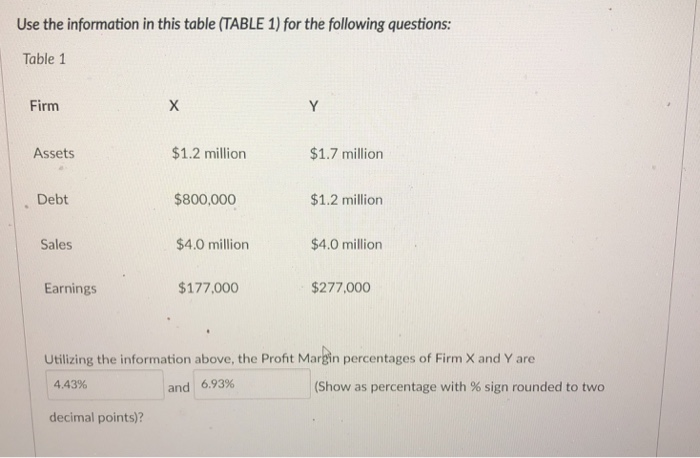

Question: Use the information in this table (TABLE 1) for the following questions: Table 1 Firm Assets $1.2 million Debt Sales Earnings $800,000 $4.0 million $177,000

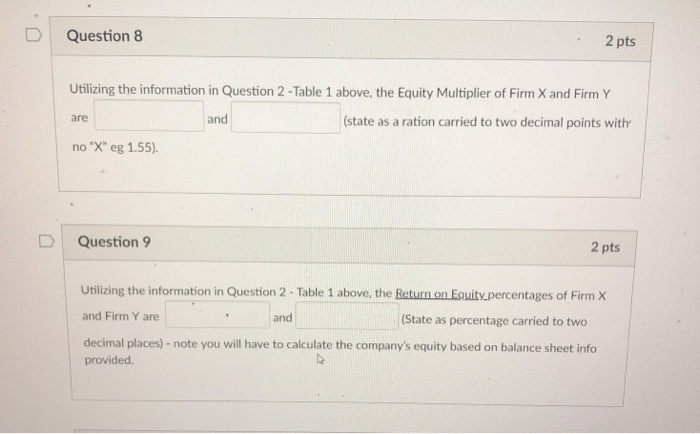

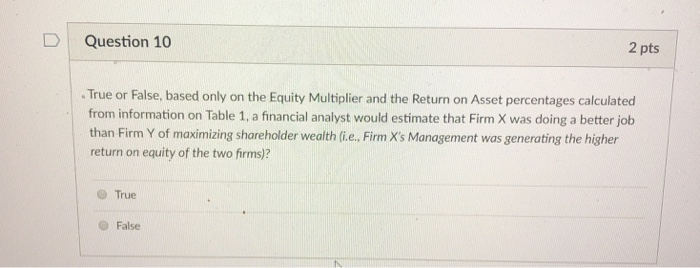

Use the information in this table (TABLE 1) for the following questions: Table 1 Firm Assets $1.2 million Debt Sales Earnings $800,000 $4.0 million $177,000 $1.7 million $1.2 milliorn $4.0 million . $277,000 Utilizing the information above, the Profit Margin percentages of Firm X and Y are 4.43% and 6.93% Show as percentage with % sign rounded to two decimal points)? D Question 8 2 pts Utilizing the information in Question 2-Table 1 above, the Equity Multiplier of Firm X and Firm Y are no"X" eg 1.55). and (state as a ration carried to two decimal points with D Question 9 2 pts Utilizing the information in Question 2 - Table 1 above, the Return on Equity.percentages of Firm X and Firm Y are decimal places)- note you will have to calculate the company's equity based on balance sheet info provided. .and (State as percentage carried to two DQuestion 10 2 pts True or False, based only on the Equity Multiplier and the Return on Asset percentages calculated from information on Table 1, a financial analyst would estimate that Firm X was doing a better job than Firm Y of maximizing shareholder wealth fi.e. Firm X's Management was generating the higher return on equity of the two firms)? True O False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts