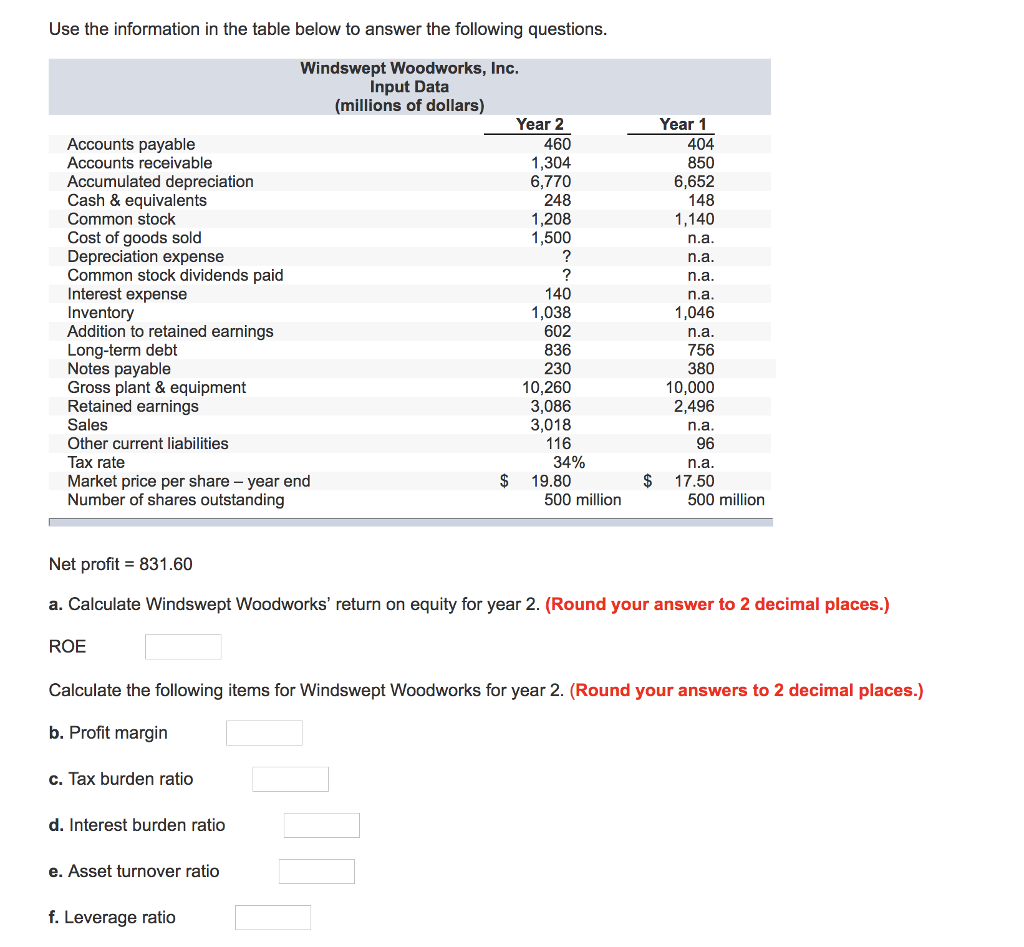

Question: Use the information in the table below to answer the following questions Windswept Woodworks, Inc. Input Data (millions of dollars) Year 2 Year 1 460

Use the information in the table below to answer the following questions Windswept Woodworks, Inc. Input Data (millions of dollars) Year 2 Year 1 460 1,304 6,770 248 1,208 1,500 Accounts payable Accounts receivable Accumulated depreciation Cash & equivalents Common stock Cost of goods sold Depreciation expense Common stock dividends paid Interest expense Inventory Addition to retained earnings Long-term debt Notes payable Gross plant & equipment Retained earnings Sales Other current liabilities Tax rate Market price per share year end Number of shares outstanding 404 850 6,652 148 1,140 n.a .a .a n.a 1,046 .a 756 380 140 1,038 602 836 230 10,260 3,086 3,018 116 10,000 2,496 n.a 96 34% .a $ 19.80 $ 17.50 500 million 500 million Net profit 831.60 a. Calculate Windswept Woodworks' return on equity for year 2. (Round your answer to 2 decimal places.) ROE Calculate the following items for Windswept Woodworks for year 2. (Round your answers to 2 decimal places.) b. Profit margin c. Tax burden ratio d. Interest burden ratio e. Asset turnover ratio f. Leverage ratio Use the information in the table below to answer the following questions Windswept Woodworks, Inc. Input Data (millions of dollars) Year 2 Year 1 460 1,304 6,770 248 1,208 1,500 Accounts payable Accounts receivable Accumulated depreciation Cash & equivalents Common stock Cost of goods sold Depreciation expense Common stock dividends paid Interest expense Inventory Addition to retained earnings Long-term debt Notes payable Gross plant & equipment Retained earnings Sales Other current liabilities Tax rate Market price per share year end Number of shares outstanding 404 850 6,652 148 1,140 n.a .a .a n.a 1,046 .a 756 380 140 1,038 602 836 230 10,260 3,086 3,018 116 10,000 2,496 n.a 96 34% .a $ 19.80 $ 17.50 500 million 500 million Net profit 831.60 a. Calculate Windswept Woodworks' return on equity for year 2. (Round your answer to 2 decimal places.) ROE Calculate the following items for Windswept Woodworks for year 2. (Round your answers to 2 decimal places.) b. Profit margin c. Tax burden ratio d. Interest burden ratio e. Asset turnover ratio f. Leverage ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts